Payroll Deduction Special Services Form

What is the Payroll Deduction Special Services

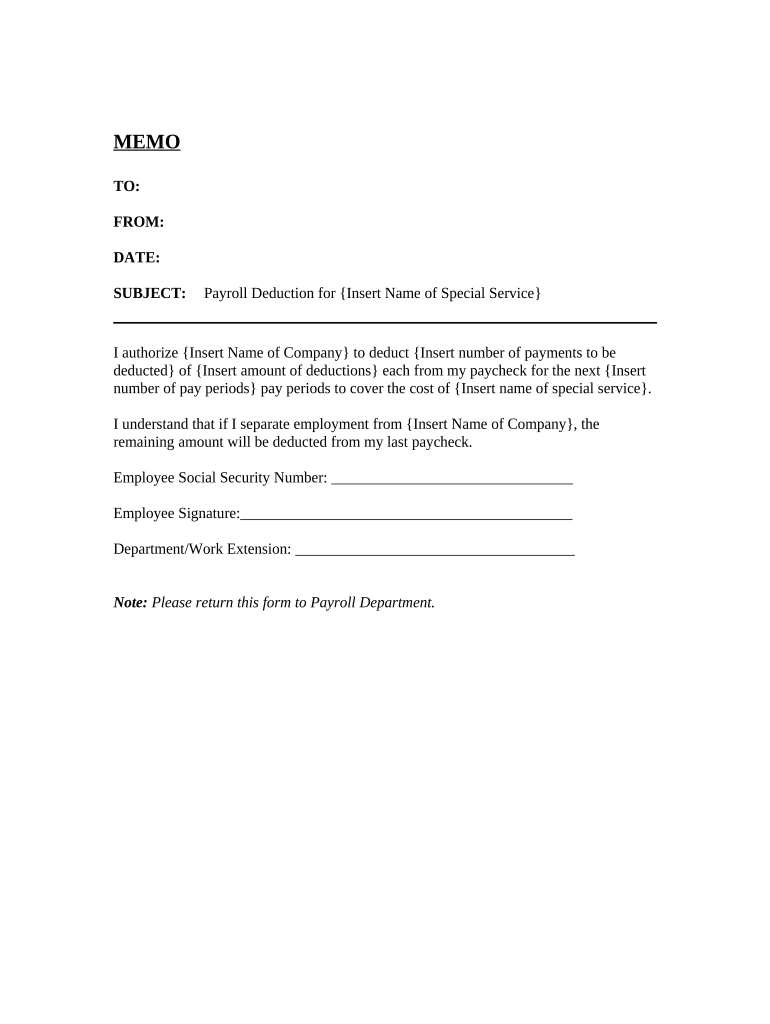

The Payroll Deduction Special Services form is designed to facilitate specific deductions from an employee's paycheck for various services or benefits. This form allows employees to authorize their employer to deduct certain amounts from their wages for services such as health insurance, retirement contributions, or other benefits. By completing this form, employees ensure that their contributions are deducted accurately and in a timely manner, aligning with their financial planning and benefits utilization.

How to Use the Payroll Deduction Special Services

Using the Payroll Deduction Special Services form involves several straightforward steps. First, employees need to obtain the form from their employer or the relevant department handling payroll. Next, they should fill out the required information, including personal details and the specific deductions they wish to authorize. After completing the form, employees must submit it to their payroll department for processing. It is crucial to keep a copy of the submitted form for personal records and future reference.

Steps to Complete the Payroll Deduction Special Services

Completing the Payroll Deduction Special Services form involves a series of clear steps:

- Obtain the form from your employer or payroll department.

- Fill in your personal information, including your name, employee ID, and department.

- Specify the deductions you wish to authorize, including the amounts and frequency.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your authorization.

- Submit the completed form to your payroll department.

Legal Use of the Payroll Deduction Special Services

The Payroll Deduction Special Services form must comply with relevant laws and regulations to be considered legally binding. This includes adherence to the Employee Retirement Income Security Act (ERISA) and other federal and state laws governing payroll deductions. Employers are responsible for ensuring that the deductions are processed according to the signed authorization and that employees are informed of any changes to their deductions. This legal framework protects both the employer and the employee in the deduction process.

Key Elements of the Payroll Deduction Special Services

Several key elements are essential for the Payroll Deduction Special Services form to function effectively:

- Employee Information: Accurate personal details must be provided.

- Deduction Types: Clear identification of the services or benefits being deducted.

- Authorization Signature: The employee's signature is necessary to validate the form.

- Effective Date: The form should indicate when the deductions will begin.

Examples of Using the Payroll Deduction Special Services

Employees may use the Payroll Deduction Special Services form in various scenarios, including:

- Contributing to a 401(k) retirement plan.

- Paying for health insurance premiums.

- Participating in flexible spending accounts (FSAs).

- Making contributions to charitable organizations through payroll deduction.

Quick guide on how to complete payroll deduction special services

Complete Payroll Deduction Special Services effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the instruments required to create, alter, and eSign your documents swiftly without delays. Manage Payroll Deduction Special Services on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Payroll Deduction Special Services without difficulty

- Find Payroll Deduction Special Services and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and eSign Payroll Deduction Special Services and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Payroll Deduction Special Services offered by airSlate SignNow?

Payroll Deduction Special Services by airSlate SignNow enable businesses to streamline their payroll processes through automated document management and electronic signatures. This service is designed to simplify employee agreements and deductions, ensuring accurate and efficient payroll processing.

-

How can Payroll Deduction Special Services benefit my business?

Utilizing Payroll Deduction Special Services can signNowly reduce administrative workload by automating document handling and signature collection. This leads to increased efficiency and minimizes errors related to payroll deductions, ultimately saving time and reducing costs for your business.

-

What pricing options are available for Payroll Deduction Special Services?

airSlate SignNow offers competitive pricing for Payroll Deduction Special Services, with several plans to fit different business needs. Pricing varies based on the features and user capacity, and we provide a free trial to help you evaluate the service before committing.

-

Can I integrate Payroll Deduction Special Services with my existing payroll system?

Yes, Payroll Deduction Special Services can easily integrate with popular payroll systems, allowing for a seamless transfer of data. This integration ensures that your payroll processes remain efficient and connected, enhancing overall operational productivity.

-

Is technical support available for Payroll Deduction Special Services?

Absolutely! Our dedicated support team is available to assist you with any questions or technical issues related to Payroll Deduction Special Services. We offer multiple channels of support, including chat, email, and phone, to ensure you receive timely assistance.

-

How secure is the information processed through Payroll Deduction Special Services?

Security is a top priority for airSlate SignNow. Payroll Deduction Special Services use advanced encryption protocols and adhere to industry standards to protect your sensitive information, ensuring your documents are secure and compliant.

-

Can Payroll Deduction Special Services help with compliance issues?

Yes, Payroll Deduction Special Services are designed to assist businesses in maintaining compliance with payroll regulations. By automating document tracking and storage, we help ensure that you have the necessary documentation readily available for audits or regulatory purposes.

Get more for Payroll Deduction Special Services

- Fax 615 253 5265 form

- Lb 0487 form

- Tennessee drug free workplace tennessee form

- Form np 659 007 ampquotnotary public commission application

- Notary public appointmentreappointment application please read carefully and follow all instructions exactly form

- Office of career services the ohio state university moritz college of form

- Printable form jctc 01

- Arkansas paramedic reciprocity form

Find out other Payroll Deduction Special Services

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online