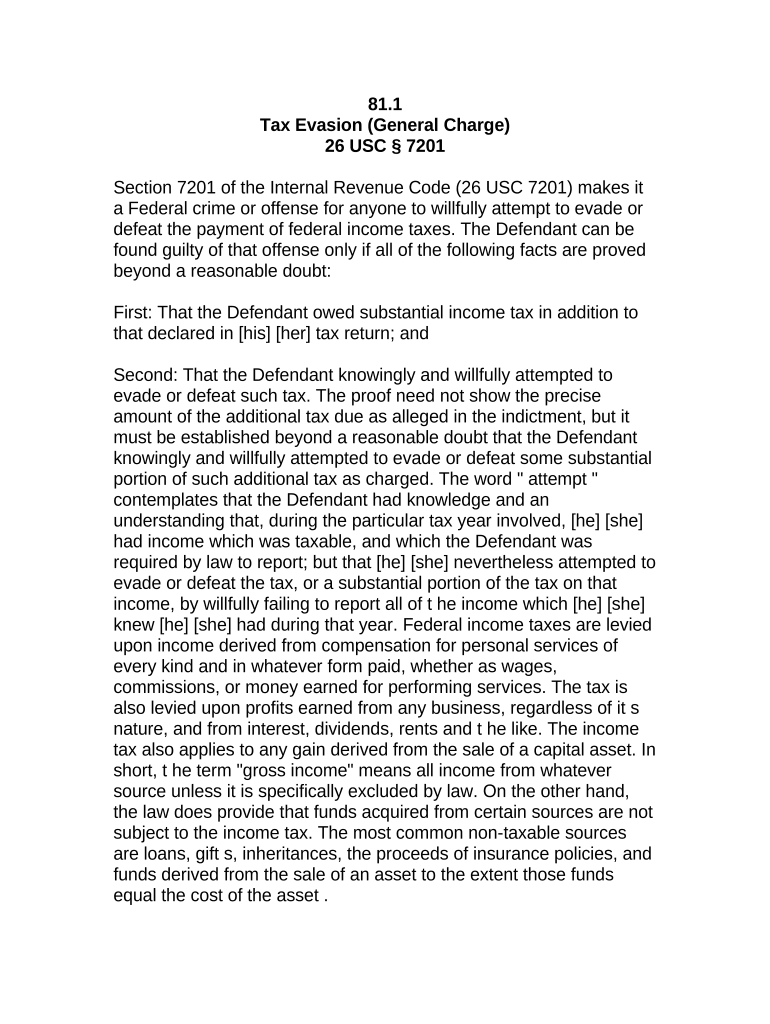

Jury Instruction Tax Evasion General Charge Form

What makes the jury instruction tax evasion general charge form legally valid?

As the world takes a step away from office working conditions, the completion of paperwork increasingly happens electronically. The jury instruction tax evasion general charge form isn’t an any different. Handling it using electronic tools differs from doing this in the physical world.

An eDocument can be regarded as legally binding provided that specific requirements are met. They are especially critical when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not ensure that the institution requesting the form or a court would consider it performed. You need a reliable tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your jury instruction tax evasion general charge form when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legal and secure. In addition, it offers a lot of opportunities for smooth completion security smart. Let's rapidly go through them so that you can be certain that your jury instruction tax evasion general charge form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Dual-factor authentication: adds an extra layer of security and validates other parties' identities via additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data safely to the servers.

Completing the jury instruction tax evasion general charge form with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete jury instruction tax evasion general charge

Finalize jury instruction tax evasion general charge form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage jury instruction tax evasion general charge form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign jury instruction tax evasion general charge form with ease

- Obtain jury instruction tax evasion general charge form and click Get Form to begin.

- Make use of the resources we provide to fill out your form.

- Mark important sections of the documents or obscure confidential information using the specialized tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign jury instruction tax evasion general charge form to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Jury Instruction Tax Evasion General Charge Form

Instructions and help about Jury Instruction Tax Evasion General Charge

Related searches to Jury Instruction Tax Evasion General Charge

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Jury Instruction Tax Evasion General Charge?

airSlate SignNow is a cloud-based eSignature solution that allows businesses to send and sign documents electronically. It simplifies the process of obtaining signatures needed for legal documents, including those related to Jury Instruction Tax Evasion General Charge cases, ensuring compliance and efficiency.

-

How can airSlate SignNow help with Jury Instruction Tax Evasion General Charge documentation?

With airSlate SignNow, users can create, manage, and store documents related to Jury Instruction Tax Evasion General Charge seamlessly. The platform provides templates and workflows tailored for legal needs, making it easier to prepare accurate documents while ensuring they are signed promptly.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Users interested in handling Jury Instruction Tax Evasion General Charge documents can choose from plans that provide unlimited signatures and document storage at competitive rates.

-

Is airSlate SignNow user-friendly for legal professionals dealing with Jury Instruction Tax Evasion General Charge?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it ideal for legal professionals managing Jury Instruction Tax Evasion General Charge. The platform’s straightforward interface ensures that documents can be sent, signed, and tracked effortlessly.

-

Does airSlate SignNow integrate with other tools for managing Jury Instruction Tax Evasion General Charge cases?

Yes, airSlate SignNow offers numerous integrations with popular business tools such as CRM systems and storage solutions. This capability makes it easier for legal teams handling Jury Instruction Tax Evasion General Charge cases to streamline their workflows without disrupting their existing processes.

-

What security features does airSlate SignNow provide for sensitive documents related to Jury Instruction Tax Evasion General Charge?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with legal standards. For sensitive documents concerning Jury Instruction Tax Evasion General Charge, its robust security features ensure that documents are safe and only accessible by authorized parties.

-

Can I customize documents for Jury Instruction Tax Evasion General Charge with airSlate SignNow?

Yes, airSlate SignNow allows extensive customization options for your documents. Users can create specific templates for Jury Instruction Tax Evasion General Charge to ensure all necessary legal language and sections are included efficiently.

Get more for Jury Instruction Tax Evasion General Charge

- Financial advisor client questionnaire form

- The haskell road to logic math and programming solutions cwi homepages cwi form

- Sp 650i pdf form

- Kansas fire marshal forms

- Imo crew list pdf form

- Arkansas dhs verification of earnings form

- Medical records release form kidkare medical

- Workman ht licence form

Find out other Jury Instruction Tax Evasion General Charge

- eSignature California Healthcare / Medical NDA Free

- eSignature California Healthcare / Medical RFP Myself

- eSignature California Healthcare / Medical NDA Secure

- eSignature California Healthcare / Medical NDA Fast

- eSignature California Healthcare / Medical NDA Simple

- eSignature California Healthcare / Medical RFP Free

- eSignature California Healthcare / Medical NDA Easy

- eSignature California Healthcare / Medical NDA Safe

- eSignature California Healthcare / Medical RFP Secure

- How To eSignature California Healthcare / Medical NDA

- eSignature California Healthcare / Medical RFP Fast

- How To eSignature California Healthcare / Medical RFP

- How Do I eSignature California Healthcare / Medical RFP

- Help Me With eSignature California Healthcare / Medical RFP

- eSignature California Healthcare / Medical RFP Simple

- How Can I eSignature California Healthcare / Medical RFP

- How Do I eSignature California Healthcare / Medical NDA

- Can I eSignature California Healthcare / Medical RFP

- eSignature California Healthcare / Medical RFP Easy

- Help Me With eSignature California Healthcare / Medical NDA