Yearly Expenses Business Form

What is the yearly expenses business?

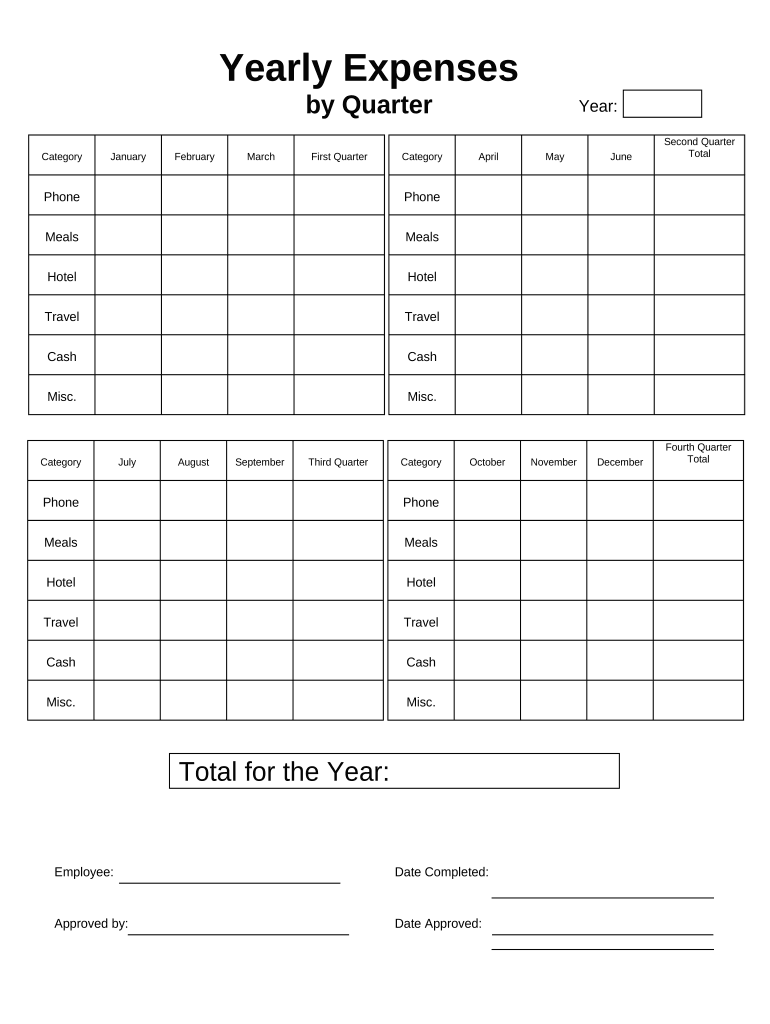

The yearly expenses business form is a financial document that outlines the total expenses incurred by a business over the course of a year. This form is essential for businesses to track their spending, manage budgets, and prepare for tax filings. It typically includes various categories of expenses, such as operational costs, salaries, utilities, and other expenditures that contribute to the overall financial health of the organization. Accurate completion of this form is vital for maintaining financial transparency and ensuring compliance with tax regulations.

How to use the yearly expenses business

To effectively use the yearly expenses business form, start by gathering all relevant financial documentation, including receipts, invoices, and bank statements. Organize these documents by category to streamline the data entry process. Once organized, input the expenses into the designated sections of the form, ensuring accuracy and completeness. After filling out the form, review it for any discrepancies or missing information. This thorough approach will help ensure that the form reflects the true financial position of the business.

Steps to complete the yearly expenses business

Completing the yearly expenses business form involves several key steps:

- Collect all financial records related to business expenses for the year.

- Organize expenses into categories such as administrative, operational, and marketing costs.

- Enter each expense into the form, ensuring that amounts are accurate and correctly categorized.

- Review the completed form for errors or omissions.

- Save the form electronically or print it for your records.

Following these steps will help ensure that the form is completed accurately and efficiently.

Legal use of the yearly expenses business

The yearly expenses business form must comply with relevant legal standards to be considered valid. In the United States, eSignature laws such as the ESIGN Act and UETA provide a framework for the legal acceptance of electronic signatures on documents. When completing this form electronically, it is important to use a reliable eSignature solution that offers compliance with these laws. This ensures that the form is legally binding and can be used for tax reporting and financial audits.

Key elements of the yearly expenses business

Several key elements should be included in the yearly expenses business form to ensure its effectiveness:

- Date: The date when the expenses were incurred.

- Expense Category: A classification of each expense (e.g., travel, supplies, utilities).

- Amount: The total cost associated with each expense.

- Description: A brief explanation of the purpose of the expense.

- Supporting Documents: Attachments such as receipts or invoices that validate the expenses.

Incorporating these elements will enhance the clarity and usefulness of the form.

Examples of using the yearly expenses business

Businesses can utilize the yearly expenses business form in various scenarios, such as:

- Preparing for annual tax filings by providing a comprehensive overview of deductible expenses.

- Creating budgets for the upcoming year based on historical spending patterns.

- Conducting financial audits to ensure compliance with internal policies and external regulations.

These examples illustrate the form's versatility in supporting effective financial management.

Quick guide on how to complete yearly expenses business

Effortlessly prepare Yearly Expenses Business on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Yearly Expenses Business on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and electronically sign Yearly Expenses Business with ease

- Locate Yearly Expenses Business and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Yearly Expenses Business and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help reduce yearly expenses for my business?

airSlate SignNow streamlines the document signing process, which can signNowly reduce yearly expenses for your business. By minimizing paper usage, postage fees, and printing costs, businesses can lower their operational costs. Additionally, the time saved by automating signature processes translates into further financial savings.

-

What features does airSlate SignNow offer to manage yearly expenses?

airSlate SignNow provides features such as automated workflows, document templates, and cloud storage that help manage yearly expenses effectively. By reducing the time and resources spent on manual paperwork, companies can reallocate their budget towards more productive activities. This efficiency can have a substantial impact on your yearly expenses business.

-

Is airSlate SignNow cost-effective for small businesses concerned about yearly expenses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises concerned with yearly expenses. The subscription model offers flexible pricing plans that cater to different budgets, allowing small businesses to adopt digital solutions without overspending.

-

Can I track the costs associated with using airSlate SignNow?

Yes, airSlate SignNow includes analytics tools that enable you to track your signing activities and associated costs. This feature can help you assess how much your yearly expenses business is reduced due to streamlined processes, providing valuable insights for future budgeting and expenditure planning.

-

What types of integrations does airSlate SignNow offer to enhance my business's efficiency?

airSlate SignNow integrates seamlessly with several business tools like CRM systems, accounting software, and cloud storage services. These integrations allow you to synchronize your workflows, which can lead to reduced yearly expenses business by optimizing task management and minimizing redundancy.

-

How does airSlate SignNow ensure the security of my documents while managing yearly expenses?

airSlate SignNow prioritizes security with features like encryption and secure access controls to protect your documents. By ensuring that your sensitive information is safe, airSlate SignNow allows your business to reduce risks and potential costs associated with data bsignNowes, further lowering yearly expenses business.

-

What support options are available for businesses using airSlate SignNow?

airSlate SignNow offers a robust support system that includes tutorials, live chat, and email assistance. This ensures that your business can troubleshoot issues efficiently, reducing downtime and allowing you to maintain lower yearly expenses business. Comprehensive support plays a key role in maximizing the value of your investment.

Get more for Yearly Expenses Business

Find out other Yearly Expenses Business

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe