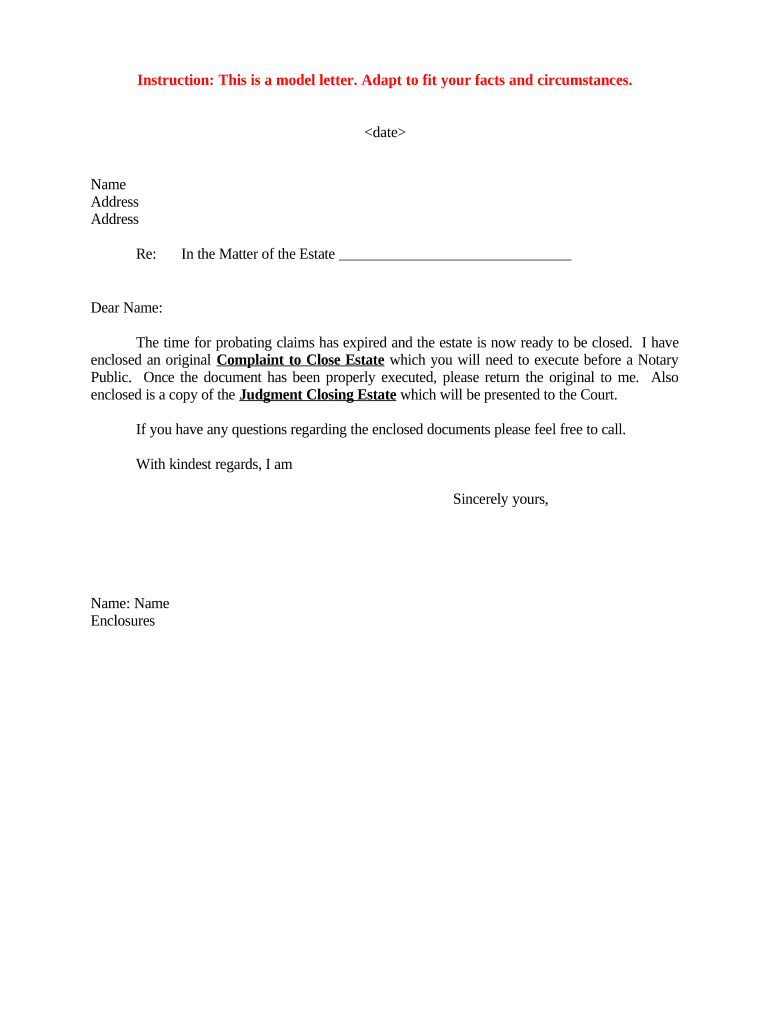

Estate Closing Form

What is the estate closing?

The estate closing refers to the legal process of settling a deceased person's estate, which involves distributing assets, paying debts, and addressing any tax obligations. This process can vary significantly depending on state laws and the complexity of the estate. It typically culminates in a formal closing of the estate, which may require the filing of specific forms and documentation with the appropriate court or authority.

Steps to complete the estate closing

Completing the estate closing involves several key steps that ensure compliance with legal requirements. These steps generally include:

- Gathering all necessary documentation, including the will, death certificate, and financial records.

- Identifying and valuing all assets and liabilities of the estate.

- Notifying creditors and settling any outstanding debts.

- Filing required forms with the court, which may include an estate closing form.

- Distributing the remaining assets to beneficiaries as outlined in the will or state law.

Legal use of the estate closing

The legal validity of the estate closing hinges on adherence to state laws and regulations. It is essential that all documents are properly executed and that the process follows the legal framework established in the jurisdiction. This includes obtaining necessary signatures, filing documents within specified time frames, and ensuring that all beneficiaries are adequately informed throughout the process.

Required documents

To successfully complete the estate closing, several key documents are typically required. These may include:

- The deceased's will, if one exists.

- A death certificate to confirm the passing of the individual.

- Financial statements detailing the estate's assets and liabilities.

- Tax returns for the deceased and the estate, if applicable.

- Any court orders or filings related to the probate process.

State-specific rules for the estate closing

Each state in the U.S. has its own laws governing the estate closing process. It is important to familiarize yourself with the specific rules that apply in your state. These rules may dictate the required documentation, the timeline for closing an estate, and the manner in which assets must be distributed. Consulting with a legal professional can help ensure compliance with local regulations.

Examples of using the estate closing

Practical examples of estate closing can illustrate the process. For instance, in a situation where a person passes away leaving behind a house and several bank accounts, the estate closing would involve:

- Valuing the house and accounts.

- Paying off any existing mortgages or debts.

- Filing the necessary estate closing forms with the probate court.

- Distributing the remaining assets to the heirs as specified in the will.

IRS guidelines

When closing an estate, it is crucial to adhere to IRS guidelines regarding tax obligations. This includes filing any necessary estate tax returns and ensuring that all income generated by the estate is reported. The estate may also be subject to specific deductions and credits, which can affect the overall tax liability. Understanding these guidelines can help in effectively managing the estate's financial responsibilities.

Quick guide on how to complete estate closing

Effortlessly prepare Estate Closing on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a fantastic environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Handle Estate Closing on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to edit and eSign Estate Closing effortlessly

- Find Estate Closing and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Estate Closing to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is estate closing, and how does it work with airSlate SignNow?

Estate closing refers to the process of finalizing the transfer of property and assets after a person's passing. With airSlate SignNow, you can simplify estate closing by securely signing and managing vital documents electronically, ensuring that all parties involved can access and agree on the necessary paperwork seamlessly.

-

How can airSlate SignNow benefit my estate closing process?

airSlate SignNow streamlines the estate closing process by providing a user-friendly platform for eSigning documents. This reduces the time spent on paperwork and minimizes delays, allowing for a smoother transition of assets. Additionally, you can access your documents anytime, anywhere, enhancing convenience.

-

What features does airSlate SignNow offer for estate closing?

airSlate SignNow includes key features such as templates for estate closing documents, customizable workflows, and automated reminders for signers. These functionalities help in managing the complex paperwork associated with estate closings, ensuring that nothing is overlooked and all signatures are collected promptly.

-

Is airSlate SignNow cost-effective for estate closing needs?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business sizes and estate closing requirements. By choosing an affordable eSigning solution, you can save time and money while ensuring professional handling of critical estate closing documents.

-

Can I integrate airSlate SignNow with other tools for estate closing?

Absolutely! airSlate SignNow seamlessly integrates with various platforms such as CRM systems and cloud storage services, enhancing your estate closing workflow. This integration allows you to sync relevant documents and manage all aspects of estate closing in one cohesive environment.

-

What security measures does airSlate SignNow provide for estate closing documents?

Security is paramount when dealing with estate closing documents. airSlate SignNow employs advanced encryption and secure cloud storage to safeguard sensitive information. Additionally, the platform complies with legal standards to protect the integrity of your estate closing transactions.

-

How do I get started with airSlate SignNow for estate closing?

Getting started with airSlate SignNow for estate closing is easy! Simply sign up for an account, explore the tutorial resources, and begin uploading your estate closing documents. The intuitive interface will guide you through creating and sending eSignatures for all your needs.

Get more for Estate Closing

Find out other Estate Closing

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document