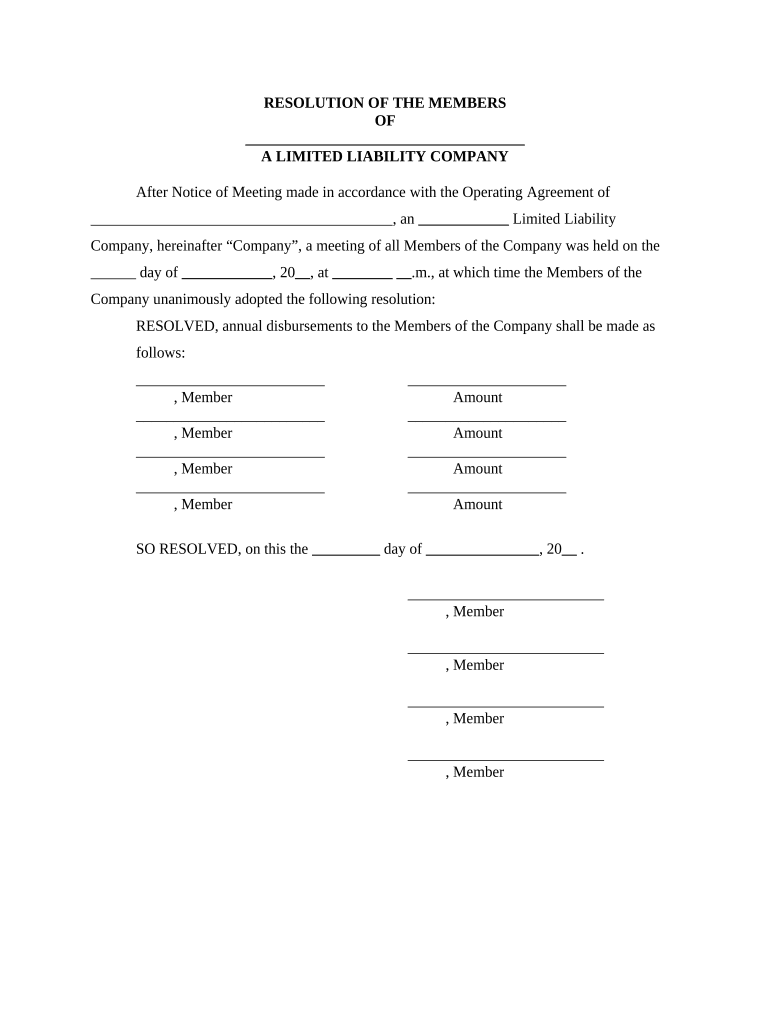

Llc Amount Form

What is the LLC amount?

The LLC amount refers to the financial contributions or investments made by members of a Limited Liability Company (LLC). This amount can vary based on the structure and agreements established within the LLC. It is essential for determining ownership percentages, profit distributions, and the financial health of the business. Understanding the LLC amount is crucial for compliance with tax regulations and for maintaining clear records of each member's investment.

How to use the LLC amount

Using the LLC amount involves accurately documenting each member's contributions and how these amounts affect the overall financial structure of the company. Members should record their investments in the operating agreement, which outlines the terms of ownership and profit sharing. Proper use of the LLC amount ensures that all members are aware of their financial stakes, which is vital for transparency and decision-making within the company.

Steps to complete the LLC amount

Completing the LLC amount involves several key steps:

- Determine the initial contributions from each member.

- Document these amounts in the operating agreement.

- Regularly update the LLC amount to reflect any additional investments or distributions.

- Ensure all records are maintained for tax purposes and compliance with state regulations.

Following these steps helps maintain clear financial records and supports the legal standing of the LLC.

Legal use of the LLC amount

The legal use of the LLC amount is governed by state laws and regulations. Each state may have specific requirements regarding how contributions are recorded and reported. It is important for LLC members to understand these legal frameworks to ensure compliance. Proper documentation of the LLC amount can protect members' interests and provide clarity in case of disputes or audits.

State-specific rules for the LLC amount

State-specific rules for the LLC amount can vary significantly. Some states may require detailed records of contributions, while others may have more lenient regulations. Members should familiarize themselves with their state's laws to ensure they are meeting all necessary requirements. Consulting with a legal professional can provide guidance tailored to the specific state in which the LLC is formed.

Examples of using the LLC amount

Examples of using the LLC amount include:

- A member contributing cash to the LLC, which is then recorded as their investment.

- Members agreeing to provide services or property instead of cash, which must also be valued and documented.

- Adjusting the LLC amount when a member withdraws or when new members are added, ensuring all contributions are updated accordingly.

These examples illustrate the importance of accurately tracking and managing the LLC amount to maintain organizational integrity.

Quick guide on how to complete llc amount

Prepare Llc Amount seamlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage Llc Amount on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Llc Amount with ease

- Locate Llc Amount and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all provided information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Llc Amount to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the average LLC amount for using airSlate SignNow?

The LLC amount for using airSlate SignNow varies depending on the plan you choose. Typically, the costs are designed to be budget-friendly, allowing businesses of all sizes to find an option that fits their budget. By offering a variety of pricing tiers, airSlate SignNow ensures that the LLC amount you pay aligns with your company's specific document signing needs.

-

How does airSlate SignNow help manage LLC amount-related documents?

airSlate SignNow simplifies the handling of documents related to your LLC amount by providing an intuitive platform for sending and signing documents securely. This means you can easily manage contracts, agreements, and other essential documents associated with your LLC in a streamlined manner. The platform enhances efficiency while reducing the hassle of paper-based processes.

-

Are there any hidden fees affecting the LLC amount with airSlate SignNow?

No, airSlate SignNow is committed to transparency in pricing, meaning there are no hidden fees that could increase your LLC amount unexpectedly. The pricing structure is clearly outlined, so you know what to expect upfront. This allows you to budget effectively without worrying about additional costs popping up later.

-

What features does airSlate SignNow offer for managing LLC amount transactions?

airSlate SignNow provides a wealth of features tailored for managing LLC amount transactions. These include customizable templates, audit trails, and secure e-signature capabilities that ensure compliance and ease of use. These features are designed to streamline the signing process and enhance overall document handling for your business.

-

Can I integrate airSlate SignNow with other tools to track LLC amount?

Yes, airSlate SignNow integrates seamlessly with various business tools, enabling you to track your LLC amount alongside other business metrics. Integrations with CRMs, cloud storage solutions, and financial software let you keep everything organized in one place. This connectivity ensures you can manage your LLC-related documents efficiently without losing sight of your financial metrics.

-

What benefits does airSlate SignNow provide concerning LLC amount management?

Using airSlate SignNow for LLC amount management comes with numerous benefits including cost savings, increased efficiency, and improved compliance. By digitizing your document processes, you save on printing and storage costs while also speeding up transaction times. The platform's secure environment enhances trust, ensuring your LLC documents are safe and accessible.

-

How does pricing scale with an increasing LLC amount in airSlate SignNow?

As your business grows and your LLC amount increases, airSlate SignNow offers flexible pricing that can scale accordingly. This allows you to upgrade to higher tiers with more features to accommodate your expanding needs. The scalability ensures that as your requirements increase, the tools you use remain effective and relevant without overspending.

Get more for Llc Amount

Find out other Llc Amount

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed