Credit Inquiry Form

What is the Credit Inquiry

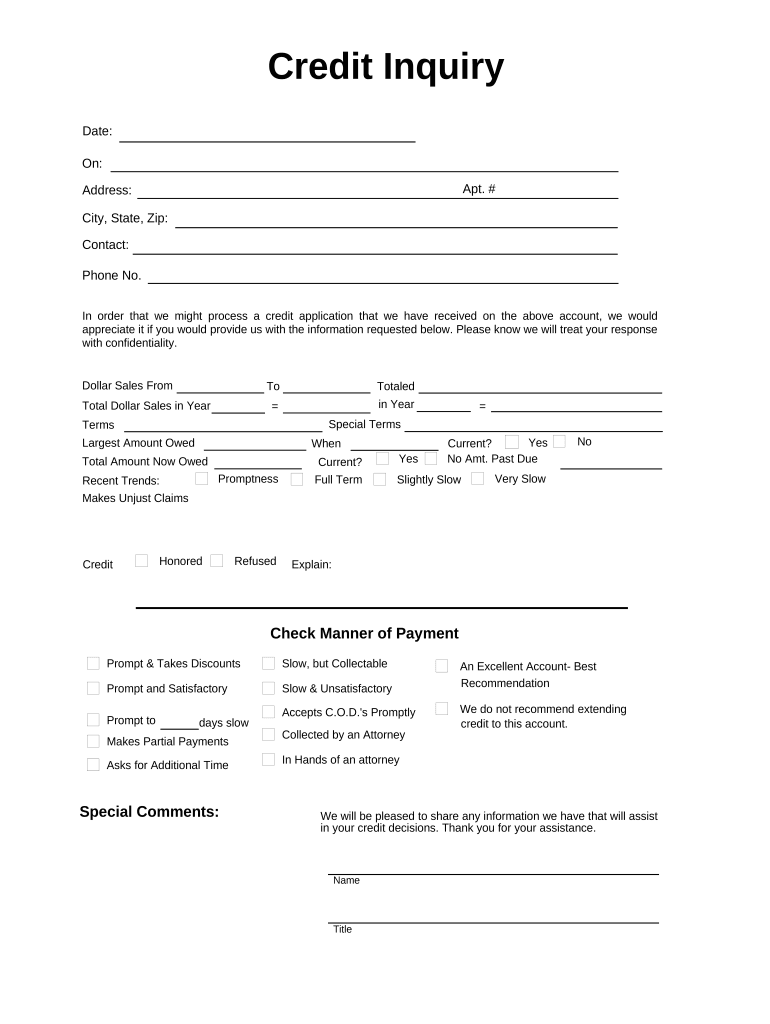

The credit inquiry form is a document used to request a detailed report of an individual's credit history from credit reporting agencies. This form is essential for lenders, landlords, and employers to assess the creditworthiness of applicants. It typically includes personal information such as the applicant's name, address, Social Security number, and the purpose of the inquiry. Understanding the credit inquiry process is crucial for individuals seeking loans, rental agreements, or employment opportunities, as it directly impacts their financial reputation.

How to Use the Credit Inquiry

Using the credit inquiry form involves several straightforward steps. First, gather the necessary personal information required to complete the form accurately. Next, identify the specific credit reporting agency from which you wish to obtain your credit report. After filling out the form with the required details, submit it according to the agency's specified method, which may include online submission, mailing, or in-person delivery. It is important to ensure that all information is accurate to avoid delays in processing your request.

Steps to Complete the Credit Inquiry

Completing the credit inquiry form involves a systematic approach:

- Collect personal information, including your full name, address, and Social Security number.

- Specify the purpose of the inquiry, such as applying for a loan or rental.

- Review the form for accuracy and completeness before submission.

- Choose your submission method: online, by mail, or in person.

- Keep a copy of the submitted form for your records.

Legal Use of the Credit Inquiry

The legal use of the credit inquiry form is governed by federal laws, including the Fair Credit Reporting Act (FCRA). This legislation ensures that credit inquiries are conducted fairly and that individuals are informed about their rights regarding credit reporting. It is essential for users of the credit inquiry form to comply with these legal requirements, ensuring that they have the consent of the individual whose credit report is being requested. Failure to adhere to these regulations can result in penalties and legal repercussions.

Key Elements of the Credit Inquiry

Several key elements define the credit inquiry form:

- Personal Information: Accurate details of the individual requesting the credit report.

- Purpose of Inquiry: A clear statement of why the inquiry is being made.

- Authorization: A signature or consent indicating that the individual agrees to the credit check.

- Submission Method: Instructions on how to submit the form to the credit reporting agency.

Who Issues the Form

The credit inquiry form is typically issued by credit reporting agencies, such as Experian, TransUnion, and Equifax. These agencies provide the necessary documentation and guidelines for individuals or organizations seeking to perform credit checks. It is crucial to use the correct form provided by the specific agency to ensure compliance with their procedures and legal standards.

Quick guide on how to complete credit inquiry

Complete Credit Inquiry effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents rapidly without hassle. Manage Credit Inquiry on any device using the airSlate SignNow Android or iOS applications and enhance document-based workflows today.

The easiest way to modify and eSign Credit Inquiry without effort

- Find Credit Inquiry and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Credit Inquiry and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Credit Inquiry and how does it affect my credit score?

A Credit Inquiry occurs when a lender checks your credit report as part of their evaluation process. Hard inquiries can have a minor impact on your credit score, while soft inquiries do not affect it at all. Understanding how Credit Inquiries work is essential to maintaining a healthy credit score, especially when seeking financing.

-

How does airSlate SignNow handle Credit Inquiry documents?

With airSlate SignNow, you can easily create, send, and eSign documents related to your Credit Inquiry processes. Our platform streamlines document management, ensuring that all critical information is securely stored and accessible. This helps you improve efficiency and maintain compliance in handling sensitive financial documents.

-

Are there any costs associated with handling Credit Inquiries using airSlate SignNow?

Our pricing model for airSlate SignNow is both flexible and competitive. We offer various subscription plans that cater to businesses of all sizes, allowing you to manage your Credit Inquiry processes without breaking the bank. You can choose a plan that fits your needs and budget while benefiting from our comprehensive eSigning features.

-

What features does airSlate SignNow offer for managing Credit Inquiry documents?

airSlate SignNow provides a suite of features designed for optimal document management, including customizable templates, in-app editing, and secure eSigning for Credit Inquiry documents. These features simplify the workflow, enhance collaboration, and ensure that all necessary compliance standards are met during the signing process.

-

Can I integrate airSlate SignNow with my existing systems for Credit Inquiry management?

Yes, airSlate SignNow supports integration with various third-party applications and CRM systems to help streamline your Credit Inquiry management. This interoperability allows you to maintain your existing workflows while enhancing document handling capabilities through our eSigning platform.

-

Is airSlate SignNow secure for processing Credit Inquiry documents?

Absolutely! Security is a top priority for airSlate SignNow. Our platform uses industry-standard encryption and complies with regulations such as GDPR and HIPAA, ensuring that all your Credit Inquiry documents are handled securely and privately.

-

What are the benefits of using airSlate SignNow for Credit Inquiry management?

Using airSlate SignNow for Credit Inquiry management enables businesses to optimize their document processes, reduce turnaround times, and enhance customer experience. Additionally, our user-friendly interface helps teams manage Credit Inquiries efficiently, leading to quicker approvals and increased satisfaction.

Get more for Credit Inquiry

- State of ri purchasing mpa form

- Sfn 58701 state of north dakota form

- Section 1151 and ftca intake form

- Texas business license application form

- Business license form pdf

- City of austin personal net worth statement form

- Form 803 general information annual statement professional sos texas

- Texas spc spcs agriculture form

Find out other Credit Inquiry

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form