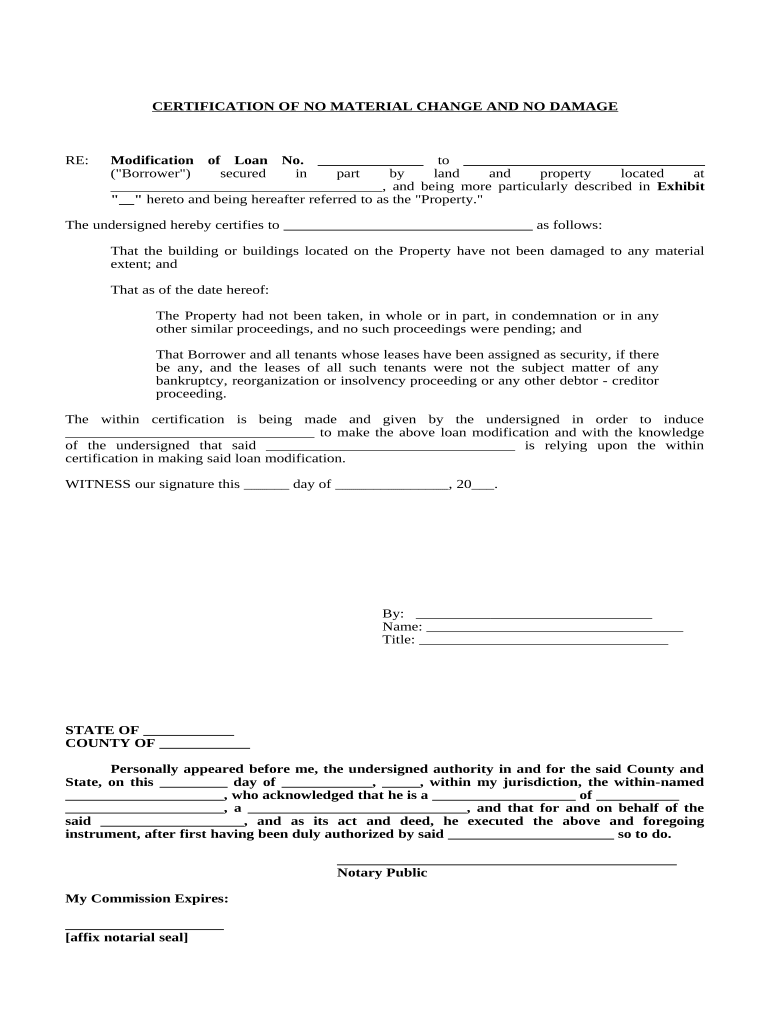

Borrowers Certification Form

What is the Borrowers Certification

The Borrowers Certification is a crucial document that verifies a borrower's financial status and eligibility for a loan. It typically includes information about the borrower's income, debts, and assets, ensuring that lenders have a clear understanding of the borrower's financial situation. This certification is essential for various types of loans, including mortgages, as it helps lenders assess risk and determine the terms of the loan.

Key elements of the Borrowers Certification

Several key elements must be included in the Borrowers Certification to ensure its validity and effectiveness:

- Borrower Information: Full name, address, and contact details.

- Income Details: Monthly income from all sources, including salary, bonuses, and any additional income.

- Debt Obligations: A comprehensive list of current debts, including credit cards, loans, and other financial obligations.

- Asset Information: Details about assets such as savings accounts, real estate, and investments.

- Signature: The borrower's signature is required to validate the certification.

Steps to complete the Borrowers Certification

Completing the Borrowers Certification involves several straightforward steps:

- Gather Financial Information: Collect all necessary documents, including pay stubs, bank statements, and tax returns.

- Fill Out the Certification: Enter the relevant information accurately, ensuring all details are up to date.

- Review the Information: Double-check all entries for accuracy and completeness.

- Sign the Document: Provide your signature to authenticate the certification.

- Submit the Certification: Send the completed document to your lender as per their instructions.

Legal use of the Borrowers Certification

The Borrowers Certification holds legal significance in the loan application process. It serves as a formal declaration of the borrower's financial status and is often required by lenders to comply with regulatory standards. Failure to provide accurate information can lead to legal repercussions, including loan denial or fraud charges. Therefore, it is essential to ensure that all information provided is truthful and complete.

How to obtain the Borrowers Certification

Obtaining the Borrowers Certification is typically a straightforward process. Most lenders provide a template or form that borrowers can fill out. This form may be available online through the lender's website or provided directly by a loan officer. In some cases, borrowers may need to create a certification independently, ensuring that it includes all necessary information and complies with lender requirements.

Examples of using the Borrowers Certification

The Borrowers Certification is commonly used in various scenarios, including:

- Mortgage Applications: Required when applying for a home loan to verify income and financial stability.

- Personal Loans: Lenders may request this certification to assess the borrower's ability to repay the loan.

- Student Loans: Often required to determine eligibility for federal or private student loans.

Quick guide on how to complete borrowers certification

Effortlessly Prepare Borrowers Certification on Any Device

The management of documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and digitally sign your documents quickly without any hold-ups. Handle Borrowers Certification on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and digitally sign Borrowers Certification with ease

- Obtain Borrowers Certification and click on Get Form to initiate.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your digital signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and digitally sign Borrowers Certification and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a material change in the context of electronic signatures?

A material change refers to signNow modifications in the terms or conditions of a document that require acknowledgment and consent from all parties involved. In electronic signatures, airSlate SignNow ensures that any material change is clearly highlighted, providing transparency for users during the signing process.

-

How does airSlate SignNow handle material changes in documents?

airSlate SignNow tracks all material changes made to documents, allowing users to see the history of modifications. This feature is crucial for maintaining document integrity and ensuring that all parties are aware of any alterations before signing.

-

Are there additional costs associated with handling material changes?

No, airSlate SignNow includes the ability to manage material changes within its pricing plans without additional fees. Our cost-effective solution ensures that you can seamlessly update documents and collect signatures without worrying about hidden costs related to material changes.

-

Can I integrate airSlate SignNow with other software to manage material changes?

Yes, airSlate SignNow offers integrations with various software solutions, allowing users to manage material changes seamlessly. Whether it's CRM systems or document management tools, our platform ensures that all updates are synced and documented correctly.

-

What benefits does airSlate SignNow offer for tracking material changes?

The primary benefit of tracking material changes with airSlate SignNow is enhanced compliance and record-keeping. By clearly documenting any changes, businesses can mitigate disputes and ensure that all participants are informed, thus reducing risks associated with misunderstandings.

-

Is airSlate SignNow suitable for industries that frequently encounter material changes?

Absolutely! airSlate SignNow is designed to cater to industries like real estate, legal, and finance, where material changes occur often. Our platform's features help streamline the process of updating and signing documents, making it easier for users to adapt to changes efficiently.

-

How can I ensure all parties are aware of material changes before signing?

airSlate SignNow provides notification and review options to alert all parties of any material changes made to documents. This transparency is vital in ensuring that everyone involved has the opportunity to review updates prior to confirming their signatures.

Get more for Borrowers Certification

- Child custody mediation agreement sample form

- Form for representatives of applicants and licensees form for representatives of applicants and licensees

- Msp 2814 form

- Rcmp grc 6330e personal information request privacy act

- Isp1401 form

- Rsp benificiary form

- Emp5398 form

- Bapplicationb for marriage certificate or registration photocopyextract form

Find out other Borrowers Certification

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement