Liens Against Form

What is the liens against?

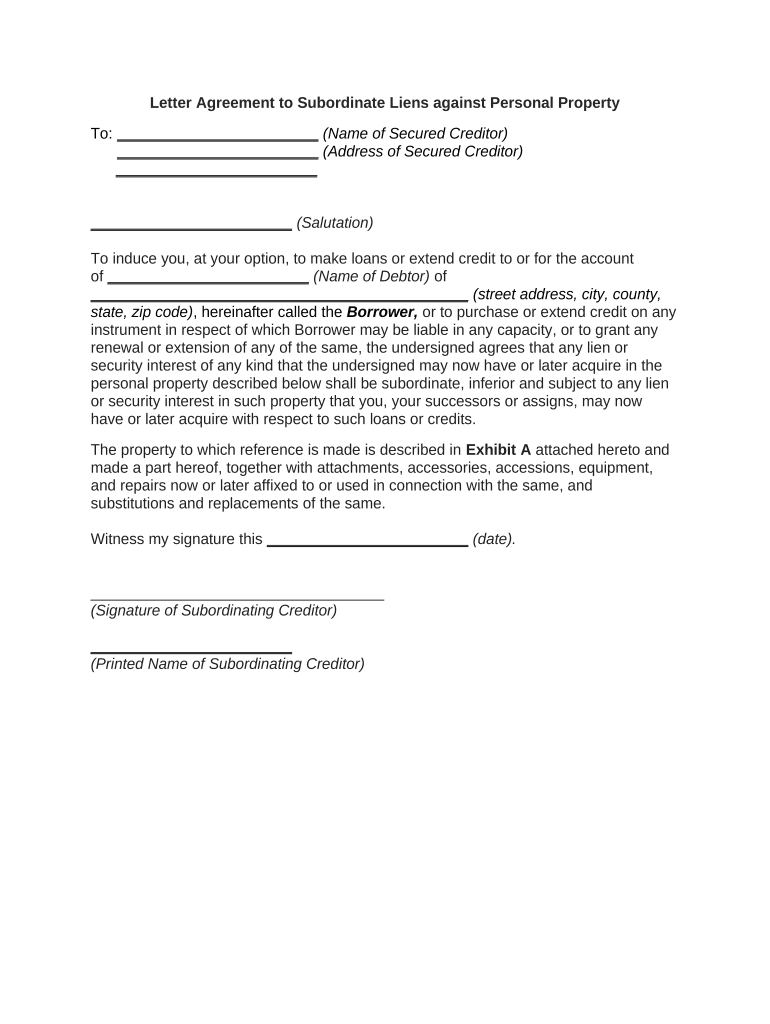

The term "liens against" refers to a legal claim or right against assets that are typically used as collateral to satisfy a debt. When a lien is placed against a property, it signifies that the creditor has a legal interest in the property until the debt obligation is fulfilled. This can occur in various scenarios, such as unpaid taxes, loans, or judgments. Understanding the nature of liens against is crucial for both individuals and businesses, as it can affect credit ratings, property ownership, and financial planning.

How to use the liens against

Using the liens against involves several steps to ensure that the process is legally sound and properly documented. First, identify the type of lien applicable to your situation, such as a tax lien or a judgment lien. Next, gather all necessary documentation that supports your claim, including contracts, payment records, and any relevant correspondence. Once you have the required information, you may need to file a formal notice with the appropriate local or state authority, depending on the jurisdiction. It is essential to follow the specific guidelines for your state to ensure that the lien is enforceable.

Key elements of the liens against

Several key elements define the effectiveness of liens against. These include:

- Documentation: Proper documentation is vital, as it provides evidence of the debt and the agreement between parties.

- Filing Process: The lien must be filed with the appropriate authority to be legally recognized.

- Notification: Creditors are often required to notify the debtor of the lien placement.

- Jurisdiction: Different states have varying laws governing liens, making it important to understand local regulations.

Steps to complete the liens against

Completing the liens against requires a systematic approach. Follow these steps:

- Determine the type of lien you need to file.

- Collect all relevant documents, including proof of debt and agreements.

- Fill out the necessary forms as required by your state or local authority.

- Submit the forms along with any required fees to the appropriate office.

- Notify the debtor of the lien, if required by law.

- Keep a copy of all documents for your records.

Legal use of the liens against

Liens against must be used in accordance with legal standards to ensure they are enforceable. This includes adhering to state laws regarding the types of liens that can be placed, the required documentation, and the filing process. Misuse of liens, such as filing without proper justification or failing to follow legal procedures, can lead to penalties or the invalidation of the lien. It is advisable to consult with a legal professional to navigate the complexities of lien laws.

State-specific rules for the liens against

Each state has its own regulations governing liens against, which can significantly impact how they are filed and enforced. For instance, some states may require specific forms, while others may have different deadlines for filing. Additionally, the types of liens recognized can vary, such as mechanic's liens, tax liens, or judgment liens. Understanding these state-specific rules is essential for ensuring compliance and protecting your rights as a creditor.

Quick guide on how to complete liens against

Complete Liens Against effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents rapidly and without interruptions. Manage Liens Against on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The optimal method to modify and eSign Liens Against easily

- Obtain Liens Against and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device of your choosing. Modify and eSign Liens Against while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are liens against and how do they affect my business?

Liens against your business can represent a legal claim on your assets, making it crucial to understand how they work. These claims can arise from unpaid debts, impacting your cash flow and creditworthiness. It's important to resolve any liens against your business to ensure smooth operations and maintain credibility with partners and customers.

-

How can airSlate SignNow help manage documents related to liens against my business?

airSlate SignNow offers a streamlined solution for managing and eSigning documents related to liens against your business. By using our platform, you can quickly access, sign, and store lien documents securely, helping you keep track of any claims. This efficient document management minimizes disruptions caused by liens against your business.

-

What features does airSlate SignNow offer for handling contracts involving liens against?

Our platform includes features specifically designed to handle contracts involving liens against your assets, such as customizable templates and in-document comments. This allows for clear communication with stakeholders regarding any existing or potential liens. Plus, with secure cloud storage, you can access these important documents anytime, ensuring that you're always informed.

-

Is there a free trial available for airSlate SignNow to understand its features related to liens against?

Yes, airSlate SignNow offers a free trial that lets you explore functionalities relevant to documents with liens against your business. During this trial, you can test sign and manage lien-related documents to see how our platform can streamline your processes. Take advantage of this opportunity to understand how we can assist you in dealing with liens against your assets.

-

What are the pricing options for airSlate SignNow when managing liens against documents?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes needing to manage liens against documents. Our plans range from basic features to advanced capabilities, ensuring you find an option that fits your budget. This cost-effective solution allows you to maintain compliance and address any liens against your business without breaking the bank.

-

Can airSlate SignNow integrate with other systems to monitor liens against?

Certainly! airSlate SignNow can integrate with various platforms, allowing you to monitor liens against and related documents effectively. These integrations enable seamless data exchange and help maintain an organized record of all lien activities. By consolidating this information, you can easily assess the impact of any liens against your business.

-

What benefits does airSlate SignNow provide for reducing risks associated with liens against?

By using airSlate SignNow, businesses can reduce risks associated with liens against through automated reminders and secure document tracking. This proactive approach ensures timely management of liens, protecting your assets. Our solution helps you maintain visibility into all lien-related activities, allowing for informed decision-making and risk mitigation.

Get more for Liens Against

Find out other Liens Against

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form