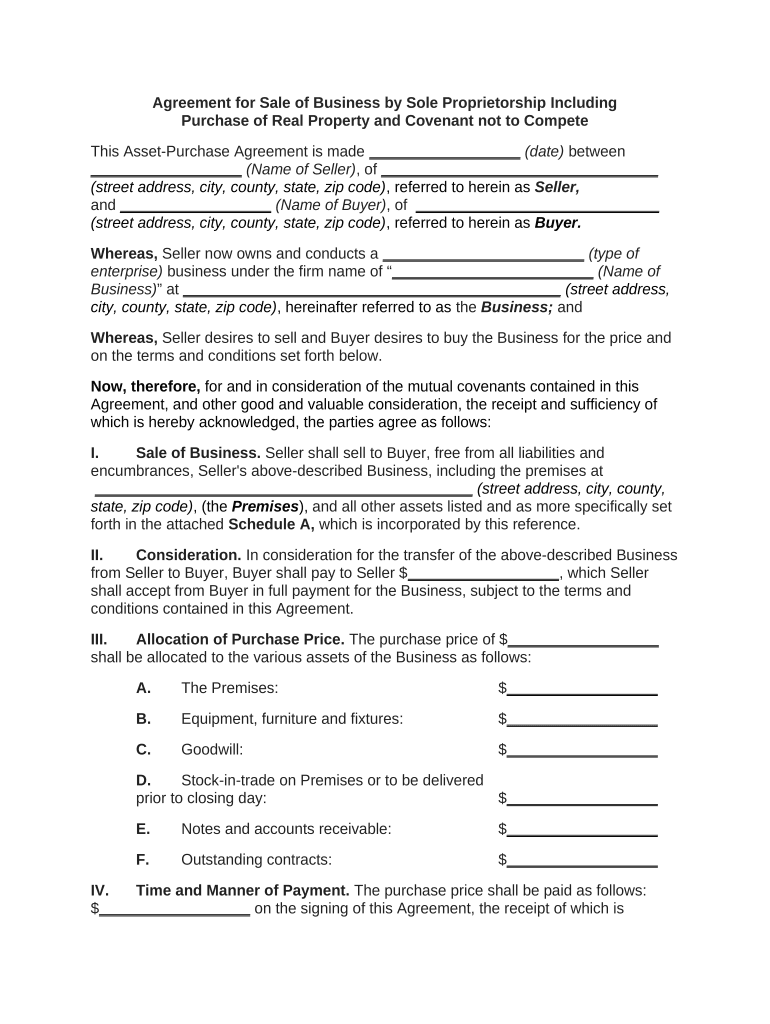

Sole Proprietorship Form

What is the sole proprietorship?

A sole proprietorship is a simple and common business structure where an individual operates a business without forming a separate legal entity. This means that the owner is personally responsible for all debts and liabilities incurred by the business. In the United States, this structure is favored for its ease of setup and minimal regulatory requirements. The owner retains complete control over decision-making and receives all profits generated by the business.

Steps to complete the sole proprietorship

To establish a sole proprietorship, follow these essential steps:

- Choose a business name: Select a unique name that reflects your business and check for availability in your state.

- Register your business: Depending on your location, you may need to file a "Doing Business As" (DBA) name with your local government.

- Obtain necessary licenses and permits: Research and apply for any required licenses or permits specific to your industry and location.

- Set up a business bank account: Open a separate bank account for your business to keep personal and business finances distinct.

- Keep accurate records: Maintain thorough records of income, expenses, and any other relevant financial information to simplify tax preparation.

Legal use of the sole proprietorship

Operating as a sole proprietorship requires compliance with various legal obligations. This includes adhering to local, state, and federal regulations that govern business operations. Business owners must ensure they are following tax laws, including income tax reporting, self-employment tax, and any applicable sales tax. Additionally, obtaining necessary licenses and permits is crucial to avoid penalties. A sole proprietorship does not provide personal liability protection, so owners should consider obtaining appropriate insurance to mitigate risks.

Required documents

While setting up a sole proprietorship typically involves fewer formalities than other business structures, certain documents are essential:

- Business registration documents: If using a DBA, you may need to file registration paperwork with your local government.

- Licenses and permits: Depending on your business type, you may need specific licenses or permits to operate legally.

- Tax identification number: While not always required, obtaining an Employer Identification Number (EIN) from the IRS can be beneficial for tax purposes.

- Financial records: Keep organized records of all financial transactions to ensure accurate reporting and compliance with tax regulations.

IRS guidelines

The IRS provides specific guidelines for sole proprietorships regarding tax obligations. Sole proprietors report business income and expenses on Schedule C of their personal tax return (Form 1040). This includes all profits and losses from the business. Additionally, sole proprietors must pay self-employment tax on net earnings exceeding a certain threshold. Understanding these guidelines is vital for compliance and to avoid potential penalties.

Eligibility criteria

Eligibility to operate as a sole proprietorship is generally straightforward. Any individual who wishes to start a business can do so without needing to file formal paperwork to create a separate legal entity. However, certain restrictions may apply based on local laws, particularly regarding business types that require specific licenses or permits. It is important to verify local regulations to ensure compliance.

Quick guide on how to complete sole proprietorship 497333569

Complete Sole Proprietorship effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Sole Proprietorship on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Sole Proprietorship with ease

- Locate Sole Proprietorship and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Sole Proprietorship and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sole proprietorship and how does it benefit from airSlate SignNow?

A sole proprietorship is a business owned and operated by one individual, making it simple to form and manage. airSlate SignNow enhances the efficiency of a sole proprietorship by streamlining document workflows, allowing you to send and eSign contracts easily, which saves time and reduces paperwork.

-

How much does airSlate SignNow cost for sole proprietors?

airSlate SignNow offers a variety of pricing plans suitable for sole proprietorships, starting at an affordable monthly rate. These plans provide access to essential features, making it a cost-effective solution for managing documents and eSigning.

-

What features does airSlate SignNow offer for sole proprietorships?

airSlate SignNow includes features such as customizable templates, cloud storage, and the ability to integrate with popular apps, all of which are beneficial for sole proprietorships. These tools help streamline document management and enhance professional communication.

-

Is airSlate SignNow secure for sole proprietorships handling sensitive documents?

Yes, airSlate SignNow prioritizes security by employing advanced encryption and authentication methods. This ensures that the documents of a sole proprietorship are protected, giving you peace of mind when managing sensitive information.

-

How can airSlate SignNow improve customer experience for sole proprietorships?

By using airSlate SignNow, sole proprietorships can provide a faster and more efficient service to clients through electronic signatures and instant document delivery. This improved workflow enhances customer satisfaction, making it easier for you to manage client relationships.

-

Can airSlate SignNow integrate with other tools used by sole proprietorships?

Absolutely, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and Dropbox. This connectivity makes it easy for sole proprietorships to incorporate document management into their existing systems without hassle.

-

What are the benefits of using airSlate SignNow for a new sole proprietorship?

For a new sole proprietorship, airSlate SignNow provides a user-friendly platform that simplifies document signing and management. The benefits include reduced operational costs, improved efficiency, and the ability to present a professional image right from the start.

Get more for Sole Proprietorship

Find out other Sole Proprietorship

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement