Family Limited Partnership Form

What is the Family Limited Partnership

A family limited partnership (FLP) is a legal entity formed by family members to manage and protect family assets. Typically, it consists of general partners, who manage the partnership, and limited partners, who contribute capital but have limited involvement in management. This structure allows families to maintain control over assets while providing benefits such as estate planning, tax advantages, and asset protection.

How to use the Family Limited Partnership

Using a family limited partnership involves several steps. First, family members must agree on the partnership's purpose and structure. Next, they should draft a partnership agreement outlining the roles, responsibilities, and profit-sharing arrangements. Once the agreement is in place, the family can transfer assets into the partnership, which can include real estate, investments, or business interests. Regular meetings should be held to ensure compliance with the partnership agreement and to discuss management strategies.

Steps to complete the Family Limited Partnership

Completing a family limited partnership involves a series of organized steps:

- Gather family members to discuss the purpose and goals of the partnership.

- Draft a partnership agreement that specifies the roles of general and limited partners.

- Transfer assets into the partnership, ensuring proper valuation and documentation.

- File any necessary paperwork with the state to officially establish the partnership.

- Maintain accurate records and hold regular meetings to review the partnership's performance.

Legal use of the Family Limited Partnership

Family limited partnerships are legally recognized entities that provide various legal protections and benefits. They can be used for estate planning, allowing families to transfer wealth while minimizing estate taxes. Additionally, FLPs can protect assets from creditors and lawsuits, as the assets held within the partnership are generally shielded from personal liability. It is essential to comply with state laws and regulations to ensure the partnership remains valid and effective.

Key elements of the Family Limited Partnership

Several key elements define a family limited partnership:

- General Partners: Responsible for managing the partnership and making decisions.

- Limited Partners: Provide capital and share in profits but have limited control over management.

- Partnership Agreement: A legal document that outlines the terms, roles, and responsibilities of the partners.

- Asset Contributions: Family members transfer assets into the partnership, which can include cash, property, or investments.

- Tax Benefits: FLPs can offer tax advantages, including potential estate and gift tax reductions.

Examples of using the Family Limited Partnership

Family limited partnerships can be utilized in various scenarios:

- A family business can be structured as an FLP to facilitate succession planning and ensure control remains within the family.

- Real estate investments can be held in an FLP, providing liability protection and simplifying the transfer of ownership among family members.

- Families can use FLPs to pool resources for investment purposes, allowing for diversified portfolios while maintaining family control.

Required Documents

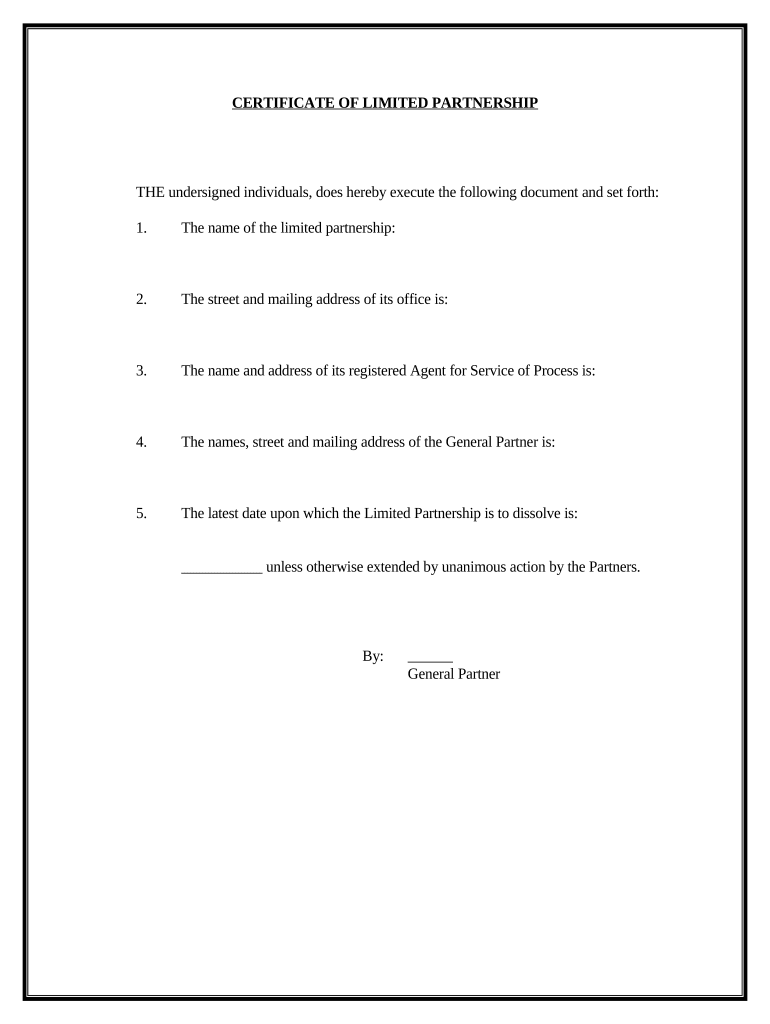

To establish a family limited partnership, several documents are typically required:

- Partnership Agreement: A comprehensive document detailing the terms and conditions of the partnership.

- Asset Transfer Documents: Documentation proving the transfer of assets into the partnership.

- State Filing Forms: Any necessary forms required by the state to register the partnership.

- Tax Identification Number: An Employer Identification Number (EIN) may be needed for tax purposes.

Quick guide on how to complete family limited partnership 497333889

Complete Family Limited Partnership effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without any holdups. Manage Family Limited Partnership on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Family Limited Partnership without stress

- Find Family Limited Partnership and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign Family Limited Partnership and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a family limited partnership?

A family limited partnership (FLP) is a legal entity created to manage and protect family assets. It allows family members to share ownership and control while benefiting from potential tax advantages. By structuring your assets within an FLP, you can help ensure smooth succession planning for wealth transfer.

-

How can airSlate SignNow facilitate the management of a family limited partnership?

airSlate SignNow offers a streamlined platform for creating, signing, and managing documents related to family limited partnerships. You can easily draft partnership agreements, member consents, and other essential documents while ensuring compliance. With our eSignature capabilities, you can also obtain legally binding signatures quickly and securely.

-

Is airSlate SignNow cost-effective for managing family limited partnerships?

Yes, airSlate SignNow is a cost-effective solution for managing a family limited partnership. Our pricing plans are designed for businesses of all sizes, ensuring you can access essential features without breaking the bank. By digitizing your document management, you'll save on printing and administrative costs.

-

What features does airSlate SignNow offer for family limited partnerships?

airSlate SignNow provides numerous features ideal for family limited partnerships, including customizable templates, bulk sending, and real-time tracking of document status. Additionally, our platform ensures security and compliance, protecting sensitive family financial information throughout the process.

-

What are the benefits of using airSlate SignNow for family limited partnerships?

Using airSlate SignNow to manage your family limited partnership enhances efficiency and simplifies communication among members. The platform allows for fast document turnaround, promotes collaboration, and reduces errors often associated with paper documents. Overall, it streamlines the management of family assets.

-

Can I integrate airSlate SignNow with other tools for family limited partnerships?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, making it easier to manage your family limited partnership alongside your other operations. Whether you're using CRM systems, cloud storage, or financial software, our integrations help you maintain a cohesive workflow.

-

Are the documents created in airSlate SignNow legally binding for family limited partnerships?

Yes, documents signed using airSlate SignNow are legally binding and comply with eSignature laws. This means that agreements within your family limited partnership will hold up in court, ensuring that your legal documents are secure and enforceable. You can conduct business with confidence knowing your documents are valid.

Get more for Family Limited Partnership

Find out other Family Limited Partnership

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form