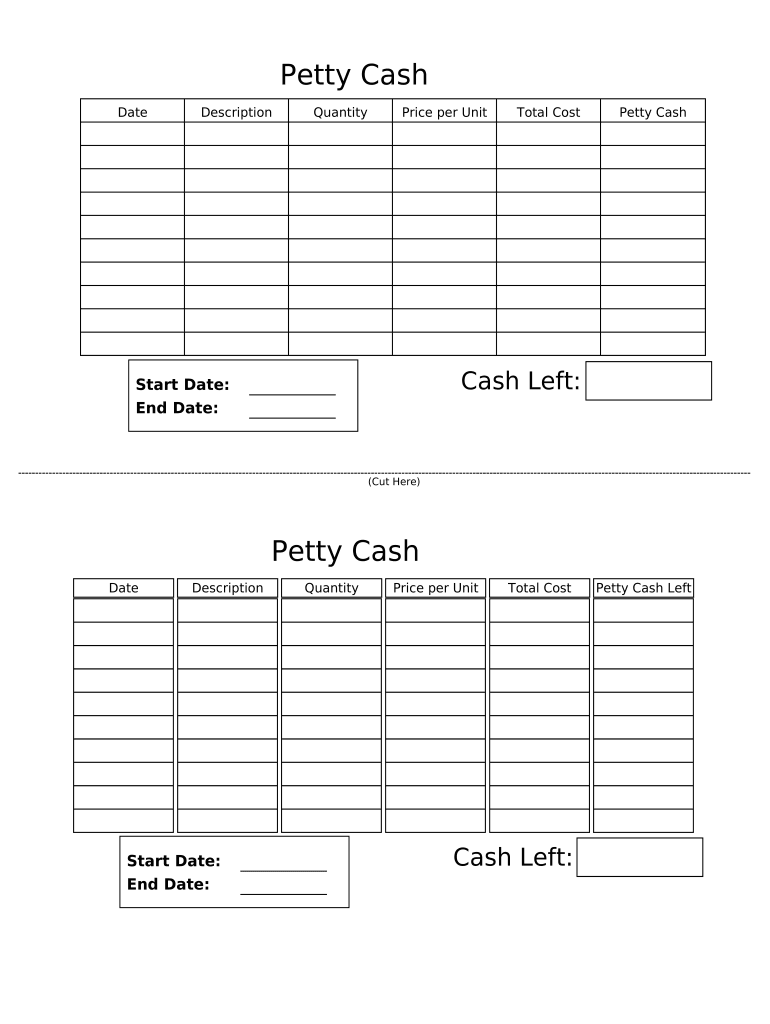

Petty Cash Funds Form

What is the Petty Cash Funds

The petty cash funds refer to a small amount of cash kept on hand by a business for minor expenses that may arise unexpectedly. This fund is typically used for purchases that are too small to warrant writing a check or using a credit card. Common uses include office supplies, postage, or employee reimbursements. Maintaining a petty cash fund helps streamline operations by allowing quick access to cash without the need for extensive paperwork.

How to use the Petty Cash Funds

Using petty cash funds involves a straightforward process. First, the business should designate a custodian responsible for managing the fund. When an expense occurs, the custodian disburses the cash and records the transaction. It is essential to keep receipts for all expenditures to ensure proper tracking and accountability. Regular reconciliation of the petty cash fund is necessary to maintain accurate records and ensure that the cash on hand matches the documented expenses.

Steps to complete the Petty Cash Funds

To complete the petty cash funds form, follow these steps:

- Identify the purpose of the petty cash fund and the amount needed.

- Designate a custodian who will manage the fund.

- Document the initial cash amount and obtain necessary approvals.

- Establish a process for disbursing cash and recording transactions.

- Regularly review and reconcile the petty cash fund to ensure accuracy.

Legal use of the Petty Cash Funds

Legal use of petty cash funds requires adherence to specific guidelines. Businesses must ensure that the fund is used solely for legitimate business expenses. Proper documentation, including receipts and transaction logs, is essential for compliance with tax regulations. Additionally, businesses should establish clear policies regarding the use of petty cash to prevent misuse or fraud.

Key elements of the Petty Cash Funds

Key elements of petty cash funds include:

- Custodian: A designated individual responsible for managing the fund.

- Documentation: Receipts and logs of all transactions to maintain transparency.

- Reconciliation: Regular checks to ensure cash on hand matches recorded expenses.

- Policy: Clear guidelines outlining acceptable uses and limits for the fund.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for the use of petty cash funds, emphasizing the importance of accurate record-keeping. Businesses must report any expenditures related to the petty cash fund on their tax returns. Proper documentation is crucial for substantiating expenses in case of an audit. Understanding these guidelines helps businesses maintain compliance and avoid potential penalties.

Quick guide on how to complete petty cash funds

Effortlessly Prepare Petty Cash Funds on Any Device

Digital document management has become favored by both businesses and individuals. It offers a sustainable alternative to conventional printed and signed paperwork, as you can easily locate the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without hindrances. Manage Petty Cash Funds on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to Edit and Electronically Sign Petty Cash Funds with Ease

- Locate Petty Cash Funds and click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that task.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Petty Cash Funds and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Petty Cash Funds?

Petty Cash Funds are small amounts of cash that businesses keep on hand for minor expenses. This helps companies avoid using checks or credit cards for insignNow purchases. Understanding the purpose and management of Petty Cash Funds is crucial for efficient cash flow.

-

How do I manage Petty Cash Funds effectively?

To manage Petty Cash Funds effectively, establish a clear policy outlining who can access the funds and for what purposes. Regularly track the transactions and reconcile the fund to ensure accuracy. Utilizing tools like airSlate SignNow can help you streamline documentation and approvals related to Petty Cash Funds.

-

What features does airSlate SignNow offer for managing Petty Cash Funds?

airSlate SignNow provides features that simplify document management for Petty Cash Funds, including electronic signatures, document templates, and audit trails. This ensures that all transactions are documented and approved quickly and securely. Our user-friendly interface makes it easy for teams to manage records related to Petty Cash Funds.

-

What are the benefits of using airSlate SignNow for Petty Cash Funds?

Using airSlate SignNow for managing Petty Cash Funds brings efficiency and transparency to your processes. The solution allows for fast approval of petty cash requests and secure storage of receipts, helping to reduce errors. Additionally, it empowers teams to maintain compliance with company policies while managing petty cash flow.

-

Is airSlate SignNow cost-effective for managing Petty Cash Funds?

Yes, airSlate SignNow offers a cost-effective solution for managing Petty Cash Funds. Our pricing plans are designed to meet the needs of businesses of all sizes, ensuring that you gain maximum value while minimizing costs. Investing in electronic document solutions enhances productivity without breaking the budget.

-

Can airSlate SignNow integrate with other financial systems for Petty Cash Funds?

Absolutely! airSlate SignNow easily integrates with various financial systems and accounting software to enhance the management of Petty Cash Funds. This seamless integration helps you track expenses and streamline workflow, ensuring that your team can access all necessary data in one place.

-

How secure is airSlate SignNow when handling Petty Cash Funds?

Security is a top priority at airSlate SignNow, especially when dealing with financial documents like those related to Petty Cash Funds. Our platform employs industry-standard encryption and secure access protocols to protect your information. You can feel confident that your data is safe and compliant with applicable regulations.

Get more for Petty Cash Funds

Find out other Petty Cash Funds

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form