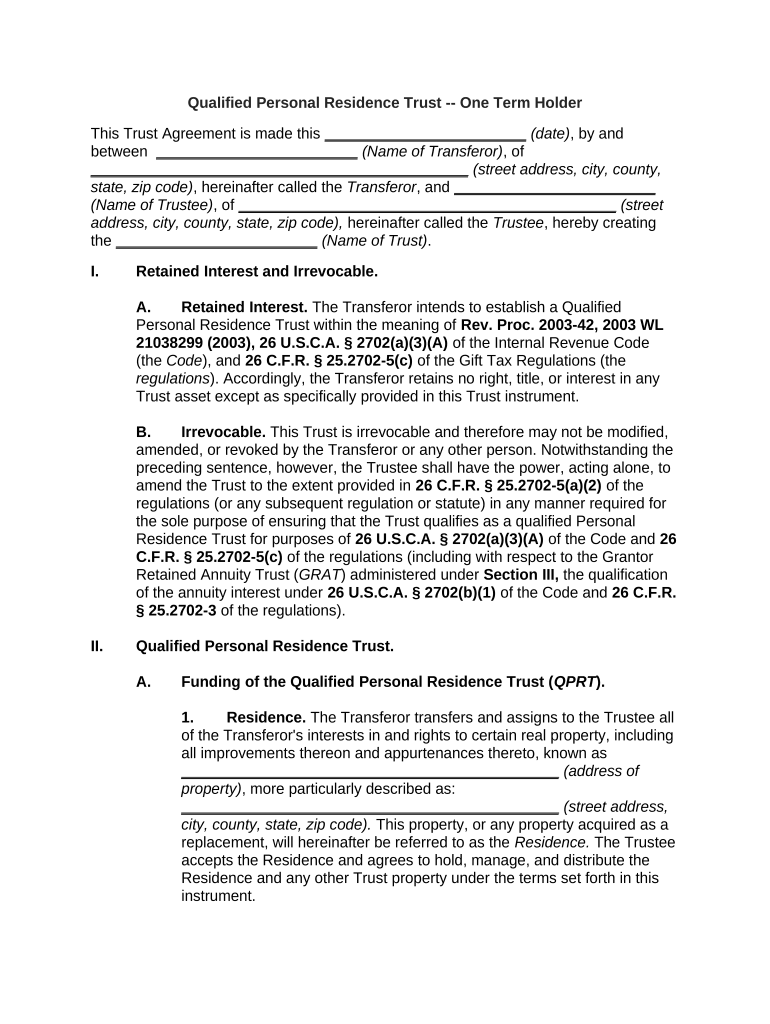

Qualified Personal Form

What is the qualified personal form?

The qualified personal form is a specific document used to establish certain legal or financial qualifications for individuals. It serves various purposes, including applications for loans, benefits, or other official processes. This form typically requires detailed personal information and may need to be submitted to government agencies or financial institutions. Understanding the purpose and requirements of this form is essential for ensuring compliance and successful submission.

Steps to complete the qualified personal form

Completing the qualified personal form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your full name, address, Social Security number, and any relevant financial details. Next, carefully read the instructions provided with the form to understand the specific requirements.

Once you have all the information, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form as directed, whether online, by mail, or in person, depending on the specific submission guidelines.

Legal use of the qualified personal form

The legal use of the qualified personal form hinges on its compliance with relevant laws and regulations. To be considered legally binding, the form must be completed accurately and submitted according to the prescribed guidelines. In the United States, eSignature laws such as the ESIGN Act and UETA provide a framework for electronic signatures, ensuring that digital submissions are recognized as valid.

It is crucial to maintain a record of the completed form and any correspondence related to its submission. This documentation can serve as evidence in case of disputes or inquiries regarding the form's validity.

Key elements of the qualified personal form

Several key elements define the qualified personal form and its functionality. These elements typically include:

- Personal Information: Essential details such as name, address, and identification numbers.

- Purpose of the Form: A clear indication of why the form is being submitted, such as for a loan application or benefits eligibility.

- Signature Section: A designated area for the individual to sign, confirming the accuracy of the information provided.

- Date of Submission: The date when the form is completed and submitted, which may be relevant for deadlines.

Understanding these elements helps ensure that the form is filled out correctly and meets all necessary requirements.

Examples of using the qualified personal form

The qualified personal form can be utilized in various scenarios, demonstrating its versatility. Common examples include:

- Loan Applications: Individuals may need to submit this form to qualify for personal loans or mortgages.

- Government Benefits: The form can be required when applying for state or federal assistance programs.

- Employment Verification: Employers may request this form to verify an applicant's qualifications or background.

Each of these examples highlights the importance of accurately completing and submitting the qualified personal form to achieve the desired outcome.

Eligibility criteria for the qualified personal form

Eligibility criteria for the qualified personal form vary depending on its intended use. Generally, individuals must meet specific requirements, such as age, residency, and financial status. For instance, when applying for a loan, lenders may require applicants to demonstrate a certain credit score or income level.

It is essential to review the eligibility criteria outlined in the instructions accompanying the form to ensure that all requirements are met before submission. Failing to meet these criteria could result in delays or denials of the application.

Quick guide on how to complete qualified personal

Finalize Qualified Personal effortlessly on any device

Digital document management has become widely adopted by both businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the necessary format and securely preserve it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Qualified Personal on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Qualified Personal effortlessly

- Obtain Qualified Personal and then click Get Form to begin.

- Employ the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools available from airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information carefully and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Adjust and eSign Qualified Personal and guarantee excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cost of using airSlate SignNow for qualified personal?

The pricing for airSlate SignNow is designed to be budget-friendly, making it a suitable choice for qualified personal. We offer a range of plans that cater to different needs, starting with a free trial, allowing you to explore the features before committing. Additional plans offer advanced capabilities at competitive prices, ensuring great value.

-

How does airSlate SignNow ensure security for qualified personal documents?

Security is a top priority for airSlate SignNow, especially for qualified personal documents. We employ advanced encryption techniques, secure data storage, and regular security audits to protect your information. This commitment to security ensures that your documents remain safe while using our eSigning solution.

-

What features does airSlate SignNow offer for qualified personal users?

airSlate SignNow provides a suite of features tailored for qualified personal users, including document templates, bulk sending, and customizable workflows. These tools streamline the signing process, making it more efficient. The easy-to-use interface ensures that users can quickly adopt these features without a steep learning curve.

-

Can qualified personal integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with numerous popular applications, making it suitable for qualified personal. You can effortlessly connect our platform with tools like Google Drive, Salesforce, and more. This interoperability enhances productivity by allowing users to manage documents within their preferred ecosystem.

-

What are the benefits of using airSlate SignNow for qualified personal?

Using airSlate SignNow delivers several benefits for qualified personal, including signNow time savings and improved accuracy in document handling. The platform reduces the need for paper, speeds up the signing process, and minimizes human error. Overall, it's a modern solution that supports efficient document management.

-

How can qualified personal get started with airSlate SignNow?

Qualified personal can easily get started with airSlate SignNow by signing up for a free trial on our website. This trial allows you to explore all features without any commitment. After experiencing the benefits firsthand, you can choose a pricing plan that best suits your needs.

-

Is airSlate SignNow suitable for qualified personal in different industries?

Absolutely! airSlate SignNow is versatile and suitable for qualified personal across various industries including healthcare, education, and real estate. Our platform's flexibility and range of features can be adapted to meet specific industry needs, making it a valuable tool regardless of sector.

Get more for Qualified Personal

Find out other Qualified Personal

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter