Qualified Personal Residence Trust Form

What is the qualified personal residence trust form?

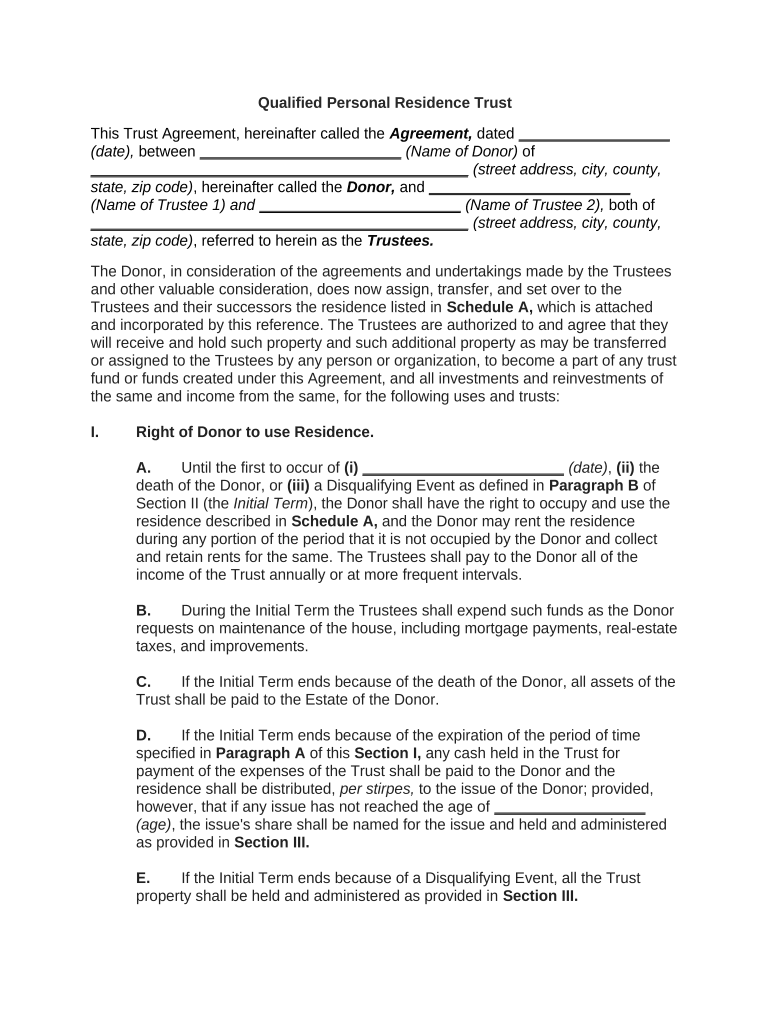

The qualified personal residence trust form is a legal document that allows individuals to transfer ownership of their personal residence into a trust while retaining the right to live in the home for a specified period. This estate planning tool helps reduce the taxable value of an estate, potentially lowering estate taxes upon the individual's death. By placing a home in a qualified personal residence trust, the grantor can benefit from significant tax advantages while still enjoying the use of the property during their lifetime.

How to use the qualified personal residence trust form

Using the qualified personal residence trust form involves several steps. First, the grantor must complete the form, providing necessary details such as the property address, the names of the beneficiaries, and the duration of the trust. Once completed, the form must be signed and notarized to ensure its legal validity. It is essential to follow state-specific regulations regarding trust formation and property transfer. After executing the trust, the grantor should file the form with the appropriate state authorities, if required, to finalize the transfer of the property into the trust.

Key elements of the qualified personal residence trust form

The qualified personal residence trust form contains several key elements that must be included for it to be legally binding. These elements typically include:

- Grantor Information: Name and address of the individual creating the trust.

- Property Description: Detailed information about the residence being placed in the trust.

- Beneficiaries: Names of individuals who will receive the property after the trust term ends.

- Trust Duration: The length of time the grantor retains the right to live in the property.

- Signature and Notarization: Required signatures and notarization to validate the trust.

