Security Interest Agreement Purchase Form

What is the Security Interest Agreement Purchase

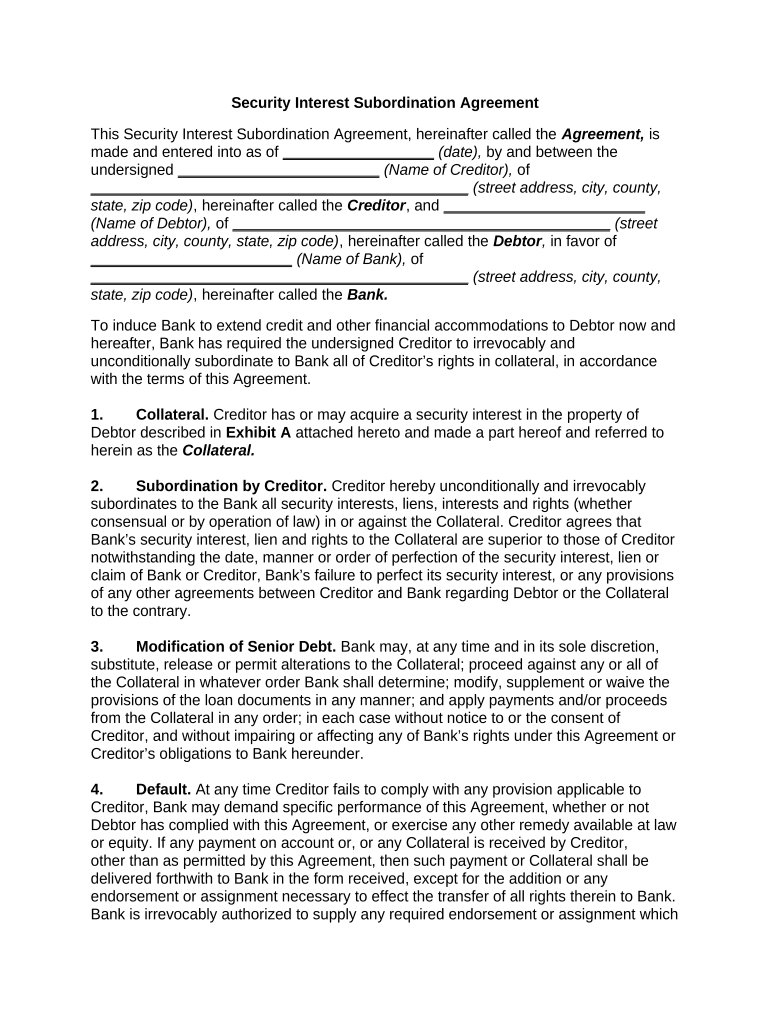

A security interest agreement purchase is a legal document that establishes a lender's interest in a borrower's property as collateral for a loan. This agreement outlines the terms under which the lender can claim the collateral if the borrower defaults on the loan. It is essential for protecting the lender's rights while providing the borrower with access to necessary funds. The agreement typically includes details such as the type of collateral, the obligations of both parties, and the conditions under which the security interest can be enforced.

Key Elements of the Security Interest Agreement Purchase

Understanding the key elements of a security interest agreement purchase is crucial for both lenders and borrowers. Important components include:

- Identification of Parties: Clearly states the lender and borrower involved in the agreement.

- Description of Collateral: Specifies the property or assets being used as collateral.

- Obligations: Outlines the responsibilities of both parties, including repayment terms and maintenance of collateral.

- Default Conditions: Defines what constitutes a default and the actions that can be taken by the lender.

- Governing Law: Indicates which state's laws will govern the agreement.

Steps to Complete the Security Interest Agreement Purchase

Completing a security interest agreement purchase involves several important steps to ensure that the document is legally binding and protects the interests of both parties. The process typically includes:

- Gathering necessary information about the borrower and collateral.

- Drafting the agreement, ensuring all key elements are included.

- Reviewing the document with legal counsel to confirm compliance with state laws.

- Obtaining signatures from both parties, ensuring that all signatures are witnessed or notarized as required.

- Filing the agreement with the appropriate state authority if necessary, to perfect the security interest.

Legal Use of the Security Interest Agreement Purchase

The legal use of a security interest agreement purchase is governed by various laws and regulations that ensure its enforceability. In the United States, the Uniform Commercial Code (UCC) provides a framework for security interests, outlining how they should be created, perfected, and enforced. Compliance with these regulations is essential for the lender to maintain their rights over the collateral. Additionally, the agreement must be executed in a manner that meets the legal requirements of the state in which it is executed.

How to Use the Security Interest Agreement Purchase

Using a security interest agreement purchase effectively requires understanding its purpose and the implications of the terms outlined within it. Borrowers should use this agreement to secure financing while ensuring they are aware of their obligations. Lenders can use the agreement to protect their investment by clearly defining the terms under which they can claim collateral. Both parties should keep a copy of the signed agreement for their records and refer to it throughout the duration of the loan.

Examples of Using the Security Interest Agreement Purchase

Practical examples of using a security interest agreement purchase can help clarify its application. For instance, a small business may use its inventory as collateral to secure a loan for expansion. In this case, the security interest agreement would specify the inventory as collateral and outline the repayment terms. Another example could involve an individual using their vehicle to secure a personal loan, where the vehicle's title is included in the agreement as collateral. These scenarios illustrate how the agreement functions in real-world situations, providing security for lenders and access to funds for borrowers.

Quick guide on how to complete security interest agreement purchase

Prepare Security Interest Agreement Purchase effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Handle Security Interest Agreement Purchase on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Security Interest Agreement Purchase without breaking a sweat

- Obtain Security Interest Agreement Purchase and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your edits.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Security Interest Agreement Purchase and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a security interest agreement?

A security interest agreement is a legal document that establishes a secured party's interest in specific collateral to secure a debt. By using airSlate SignNow, businesses can create, send, and eSign security interest agreements quickly and efficiently, ensuring all parties are protected.

-

How can airSlate SignNow benefit my security interest agreement process?

airSlate SignNow streamlines the creation and signing of security interest agreements, making it easy to manage documents electronically. Its user-friendly interface and automation features enhance efficiency, saving time and reducing the risk of errors during the signing process.

-

Is airSlate SignNow secure for handling security interest agreements?

Yes, airSlate SignNow employs industry-leading security measures to protect your documents, including security interest agreements. With strong encryption protocols, secure storage, and compliance with major security standards, you can trust that your sensitive information is safe.

-

What features does airSlate SignNow offer for creating security interest agreements?

airSlate SignNow provides a variety of features for creating security interest agreements, including customizable templates, automated workflows, and multi-party signing capabilities. These tools simplify the entire agreement process, ensuring that you can tailor documents to your specific needs.

-

How does pricing for airSlate SignNow work for security interest agreements?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring security interest agreements. You can choose from various subscription options, allowing you to access essential features without overspending.

-

Can I integrate airSlate SignNow with other applications for managing security interest agreements?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows you to manage your security interest agreements within your existing workflow, enhancing productivity and collaboration.

-

What is the turnaround time for eSigning a security interest agreement with airSlate SignNow?

The turnaround time for eSigning a security interest agreement can be very quick with airSlate SignNow. Once a document is sent for eSignature, it can often be signed and returned within minutes, depending on the signatories' availability, streamlining the process signNowly.

Get more for Security Interest Agreement Purchase

Find out other Security Interest Agreement Purchase

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement