Sample Loan Form

What is the Sample Loan?

The sample loan refers to a template or model document used to outline the terms and conditions of a loan agreement. This document serves as a guide for borrowers and lenders, detailing aspects such as the loan amount, interest rate, repayment schedule, and any collateral involved. It is essential for both parties to understand their rights and obligations under the agreement. A well-structured sample loan can help facilitate smoother transactions and reduce misunderstandings.

Key Elements of the Sample Loan

When creating or reviewing a sample loan, several key elements should be included to ensure clarity and legal validity:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Schedule: The timeline for repaying the loan, including due dates and payment amounts.

- Collateral: Any assets pledged as security for the loan, which can be seized in case of default.

- Default Terms: Conditions under which the borrower may be considered in default and the lender's rights in such an event.

- Signatures: The agreement must be signed by both parties to be legally binding.

Steps to Complete the Sample Loan

Completing a sample loan involves several important steps to ensure that all necessary information is accurately captured:

- Gather necessary information, including personal details, financial information, and the purpose of the loan.

- Fill out the sample loan template, ensuring all fields are completed accurately.

- Review the document for clarity and completeness, checking for any errors or omissions.

- Consult with a legal professional if needed to ensure compliance with relevant laws.

- Obtain signatures from both the borrower and lender to finalize the agreement.

- Keep copies of the signed document for both parties' records.

Legal Use of the Sample Loan

The legal use of a sample loan is governed by various laws and regulations that vary by state. It is crucial to ensure that the loan agreement complies with federal and state lending laws, including interest rate limits and disclosure requirements. Additionally, both parties must understand their rights under the agreement and the implications of default. Utilizing a legally compliant sample loan can help protect both the lender's and borrower's interests.

Required Documents

When preparing to execute a sample loan, several documents may be required to support the application process:

- Proof of Identity: Government-issued identification to verify the borrower's identity.

- Income Verification: Recent pay stubs, tax returns, or bank statements to demonstrate the borrower's ability to repay the loan.

- Credit Report: A report detailing the borrower's credit history and score, which may be requested by the lender.

- Collateral Documentation: Any documents related to assets pledged as collateral, such as titles or appraisals.

Application Process & Approval Time

The application process for a sample loan typically involves submitting the completed loan document along with required supporting documents to the lender. The approval time can vary based on several factors, including the lender's policies, the complexity of the loan, and the completeness of the application. Generally, borrowers can expect a response within a few days to a few weeks, depending on the lender's workload and the nature of the loan.

Quick guide on how to complete sample loan

Effortlessly Prepare Sample Loan on Any Device

Digital document administration has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without any delays. Manage Sample Loan on any device with the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to Modify and Electronically Sign Sample Loan with Ease

- Obtain Sample Loan and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important parts of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Sample Loan to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

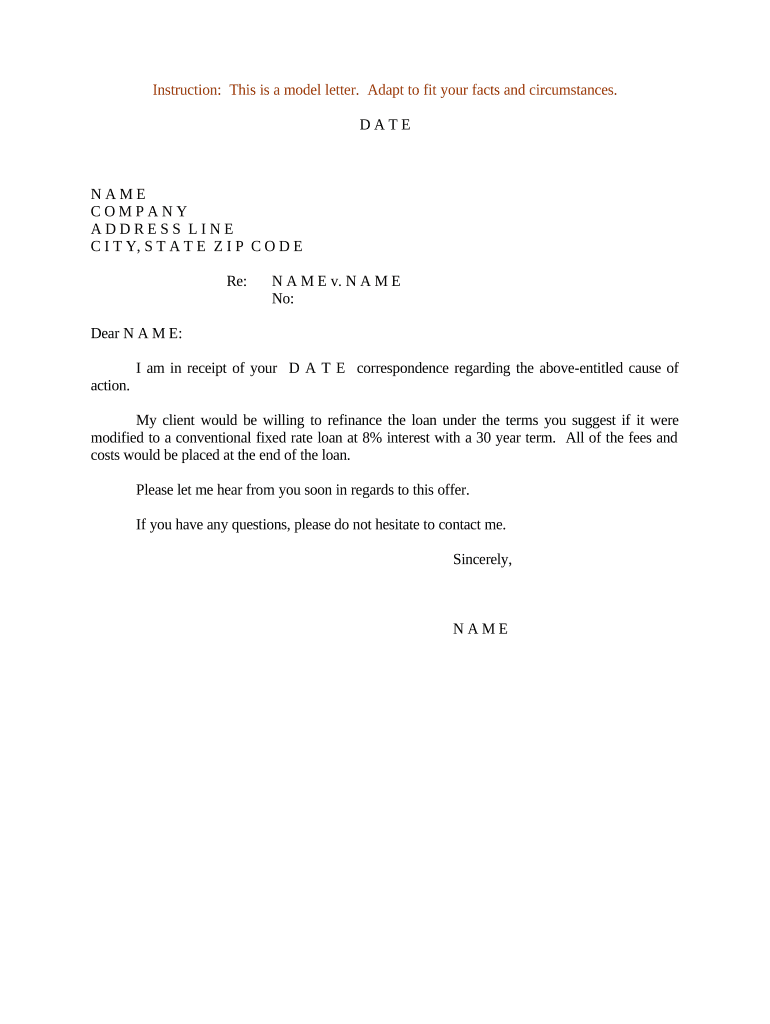

What is a sample letter refinancing?

A sample letter refinancing is a document that outlines the terms and conditions of a loan refinancing proposal. It serves as a template to help individuals communicate with lenders, ensuring all necessary information is included for effective processing. Providing a clear and concise sample letter refinancing can expedite negotiations.

-

Why should I use airSlate SignNow for my sample letter refinancing?

airSlate SignNow offers a user-friendly platform to create, send, and eSign your sample letter refinancing. With features like templates and real-time collaboration, you can streamline the process and ensure all parties are on the same page. This saves time and enhances the accuracy of your refinancing proposal.

-

Is there a cost associated with using airSlate SignNow for sample letter refinancing?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including those who require sample letter refinancing services. Each plan is designed to provide value through cost-effective solutions that enhance document management and eSigning capabilities. You can choose a plan that best fits your budget and usage requirements.

-

Can I customize my sample letter refinancing using airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize your sample letter refinancing according to your specific needs. You can edit text, add your branding, and include necessary signatures, ensuring that your document aligns perfectly with the requirements of your lender.

-

How secure is the information when creating my sample letter refinancing?

Security is a top priority for airSlate SignNow. When creating your sample letter refinancing, all data is protected with advanced encryption and secure cloud storage. This ensures that your sensitive financial information remains confidential and safeguarded from unauthorized access.

-

Does airSlate SignNow integrate with other applications for sample letter refinancing?

Yes, airSlate SignNow seamlessly integrates with various applications that can assist in the refinancing process. These integrations streamline workflows, allowing you to manage your sample letter refinancing along with other financial documents efficiently within one platform.

-

What features does airSlate SignNow offer that assist with sample letter refinancing?

airSlate SignNow provides an array of features that simplify the creation and management of your sample letter refinancing. Key features include customizable templates, eSigning capabilities, real-time collaboration, and automated reminders, ensuring that the refinancing process is as smooth and quick as possible.

Get more for Sample Loan

Find out other Sample Loan

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form