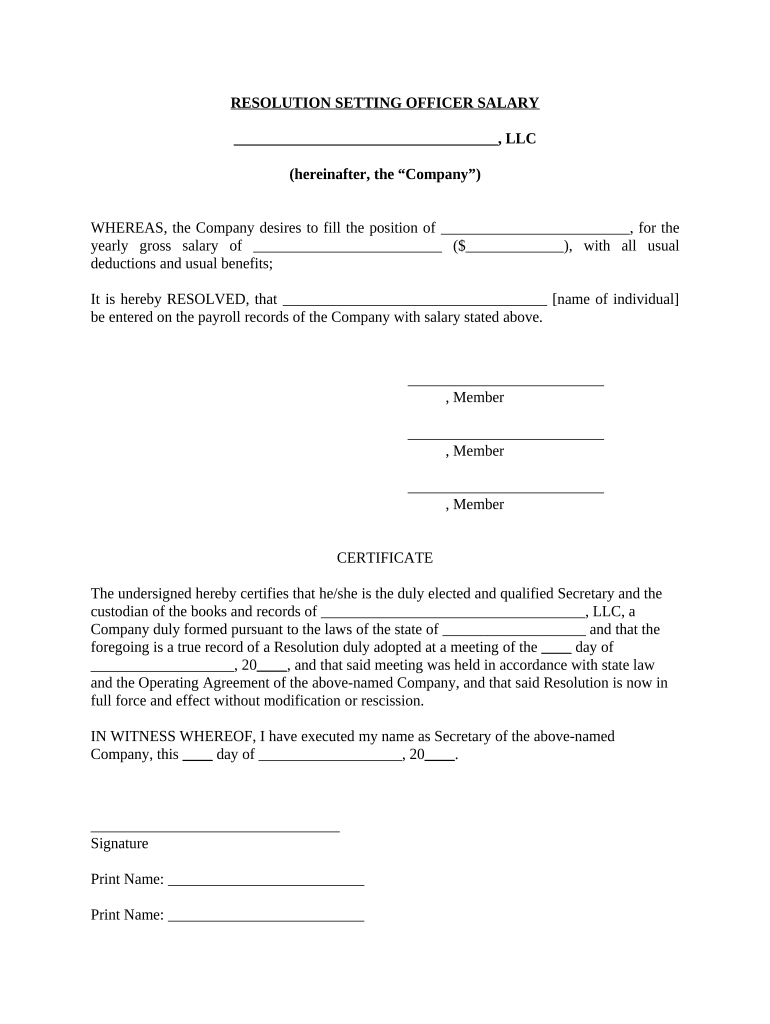

Llc Salary Form

What is the LLC Salary

The LLC salary refers to the compensation that members of a Limited Liability Company (LLC) receive for their services to the business. Unlike traditional employees, LLC members may choose how they want to be compensated, which can include salaries, distributions, or a combination of both. The structure of the LLC allows for flexibility in how members are paid, but it is essential to ensure that the compensation aligns with IRS guidelines to avoid tax complications.

Key Elements of the LLC Salary

Several key elements must be considered when determining the LLC salary:

- Member Role: The responsibilities and roles of each member can influence salary decisions. Members who take on more significant operational roles may receive higher compensation.

- Profit Distribution: LLCs can distribute profits to members based on their ownership percentage, which may also impact salary levels.

- Market Rates: It's advisable to consider industry standards and market rates for similar positions when setting salaries to ensure they are reasonable and defensible.

- Tax Implications: Understanding the tax treatment of salaries versus distributions is crucial, as it affects both the LLC and its members.

Steps to Complete the LLC Salary

To establish an LLC salary, follow these steps:

- Determine the roles and responsibilities of each member within the LLC.

- Research industry standards for compensation to establish a benchmark.

- Decide on the payment structure, whether it will be a fixed salary, profit distribution, or a combination.

- Document the decision in the LLC operating agreement to ensure clarity and compliance.

- Consult with a tax professional to understand the implications of your chosen compensation structure.

Legal Use of the LLC Salary

Ensuring the legality of the LLC salary involves adhering to IRS guidelines and state regulations. Members should document their salaries in the operating agreement and maintain accurate records of all payments made. This documentation is vital for tax purposes and can help defend the compensation structure in case of an audit. Additionally, salaries should be reasonable and reflect the services provided to the LLC to avoid potential penalties.

IRS Guidelines

The IRS has specific guidelines regarding how LLC members should be compensated. Members classified as self-employed must pay self-employment taxes on their earnings. It is crucial to distinguish between guaranteed payments, which are treated as ordinary income, and distributions, which may be subject to different tax treatments. Understanding these guidelines helps ensure compliance and minimizes tax liabilities.

State-Specific Rules for the LLC Salary

Each state may have unique regulations regarding the compensation of LLC members. It is essential to research and understand your state's specific rules, as they can affect how salaries are structured and taxed. Some states may require additional filings or impose different tax rates on LLC income, which can impact the overall compensation strategy.

Quick guide on how to complete llc salary

Effortlessly Complete Llc Salary on Any Device

Web-based document management has gained traction among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Manage Llc Salary across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Method to Modify and eSign Llc Salary with Ease

- Obtain Llc Salary and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed by airSlate SignNow for this purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Verify all information and click on the Done button to preserve your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searching, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Llc Salary to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the average salary for LLC members?

The average salary for LLC members can vary widely based on the industry, business profits, and member contributions. Typically, LLC members may choose to pay themselves a salary that reflects their role and responsibilities while adhering to IRS guidelines. It's important to consult a financial advisor about how to set and structure LLC members' salaries effectively.

-

How can airSlate SignNow assist with documenting LLC members' salaries?

airSlate SignNow allows businesses to create and send formal documents that outline LLC members' salaries in a professional manner. With its eSigning feature, members can quickly review and sign salary agreements, ensuring complete transparency and compliance. The platform's ease of use makes managing such documents hassle-free.

-

Are there any specific tax implications for LLC members' salaries?

Yes, there are specific tax implications for LLC members' salaries. Salary payments to members are subject to self-employment tax, and it's essential to maintain accurate records to comply with IRS regulations. Through airSlate SignNow, you can create salary agreements that help ensure compliance and keep all members informed about tax responsibilities.

-

Can airSlate SignNow help in managing benefits for LLC members?

Absolutely! airSlate SignNow provides features that facilitate the management of benefits for LLC members. You can create custom documents outlining salary and benefits, properly signed and stored securely. This enhances clarity on what LLC members can expect regarding their salaries and additional compensation.

-

What features does airSlate SignNow offer for LLC salary management?

airSlate SignNow includes a suite of features that make LLC salary management efficient, such as document creation, templates, eSigning, and secure storage. These tools allow you to quickly generate salary agreements for LLC members and ensure all necessary documentation is completed accurately. This simplifies the salary setting process for you and your team.

-

How does pricing work for airSlate SignNow when it comes to salary documentation?

airSlate SignNow offers competitive pricing based on the plans you choose, allowing you to manage salary documentation effectively without breaking the bank. Each plan includes features tailored to your needs, including document management and eSigning. This cost-effective solution saves time and helps streamline the process of setting and documenting LLC members' salaries.

-

Can I integrate airSlate SignNow with my existing accounting software for LLC payroll?

Yes, airSlate SignNow can integrate with various accounting software to facilitate seamless payroll management for LLC members. This integration helps automate the documentation process concerning members' salaries and ensures accuracy in record-keeping. Simplifying these operations enhances productivity and allows focus on growing your business.

Get more for Llc Salary

Find out other Llc Salary

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast