Form Ct Nrp 1

What is the Form Ct Nrp 1

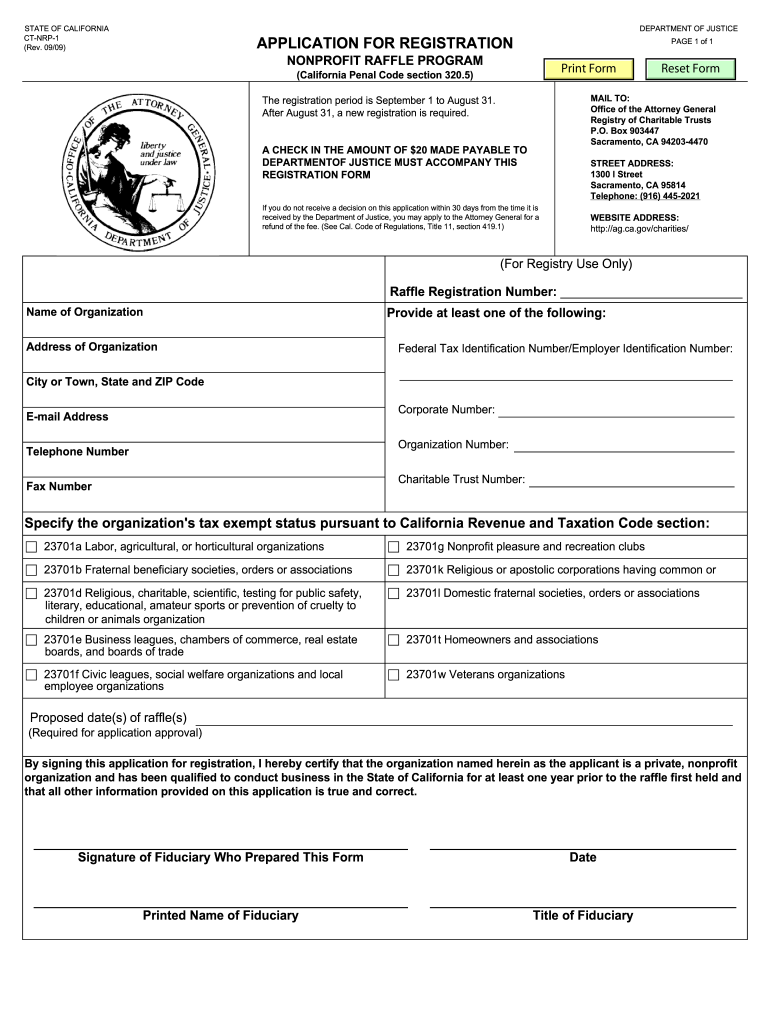

The California Form CT NRP 1 is an application for registration of a nonprofit raffle program. This form is essential for organizations that wish to conduct raffles as a means of fundraising. By completing this form, nonprofits can ensure compliance with state regulations governing raffle activities. The form requires detailed information about the organization, the raffle event, and how the proceeds will be used. Understanding the purpose and requirements of the CT NRP 1 is crucial for any nonprofit looking to engage in this fundraising method legally.

Steps to Complete the Form Ct Nrp 1

Completing the California Form CT NRP 1 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your organization, including its name, address, and tax identification number. Next, provide details about the raffle, such as the date, location, and the purpose of the event. It is also important to specify how the funds raised will be utilized. After filling out the form, review it carefully for any errors or omissions. Finally, submit the completed form to the appropriate state agency, ensuring you meet any deadlines associated with your raffle event.

Legal Use of the Form Ct Nrp 1

The legal use of the California Form CT NRP 1 is governed by state laws that regulate nonprofit raffles. To ensure your raffle is compliant, it is vital to understand the legal framework surrounding this form. The CT NRP 1 must be submitted prior to conducting any raffle activities, and organizations must adhere to the guidelines outlined by the California Department of Justice. This includes maintaining accurate records of ticket sales and ensuring that proceeds are used for the stated charitable purpose. Failure to comply with these regulations can result in penalties or the revocation of the organization's ability to conduct future raffles.

How to Obtain the Form Ct Nrp 1

The California Form CT NRP 1 can be obtained through the California Department of Justice's official website or by contacting their office directly. Organizations may also find the form available at local nonprofit resource centers or community organizations that assist with fundraising efforts. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process. Additionally, some organizations may offer assistance in completing the form to ensure all necessary information is accurately provided.

Form Submission Methods

Submitting the California Form CT NRP 1 can be done through various methods, depending on the preferences of the organization and the requirements set by the state. Organizations may choose to submit the form online, if available, which can expedite the processing time. Alternatively, the form can be mailed to the appropriate state agency or delivered in person. It is essential to keep a copy of the submitted form for your records, regardless of the submission method chosen. Be mindful of any specific submission guidelines or deadlines to ensure compliance.

Eligibility Criteria

To be eligible to use the California Form CT NRP 1, organizations must be recognized as nonprofit entities under state law. This typically includes charitable organizations, religious institutions, and other nonprofit groups that operate for the public benefit. Additionally, the organization must be in good standing with the state and have a valid tax identification number. Understanding these eligibility criteria is crucial for any organization planning to conduct a raffle, as noncompliance can lead to legal complications.

Quick guide on how to complete ct nrp 1 formpdffillercom

Complete Form Ct Nrp 1 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without interruptions. Handle Form Ct Nrp 1 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form Ct Nrp 1 with ease

- Obtain Form Ct Nrp 1 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal weight as a traditional pen-and-ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form Ct Nrp 1 and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a address line 1?

The recipients name/company:Name (John, Smith)Adresss (1000 County Way, Unit 200)ZIP, City, State, Country (90254, Neverland, CA, USAIn Europe the addressing scheme is slightly different:AustriaHerr Franz HuberBeethovenstrasse 121010 WIENAUSTRIABelgiumMr Willy JanssensLange Stationsstraat 3523000 LEUVENBELGIUMM. Emile DuboisRue du Diamant 2154800 VERVIERSBELGIUMDenmarkMr Thor NielsenTietgensgade 1378800 VIBORGDENMARKMr Torben RaldorfPO Box 100COPENHAGEN1004 VIBORGDENMARKFinlandMr Asko TeirilaPO Box 51139140 AKDENMAAFINLANDFranceM. Robert MARINRue de l’EgliseDunes82340 AUVILLARFRANCEMme Marie PAGE23 Rue de Grenell75700 PARIS CEDEXFRANCEWhen addressing mail to France, write the addressee’s surname in CAPITAL letters.GermanyMrs F MeierWeberstr. 253113 BONN 1GERMANYMr P KundeLange Str. 1204103 LEIPZIGGERMANYGermany has strict rules about receiving mail, which, if ignored, may result in your mail being returned to you with no attempt at delivery. When addressing mail to Germany, always:• Use the new five-digit postcode (using an old four-digit postcode will cause delay)• Put the postcode before the town name• Put the house number after the street nameGreeceMr George LatsisAlkamenou 37117 80 ATHENSGREECEIcelandMr Jon JonssonEinimel 80107 REYKJAVIKICELANDIrelandFrom 15 July 2015, a new seven digit postcode system has been developed for Ireland and should be used in all addresses, other than those for PO Boxes.All mail for Ireland should now be addressed as illustrated below:Eason80 Abbey Street MiddleDUBLIN 1DO1 P8N3IRELANDThe introduction of the new codes will not in any way affect the existing address structure. The postcode will occupy a new line at the bottom of addresses for domestic mail and the penultimate line for international mail.ItalySig. Giovanni Mascivia Garibaldi 2747037 RIMINI RNITALYLuxembourgM. Jaques Muller71 route de Longway4750 PETANGELUXEMBOURGMonacoAs FranceThe NetherlandsMr J van DietenMorsstr 1112312 BK LEIDENTHE NETHERLANDS(There should be a double space between the postcode and the post town)NorwayHerr Hans HansenSvingen 229230 BEKKEHAUGNORWAYPortugalSenhor Carlos Manuel PereiraAv das A’Augsa LivresMonte Trigo7220 PORTELPORTUGALRosalina SilvaR Conde Redondo 801192 LISBOA CODEXPORTUGALSpainSra Ana JimenezMimbreras 403201 ELCHE (Alicante)SPAIN(The province should be included in brackets after the town)SwedenFru Inger LiljaVasavagen 3 4tr582 20 LINKOPINGSWEDENSwitzerlandM. Andre PerretSchanzenstrasse 73030 BERNESWITZERLAND

-

How do I fill out adress line 1 on amazon.com?

To tell you the truth, I don’t have an account in amazon.com.First, about the address 1 portion, it can be found online stating that address 1 is where you put you house number and street address. As for address 2, you may or may not have to put additional information such as for apartments/condominiums/studio units and etc of which level.Second, as some have stated that address 2 is optional. Some stated that it is just when your address is too long and cannot fit in address 1, you might continue typing it in address 2.Third, some stated that address 1 and address 2 is where people will write down both of their address and stating that you have to send the package to address 2 instead of address 1.Commonly is the first one. I am not sure it helps. To clarify this, you may ask at its official website support team. Or you may wait for the next person who will answer this question.

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I fill out the GSTR 1?

GST has rolled out and paved the way for a uniform and systematic reporting system that is seldom found anywhere else. This transaction-wise, destination-based reporting system provides for a much effective credit flow, removes chances of corruption and illegal transactions.To achieve this, the government has come up with an effective form-based reporting system that needs to be filed either monthly, quarterly or yearly, as the case may be, by the dealers and manufacturers. The aggregation of information uploaded by all the dealers will lead to a common reservoir of data, which can be accessed by either. Moreover, dealers can view their credit statement or payables with respect to GST easily in a common internet portal.What Is GSTR-1 ?It all starts with GSTR-1. It is where the suppliers will report their outward supplies during the reporting month. As such, all registered taxable persons are required to file GSTR-1 by the 10th of the following month. It is the first or the starting point for passing input tax credits to the dealers.Who needs to file GSTR-1?GSTR-1 has to be filed by “all” taxable registered persons under GST. However, there are certain dealers who are not required to file GSTR-1, instead, are required to file other different GST returns as the case may be. These dealers are E-Commerce Operators, Input Service Distributors, dealers registered under the Composition Scheme, Non-Resident dealers and Tax deductors. It has to be filed even in cases where there is no business conducted during the reporting month.How to file GSTR-1 In few steps.What needs to be filled in GSTR-1?GSTR-1 has 13 different heads that need to be filled in. The major ones are enlisted here:GSTIN of the taxable person filing the return – Auto-populated resultName of the taxable person – Auto-populated fieldTotal Turnover in Last Financial Year – This is a one-time action and has to be filled once. This field will be auto-populated with the closing balance of the last yearThe Period for which the return is being filed – Month & Year is available as a drop down for selectionDetails of Taxable outward supplies made to registered persons – CGST and SGST shall be filled in case of intra-state movement whereas IGST shall be filled only in the case of inter-state movement. Details of exempted sales or sales at nil rate of tax shall also be mentioned hereDetails of Outward Supplies made to end customer, where the value exceeds Rs. 2.5 lakhs – Other than mentioned, all such supplies are optional in natureThe total of all outward supplies made to end consumers, where the value does not exceed Rs. 2.5 lakhs.Details of Debit Notes or Credit NotesAmendments to outward supplies of previous periods – Apart from these two, any changes made to a GST invoice has to be mentioned in this sectionExempted, Nil-Rated and Non-GST Supplies – If nothing was mentioned in the above sections, then complete details of such supplies have to be declared.Details of Export Sales made – In addition to the sales figures, HSN codes of the goods supplied have to be mentioned as well.Tax Liability arising out of advance receiptsTax Paid during the reporting period – it can also include taxes paid for earlier periods.The form has to be digitally signed in case of a Company or an LLP, whereas in the case of a proprietorship concern, the same can be signed physically.How shall I file GSTR-1?After going through the checklist, suppliers need to log in to the GSTN portal with the given User ID and password, follow these steps to file their returns successfully.Search for “Services” and then click on Returns, followed by Returns Dashboard.In the dashboard, the dealer has to enter the financial year and the month for which the return needs to be filed. Click on Search after that.All returns relating to this period will be displayed on the screen in a tiled manner.Dealer has to select the tile containing GSTR-1After this, he will have the option either to prepare online or to upload the return.The dealer will now Add invoices or upload all invoices directlyOnce the entire form is filled up, the dealer shall then click on Submit and validate the data filled upWith the data validated, dealer will now click on FILE GSTR-1 and proceed to either E-Sign or digitally sign the formAnother confirmation pop-up will be displayed on the screen with a yes or no option to file the return.Once yes is selected, an Acknowledgement Reference Number (ARN) is generated.How To File GSTR-1 Online?Apart from filing GSTR-1 directly on GSTN portal, you can use third party softwares which are simpler to use. Most of these software accept data from your existing accounting software and help you upload it to GSTN portal. Almost all the GSPs have come up with their return filing solution.If you want to avoid multiple steps and hassle of using lot of softwares, try ProfitBooks today. Its an easy to use accounting software with super fast GST return filing. Its designed for business owners who do not have any accounting background.You can read the entire article here http://www.profitbooks.net/gstr-1-return-filing/.

-

Can you add 5 odd numbers to get 30?

It is 7,9 + 9,1 + 1 + 3 + 9 = 30Wish you can find the 7,9 and 9,1 in the list of1,3,5, 7,9 ,11,13,151,3,5,7, 9,1 1,13,15

-

How many empty folders would it take to fill out a brand new 1 TB hard/solid disk drive?

This was also addressed in another forum: How much space do directories consume? and I don’t think I can add much to the explanation, so here it is:According to the Wikipedia article about NTFS, all permissions are stored in the Master File Table. It's space can be seen apparently through the Disk Defragmenter, as shown on here.The size a MFT record occupies from both a folder or a file, is described in here:File and folder records are 1 KB each and are stored in the MFT, the attributes of which are written to the allocated space in the MFT. Besides file attributes, each file record contains information about the position of the file record in the MFT.When a file’s attributes can fit within the MFT file record for that file, they are called resident attributes. Attributes such as file name and time stamp are always resident. When the amount of information for a file does not fit in its MFT file record, some file attributes become nonresident. Nonresident attributes are allocated one or more clusters of disk space. A portion of the nonresident attribute remains in the MFT and points to the external clusters. NTFS creates the Attribute List attribute to describe the location of all attribute records. The table NTFS File Attribute Types lists the file attributes currently defined by NTFS.So, in NTFS, folders occupy at least 1 KB of space, unless they have very long argument and permission lists; at that point, the MFT record occupies an additional cluster in the partition, the size of which depends on how it was formatted, although for more than 2GB Microsoft in that post recommends 4KB clusters.As to why this could be important, a few years back I was developing a data logging feature as part of an IoT embedded system. The architecture was set up so that each calendar day would have it’s own folder (much like many digital cameras do to store pictures).Memory space was limited, so we had to calculate precisely how all of the memory was allocated including the system memory for the directories. The goal was to match the memory space with the battery life so that it was still capturing data until it just ran out of power.Without including the “overhead” for the folders / directories, the calculations would have been off.However, with 1TB of memory to work with, the overhead just becomes a rounding error.FYI - we recently published a review / buyers guide featuring the Seagate as the top pick: Best 1TB Portable External Hard Drive for under $50

Create this form in 5 minutes!

How to create an eSignature for the ct nrp 1 formpdffillercom

How to make an electronic signature for the Ct Nrp 1 Formpdffillercom in the online mode

How to create an electronic signature for the Ct Nrp 1 Formpdffillercom in Chrome

How to make an eSignature for putting it on the Ct Nrp 1 Formpdffillercom in Gmail

How to generate an eSignature for the Ct Nrp 1 Formpdffillercom straight from your smartphone

How to make an eSignature for the Ct Nrp 1 Formpdffillercom on iOS devices

How to create an eSignature for the Ct Nrp 1 Formpdffillercom on Android OS

People also ask

-

What is the Form Ct Nrp 1, and how is it used in airSlate SignNow?

The Form Ct Nrp 1 is a specific document template used for various business operations within airSlate SignNow. It allows users to streamline their document workflows by providing a standardized format for submitting necessary information. By utilizing the Form Ct Nrp 1, businesses can ensure compliance and enhance their document management processes.

-

How can I access the Form Ct Nrp 1 template in airSlate SignNow?

To access the Form Ct Nrp 1 template, simply log in to your airSlate SignNow account and navigate to the template section. You can search for ‘Form Ct Nrp 1’ in the available templates and customize it to fit your specific needs. This feature makes it easy for users to create and manage documents efficiently.

-

What pricing plans include access to the Form Ct Nrp 1?

airSlate SignNow offers various pricing plans that include access to the Form Ct Nrp 1. Whether you opt for the basic, business, or enterprise plan, you will have the ability to use this template to enhance your document signing process. For detailed pricing information, visit our pricing page.

-

What are the key benefits of using the Form Ct Nrp 1 in airSlate SignNow?

Using the Form Ct Nrp 1 in airSlate SignNow provides several benefits, including improved efficiency and accuracy in document handling. It allows for easy customization and integration with other tools, ensuring a seamless workflow. Additionally, it helps businesses comply with regulatory requirements while saving time and reducing errors.

-

Can I integrate the Form Ct Nrp 1 with other software?

Yes, airSlate SignNow allows you to integrate the Form Ct Nrp 1 with various software applications to enhance your workflow. This means you can connect it with CRM systems, project management tools, and other business applications to automate processes. Integrations streamline your operations and ensure all documents are easily accessible.

-

Is the Form Ct Nrp 1 secure for sensitive information?

Absolutely! The Form Ct Nrp 1 in airSlate SignNow is designed with security in mind. All documents are encrypted, and access controls are in place to protect sensitive information. This ensures that your data remains confidential and secure throughout the signing process.

-

How does the eSigning process work with the Form Ct Nrp 1?

The eSigning process with the Form Ct Nrp 1 is straightforward. Once you have prepared your document, simply send it to the intended recipients for their signatures. They will receive an email notification, can sign electronically, and you will receive a completed copy automatically, making document management hassle-free.

Get more for Form Ct Nrp 1

- Albemarle county police ride along form

- Dissolution no children athens county government co athensoh form

- Onsite inspection form

- Mass gathering application bexar county gov bexar form

- Fsa claim form ky

- Temporary permit application brazoria county form

- Information on suit affecting the family relationship vital statistics vs 165

- How much time do i have to file a case in small claims court in brazoria county form

Find out other Form Ct Nrp 1

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template