Steps to complete the qualified personal residence trust form

Completing the qualified personal residence trust form involves a systematic approach to ensure accuracy and compliance with legal requirements. The steps include:

- Gather necessary information about the property and beneficiaries.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign the form in the presence of a notary public.

- File the form with the appropriate authorities, if necessary, to finalize the trust.

Legal use of the qualified personal residence trust form

The legal use of the qualified personal residence trust form is governed by specific laws and regulations. This form is recognized under U.S. tax law, allowing individuals to transfer their primary residence into a trust without incurring gift taxes, provided certain conditions are met. It is essential for the grantor to comply with IRS guidelines regarding the trust's duration and the fair market value of the property. Failure to adhere to these regulations may result in unintended tax consequences.

Eligibility criteria for the qualified personal residence trust

To use the qualified personal residence trust form, individuals must meet certain eligibility criteria. These typically include:

- The grantor must be the owner of the residence being transferred.

- The property must be classified as a personal residence, not an investment property.

- The grantor must intend to live in the residence for the duration specified in the trust.

- All beneficiaries must be legally capable of receiving the property upon the trust's termination.

Quick guide on how to complete qualified personal residence trust form

Effortlessly prepare Qualified Personal Residence Trust Form on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Qualified Personal Residence Trust Form on any platform using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

The easiest way to modify and eSign Qualified Personal Residence Trust Form with ease

- Find Qualified Personal Residence Trust Form and click on Get Form to initiate.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs within a few clicks from any device of your choice. Modify and eSign Qualified Personal Residence Trust Form and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a qualified personal residence trust form?

A qualified personal residence trust form is a legal document used to establish a trust that allows you to transfer ownership of your personal residence while retaining the right to live there for a specified period. This form aims to reduce your estate tax liability and protect your assets. Using this form effectively can be beneficial for estate planning.

-

How does the qualified personal residence trust form benefit estate planning?

By utilizing a qualified personal residence trust form, you can signNowly lower your taxable estate by removing the value of your home from your estate. This protection not only helps in tax savings but also ensures that your residence can be passed on to your beneficiaries without incurring substantial estate taxes. Many individuals find this strategy advantageous for long-term financial security.

-

What features does airSlate SignNow offer for signing a qualified personal residence trust form?

airSlate SignNow provides a user-friendly platform that allows you to easily upload, edit, and eSign your qualified personal residence trust form. With features like document templates and automated workflows, completing this essential document becomes a streamlined process. Additionally, the platform ensures secure handling of your sensitive data.

-

Is there a cost associated with the qualified personal residence trust form through airSlate SignNow?

Yes, while creating a qualified personal residence trust form may involve some initial costs, airSlate SignNow offers competitive pricing plans that make document signing affordable. The pricing structure is transparent, allowing you to choose a plan that fits your needs and budget. This ensures you receive valuable document management services at a reasonable price.

-

Can I integrate airSlate SignNow with other software while using the qualified personal residence trust form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enabling efficient management of your qualified personal residence trust form. This integration capability enhances your workflow, allowing you to connect with popular productivity tools and streamline processes, making it easier to manage your documents.

-

What makes airSlate SignNow stand out for creating a qualified personal residence trust form?

airSlate SignNow stands out due to its intuitive interface, robust security features, and efficient workflows tailored for creating a qualified personal residence trust form. Its advanced tracking options allow you to monitor the signing process and ensure all necessary parties complete the document timely. This guarantees a smooth experience from start to finish.

-

Can I collaborate with my attorney on the qualified personal residence trust form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the qualified personal residence trust form in real time. You can easily share documents with your attorney, allowing for quick feedback, edits, and approvals. This collaborative aspect ensures that you receive professional guidance while maintaining control over your document.

Get more for Qualified Personal Residence Trust Form

- University of south alabama declaration of abm accelerated bachelors to masters degree program form

- Tcc questionnaire form

- Tasfa financial aid and scholarships texas state university form

- University supervisormentor teacher resources school of form

- Scan amp upload to mappingexpress form

- University va joint appointment form

- Fillable online price county uw extension fax email print pdffiller form

- Gcu student form

Find out other Qualified Personal Residence Trust Form

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself