Trust Check Form

What is the Trust Check

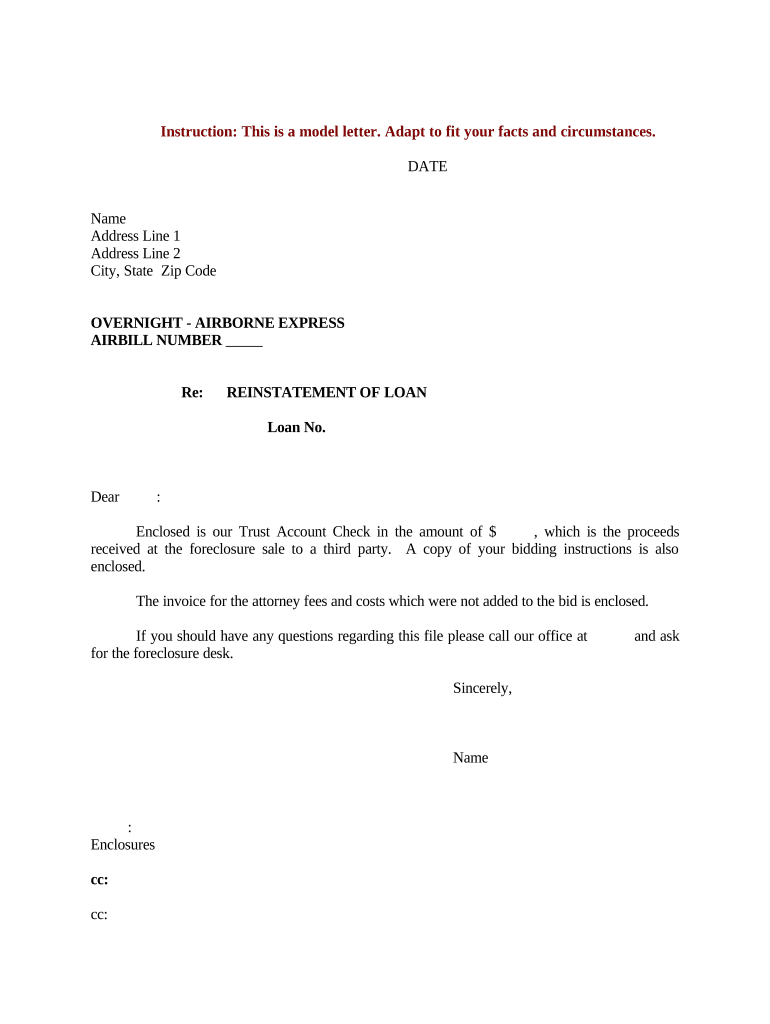

A trust check is a formal document that verifies the existence and status of a trust account. It serves as a crucial tool for individuals and entities managing trust funds, ensuring compliance with legal and financial obligations. This document typically includes information about the trust's purpose, the trustee's authority, and the beneficiaries involved. Understanding the trust check is essential for anyone involved in estate planning, asset management, or legal proceedings related to trusts.

How to use the Trust Check

Using a trust check involves several steps to ensure its effectiveness and compliance. First, gather all necessary documentation related to the trust, including the trust agreement and any amendments. Next, complete the trust check form accurately, providing details about the trust and its beneficiaries. Once filled out, the trust check should be submitted to the appropriate financial institution or legal entity for verification. This process not only confirms the trust's status but also helps maintain transparency and accountability in trust management.

Key elements of the Trust Check

The key elements of a trust check include the trust's name, the trustee's contact information, and the beneficiaries' details. Additionally, it should outline the purpose of the trust and any specific instructions regarding the management of the assets. It's also important to include the date the trust was established and any relevant identification numbers, such as a tax identification number. These components ensure that the trust check is comprehensive and meets legal requirements.

Legal use of the Trust Check

The legal use of a trust check is vital for ensuring compliance with state and federal regulations. It can be used in various scenarios, such as when a trustee needs to provide proof of the trust's existence to financial institutions, during estate settlements, or when addressing tax obligations. Properly executed trust checks can help prevent disputes among beneficiaries and ensure that the trustee is fulfilling their fiduciary duties in accordance with the law.

Steps to complete the Trust Check

Completing a trust check involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant trust documents, including the trust agreement.

- Fill out the trust check form with accurate information about the trust and its beneficiaries.

- Review the completed form for any errors or omissions.

- Submit the trust check to the designated financial institution or legal entity.

- Keep a copy of the submitted trust check for your records.

Examples of using the Trust Check

Examples of using a trust check can vary based on individual circumstances. For instance, a trustee may need to present a trust check to a bank when opening a trust account. Similarly, during the probate process, a trust check may be required to validate the existence of the trust to the court. In real estate transactions, a trust check can help verify that funds held in trust are available for property purchases or distributions to beneficiaries.

Quick guide on how to complete trust check

Effortlessly Prepare Trust Check on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow provides all the resources necessary to draft, modify, and electronically sign your documents swiftly and without interruptions. Manage Trust Check on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented procedure today.

The simplest method to edit and electronically sign Trust Check with ease

- Find Trust Check and select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your selected device. Modify and electronically sign Trust Check to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter trust account?

A letter trust account is a specialized financial account used to hold and manage funds on behalf of another party. It is commonly used in real estate transactions and legal matters. By utilizing a letter trust account, businesses can ensure secure handling of client funds and maintain transparency during financial dealings.

-

How does airSlate SignNow manage letter trust accounts?

airSlate SignNow offers a streamlined solution for managing letter trust accounts with integrated eSignature capabilities. This allows businesses to send, sign, and store documents related to trust accounts securely. Our platform ensures compliance and provides tracking features, enhancing the overall management of your letter trust account.

-

What are the benefits of using a letter trust account?

Using a letter trust account provides several benefits, including enhanced security for funds, clear documentation of transactions, and improved trust between parties. It allows for appropriate fund management and can help in resolving disputes effectively. Overall, a letter trust account is essential for protecting both clients and service providers in financial transactions.

-

Is there a fee for using a letter trust account with airSlate SignNow?

While airSlate SignNow offers a competitively priced subscription model, specific fees associated with managing a letter trust account may vary based on your business's needs. Our transparent pricing ensures you know what to expect, including any costs that may arise from document management or eSignature services related to your letter trust account.

-

Can I integrate airSlate SignNow with my existing accounting software for my letter trust account?

Yes, airSlate SignNow provides seamless integrations with various accounting and financial software, making it easy to manage your letter trust account efficiently. This integration allows for automatic updates and real-time collaboration, ensuring that your accounting records reflect all transactions accurately. By connecting your tools, you enhance the functionality of managing your letter trust account.

-

What industries benefit from using letter trust accounts?

Industries such as real estate, law, and finance benefit signNowly from using letter trust accounts. They help manage funds related to transactions securely while ensuring compliance with regulatory requirements. By leveraging airSlate SignNow, professionals in these fields can enhance their document management processes linked to letter trust accounts.

-

How secure is a letter trust account with airSlate SignNow?

A letter trust account with airSlate SignNow is highly secure, employing advanced encryption and compliance mechanisms to protect sensitive information. Our platform ensures that all transactions are securely processed and logged, safeguarding your funds and documentation. Clients can trust that their financial data related to letter trust accounts is in safe hands.

Get more for Trust Check

Find out other Trust Check

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself