Conditional Gifts Form

Understanding Conditional Gifts

Conditional gifts are donations or transfers of property that depend on the occurrence of a specific event or condition. These gifts are often used in estate planning or charitable giving, allowing the donor to specify terms under which the gift will be given. For example, a donor might give a conditional gift to a charity, stipulating that the funds can only be used for a particular project. Understanding the legal framework surrounding these gifts is essential for both donors and recipients to ensure compliance and clarity.

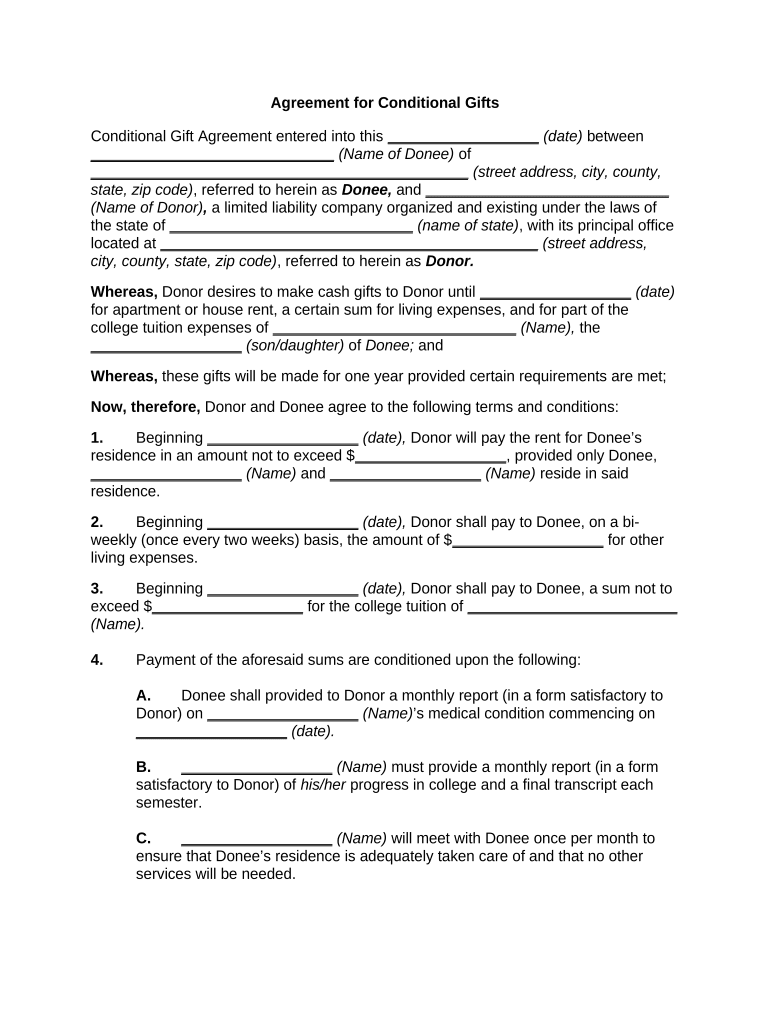

Steps to Complete a Conditional Gift Agreement

Completing a conditional gift agreement involves several key steps to ensure that the terms are clear and legally binding. Start by clearly defining the conditions attached to the gift, such as specific milestones or timelines. Next, draft the agreement using precise language to avoid ambiguity. It is advisable to include the names of all parties involved, a detailed description of the gift, and any relevant deadlines. Once the agreement is drafted, both parties should review it thoroughly before signing. Utilizing a reliable eSignature solution can streamline this process, ensuring that the document is executed securely and in compliance with legal standards.

Legal Considerations for Conditional Gifts

When creating a conditional gift, it is crucial to understand the legal implications. Conditional gifts must comply with state laws and regulations, which can vary significantly. For example, some states may have specific requirements for the documentation of such gifts, while others may impose restrictions on the conditions that can be set. Additionally, the gift must be executed in a manner that is legally recognized, such as through a written agreement that is signed by all parties. Consulting with a legal professional can help ensure that the conditional gift adheres to all applicable laws.

Examples of Conditional Gifts

Conditional gifts can take many forms, often tailored to the donor's intentions. Common examples include:

- A donor may provide funds to a university with the condition that the money is used for a specific scholarship program.

- A parent might offer a conditional gift to their child, stating that the funds can only be used for educational expenses.

- A charitable organization may receive a donation that is contingent upon matching funds being raised within a certain timeframe.

These examples illustrate how conditional gifts can help achieve specific goals while providing flexibility in how the funds are utilized.

Eligibility Criteria for Conditional Gifts

Eligibility for making or receiving conditional gifts can vary based on several factors. Generally, the donor must have the legal capacity to make a gift, which includes being of legal age and sound mind. Recipients must also be capable of fulfilling the conditions set forth in the gift agreement. Additionally, certain types of conditional gifts may be subject to specific regulations, such as those involving charitable organizations, which must adhere to IRS guidelines to maintain their tax-exempt status. Understanding these criteria is vital for both parties to ensure compliance and avoid potential legal issues.

IRS Guidelines on Conditional Gifts

The IRS provides specific guidelines regarding the treatment of conditional gifts for tax purposes. Generally, conditional gifts may be deductible if they meet certain criteria, such as being made to qualified charitable organizations. However, the deductibility can be affected by the conditions attached to the gift. For instance, if the donor retains control over the use of the gift or if the conditions are too restrictive, it may impact the tax benefits. It is essential for donors to consult IRS guidelines or a tax professional to understand the implications of their conditional gifts.

Quick guide on how to complete conditional gifts

Easily prepare Conditional Gifts on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Conditional Gifts across any platform with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Conditional Gifts effortlessly

- Find Conditional Gifts and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to confirm your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), an invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Conditional Gifts and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an agreement conditional in the context of electronic signatures?

An agreement conditional refers to a contractual understanding where certain conditions must be met for the agreement to take effect. Using airSlate SignNow, you can easily create and manage agreement conditionals to ensure that all parties comply with specific requirements before the document is finalized.

-

How does airSlate SignNow handle agreement conditionals?

airSlate SignNow provides features that allow users to set up agreement conditionals seamlessly. You can specify triggers based on recipient actions or predefined criteria, ensuring that your documents adhere to desired conditions before moving forward in the signing process.

-

Can I integrate airSlate SignNow with my existing CRM for managing agreement conditionals?

Yes, airSlate SignNow offers robust integrations with popular CRM systems, enabling smooth management of agreement conditionals within your existing workflows. This integration streamlines document processes and ensures that all conditional agreements are tracked and executed efficiently.

-

What are the pricing options for using airSlate SignNow features related to agreement conditionals?

airSlate SignNow offers various pricing plans tailored to different business needs, including features for managing agreement conditionals. By choosing the right plan, you can access advanced functionalities that help streamline the signing process while maintaining compliance with your conditional agreements.

-

What benefits does using airSlate SignNow bring for agreement conditionals?

Using airSlate SignNow for agreement conditionals enhances transaction security, compliance, and efficiency. The platform simplifies the creation and tracking of conditional agreements, reducing errors and saving time in the communication process between parties.

-

Is it possible to customize templates for agreement conditionals in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize document templates, including those for agreement conditionals. This feature enables you to tailor your contracts to fit specific conditions, ensuring that all necessary terms are included for clarity and compliance.

-

What industries benefit the most from using agreement conditionals?

Many industries including real estate, legal, and finance signNowly benefit from utilizing agreement conditionals. By leveraging airSlate SignNow, businesses in these sectors can ensure compliance and streamline their workflows, ultimately reducing the risk of contract disputes.

Get more for Conditional Gifts

Find out other Conditional Gifts

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe