Liability Foreclosure Form

What is the liability foreclosure?

The liability foreclosure refers to the legal process that occurs when a property owner fails to meet their mortgage obligations, resulting in the lender taking possession of the property. This process can lead to significant financial implications for the homeowner, including the potential loss of the property and a negative impact on their credit score. Understanding the nuances of liability foreclosure is crucial for homeowners facing financial difficulties, as it can help them navigate their options and rights during this challenging time.

Steps to complete the liability foreclosure

Completing the liability foreclosure process involves several key steps that must be followed to ensure compliance with legal requirements. These steps include:

- Reviewing the mortgage agreement to understand the terms and conditions.

- Receiving a notice of default from the lender, which indicates that payments have not been made.

- Responding to the notice and exploring options such as loan modification or repayment plans.

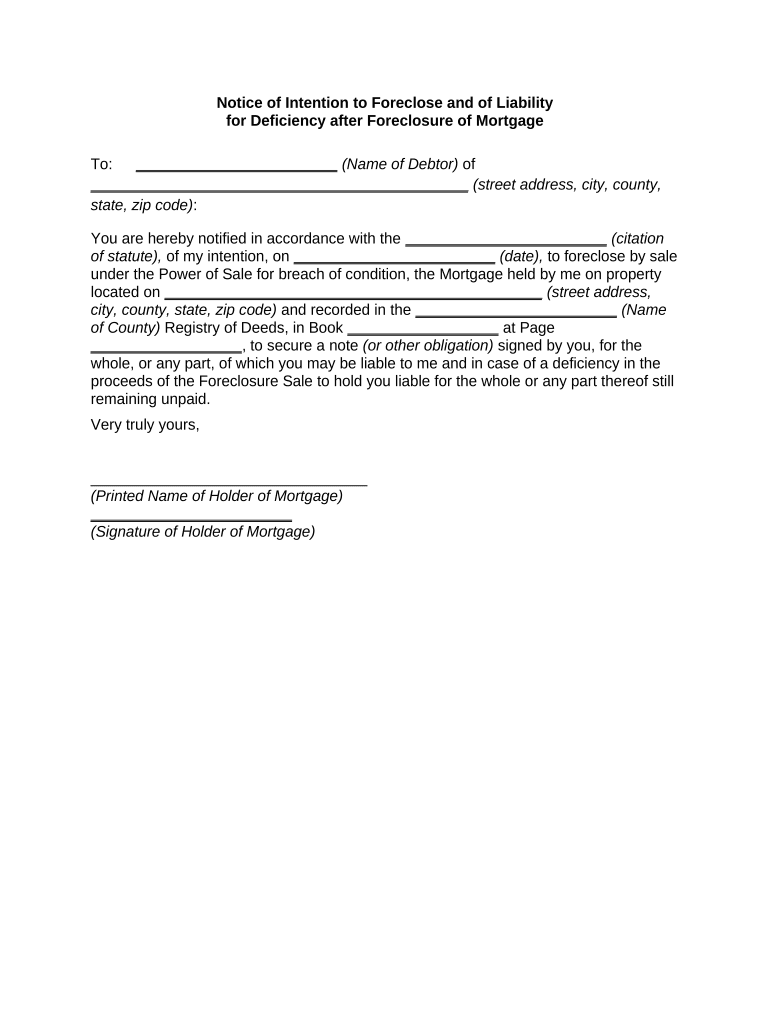

- Preparing the necessary documentation, including the notice liability form, to formally acknowledge the situation.

- Submitting the completed notice liability form to the appropriate parties, ensuring all information is accurate and complete.

Legal use of the liability foreclosure

The legal use of the liability foreclosure process is governed by state and federal laws, which dictate how foreclosures must be conducted. This includes the requirement for lenders to provide proper notice to homeowners, the right to contest the foreclosure in court, and the ability to seek alternatives to foreclosure, such as short sales. Homeowners should be aware of their rights and the legal implications of the foreclosure process to protect themselves effectively.

Key elements of the liability foreclosure

Several key elements define the liability foreclosure process. These include:

- The notice of default, which alerts the homeowner to the impending foreclosure.

- The timeline for the foreclosure process, which varies by state.

- The opportunity for the homeowner to rectify the situation before the property is sold.

- The role of the court in overseeing the foreclosure proceedings, if contested.

- The potential for deficiency judgments, which can hold the homeowner liable for any remaining debt after the property is sold.

Who issues the form?

The notice liability form is typically issued by the lender or financial institution holding the mortgage. This form serves as an official record of the homeowner's acknowledgment of the foreclosure process and their rights regarding the property. It is essential for homeowners to ensure that they receive this form and understand its implications, as it plays a critical role in the foreclosure proceedings.

Required documents

When completing the liability foreclosure process, several documents are required to ensure compliance and proper handling of the situation. These documents may include:

- The original mortgage agreement.

- The notice liability form, properly filled out.

- Any correspondence with the lender regarding the default.

- Proof of income and financial statements to support any claims for loan modification or assistance.

- Documentation of any attempts to rectify the situation, such as payment records or communication logs.

Penalties for non-compliance

Failing to comply with the liability foreclosure process can result in serious consequences for homeowners. These penalties may include:

- Loss of the property through a foreclosure sale without the opportunity to contest.

- Potential deficiency judgments, leading to further financial liability.

- Negative impacts on credit scores, affecting future borrowing capabilities.

- Legal fees and costs associated with contested foreclosure proceedings.

Quick guide on how to complete liability foreclosure

Prepare Liability Foreclosure effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Liability Foreclosure on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Liability Foreclosure without hassle

- Locate Liability Foreclosure and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, through email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Liability Foreclosure and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is notice liability in the context of e-signatures?

Notice liability refers to the obligation to inform signing parties about the nature of documents they are signing electronically. In the context of airSlate SignNow, it ensures that users are fully aware of the agreements they are entering into, thereby reducing potential legal risks associated with miscommunication.

-

How can airSlate SignNow help me with notice liability?

AirSlate SignNow provides comprehensive documentation and user notifications to ensure that all parties are aware of their obligations. By using our platform, you can easily maintain records that show compliance with notice liability requirements, protecting your business during audits or disputes.

-

Are there specific features in airSlate SignNow that address notice liability?

Yes, airSlate SignNow includes features such as audit trails and detailed signing workflows that help manage notice liability. These features ensure that every step of the e-signature process is documented, making it clear that all parties received proper notice of the terms before signing.

-

What types of documents can I send using airSlate SignNow related to notice liability?

You can send a wide range of documents using airSlate SignNow, including contracts, agreements, and notices that require acknowledgment of notice liability. Our platform is designed to handle various document types efficiently while ensuring legal compliance.

-

Is there a free trial available for airSlate SignNow to understand notice liability better?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore our features related to notice liability. This trial will help you understand how our platform can streamline the e-signature process while ensuring compliance.

-

What are the pricing plans for airSlate SignNow that cover notice liability features?

AirSlate SignNow offers several pricing plans that include features essential for managing notice liability. These plans are designed to cater to businesses of all sizes, ensuring you find a suitable option that meets your legal and operational needs.

-

Can I integrate airSlate SignNow with other applications for notice liability management?

Absolutely! AirSlate SignNow integrates seamlessly with various applications like CRMs and document management systems, enhancing your ability to manage notice liability effectively. These integrations help streamline workflows and ensure that all necessary documents are in one place.

Get more for Liability Foreclosure

Find out other Liability Foreclosure

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease