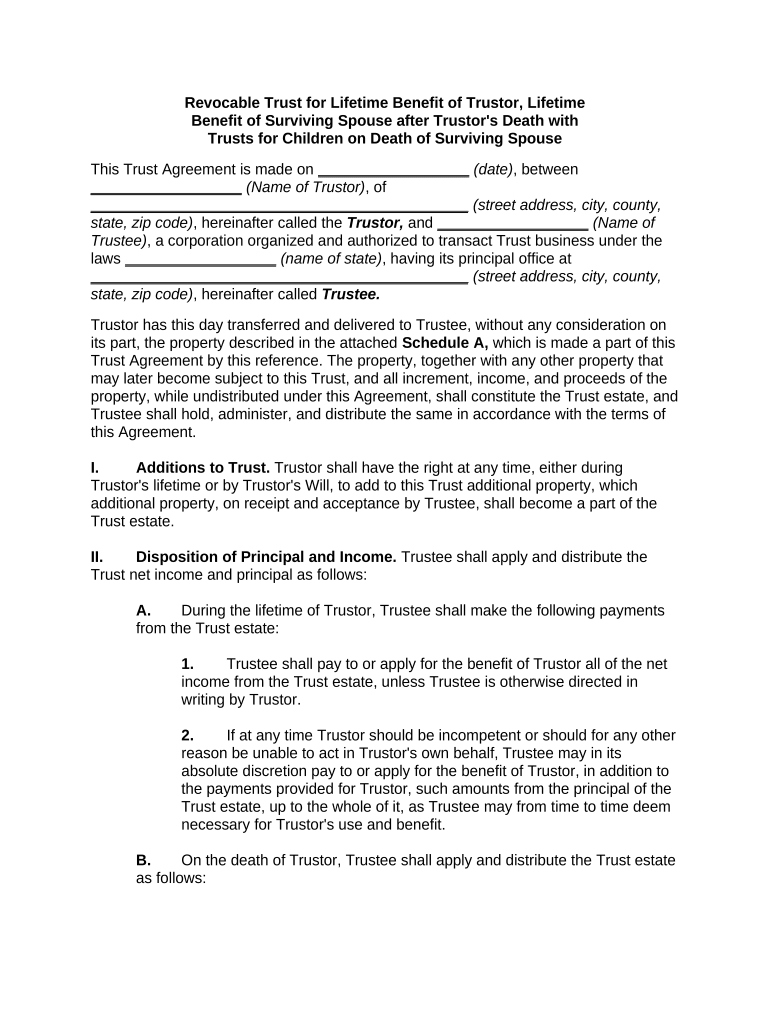

Revocable Trust Benefit Form

What is the Revocable Trust Benefit

A revocable trust benefit refers to the advantages of establishing a revocable trust, a legal entity that allows individuals to manage their assets during their lifetime and dictate their distribution after death. This type of trust can be altered or revoked by the grantor at any time, providing flexibility in estate planning. Key benefits include avoiding probate, maintaining privacy, and ensuring a smoother transition of assets to beneficiaries. Additionally, a revocable trust can help manage assets in the event of incapacity, allowing a designated trustee to take over management without court intervention.

How to use the Revocable Trust Benefit

To utilize the revocable trust benefit effectively, individuals should begin by drafting a trust document that outlines the terms and conditions of the trust. This document should specify the assets included in the trust, the roles of the grantor and trustee, and the distribution plan for beneficiaries. Once the trust is established, the grantor should transfer ownership of the specified assets into the trust. This can include real estate, bank accounts, and investment accounts. Regular reviews and updates to the trust are recommended to reflect any changes in personal circumstances or laws.

Steps to complete the Revocable Trust Benefit

Completing the revocable trust benefit involves several key steps:

- Consult with an attorney: Seek legal advice to ensure compliance with state laws and to tailor the trust to specific needs.

- Draft the trust document: Create a comprehensive document detailing the trust's terms, including the grantor, trustee, and beneficiaries.

- Transfer assets: Change the title of assets to the trust's name to ensure they are included in the trust.

- Sign the document: Execute the trust in accordance with state requirements, which may include notarization.

- Review regularly: Periodically assess the trust to make necessary adjustments based on life changes or legal updates.

Legal use of the Revocable Trust Benefit

The legal use of a revocable trust benefit is governed by state laws, which dictate how trusts are created, managed, and dissolved. It is essential to ensure that the trust document complies with these regulations to be enforceable. A properly executed revocable trust can provide legal protection for the grantor's assets and ensure that the grantor's wishes are honored after their death. Additionally, the trust can help avoid probate, which can be a lengthy and costly process, thereby facilitating a more efficient transfer of assets to beneficiaries.

Key elements of the Revocable Trust Benefit

Several key elements define the revocable trust benefit:

- Flexibility: The grantor can modify or revoke the trust at any time, adapting to changing circumstances.

- Asset management: A trustee can manage the assets, ensuring they are handled according to the grantor's wishes.

- Privacy: Unlike wills, which become public records, a revocable trust remains private, protecting the grantor's financial information.

- Avoiding probate: Assets held in a revocable trust bypass the probate process, allowing for quicker distribution to beneficiaries.

Eligibility Criteria

To establish a revocable trust benefit, individuals must meet certain eligibility criteria. Generally, any adult of sound mind can create a revocable trust. There are no specific income or asset requirements; however, individuals should consider the value of the assets they wish to place in the trust. It is also advisable to consult with legal professionals to ensure that the trust aligns with personal and financial goals, as well as state regulations.

Quick guide on how to complete revocable trust benefit

Prepare Revocable Trust Benefit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Handle Revocable Trust Benefit on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centered workflow today.

How to edit and eSign Revocable Trust Benefit effortlessly

- Obtain Revocable Trust Benefit and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Indicate important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal value as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Revocable Trust Benefit and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocable trust benefit?

A revocable trust benefit refers to the advantages gained by creating a revocable trust, such as flexibility in managing assets and avoiding probate. This estate planning tool allows you to maintain control over your assets while simplifying the transfer of ownership after your passing. With a revocable trust, you can amend or dissolve it at any time, ensuring your estate plan remains relevant to your needs.

-

How can airSlate SignNow help in managing revocable trusts?

airSlate SignNow facilitates the efficient management of revocable trusts by allowing you to send, sign, and store trust documents securely online. With this electronic signature solution, updating and sharing revocable trust documents becomes effortless and timestamped for compliance. By leveraging airSlate SignNow's features, you can streamline the management of your revocable trust benefit.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing structures tailored to meet various organizational needs. Businesses can choose from multiple plans that include features relevant to handling revocable trust documents efficiently. The flexible pricing options ensure that you only pay for the features that align with the revocable trust benefit you seek.

-

What features does airSlate SignNow offer for trust management?

airSlate SignNow provides features that support the management of revocable trusts, including customizable templates, bulk sending, and automated reminders. These tools help ensure your documents are completed accurately and on time, maximizing the revocable trust benefit. Enhanced security measures also protect your sensitive information throughout the process.

-

Can airSlate SignNow integrate with other business applications?

Yes, airSlate SignNow easily integrates with popular business applications like Google Workspace and Salesforce, enhancing its functionality. This seamless integration allows for a more streamlined workflow when managing revocable trusts and their associated documents. By leveraging these integrations, you can maximize the revocable trust benefit while maintaining efficiency in your business processes.

-

How does eSigning enhance the revocable trust benefit?

eSigning through airSlate SignNow enhances the revocable trust benefit by providing a fast and secure way to execute trust documents. This digital signature solution eliminates the need for physical paperwork, speeding up the process of establishing and managing your revocable trust. Moreover, eSignatures are legally recognized, ensuring the validity of your documents.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow offers robust customer support to assist users in navigating their platforms. Whether you have questions about leveraging the revocable trust benefit or need help with technical issues, dedicated support representatives are ready to provide assistance and ensure a smooth experience.

Get more for Revocable Trust Benefit

- Bmv 4301 form

- Twenty four hour affidavit ohio department of public safety form

- Incomplete information will result in the delay of processing your application

- Application for address ohio department of public safety publicsafety ohio form

- Handicap parking permit oklahoma application print form

- Ok 701 7 form

- Department of public safety handicap parking placard application fillable form

- Form 701 7 ok

Find out other Revocable Trust Benefit

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT