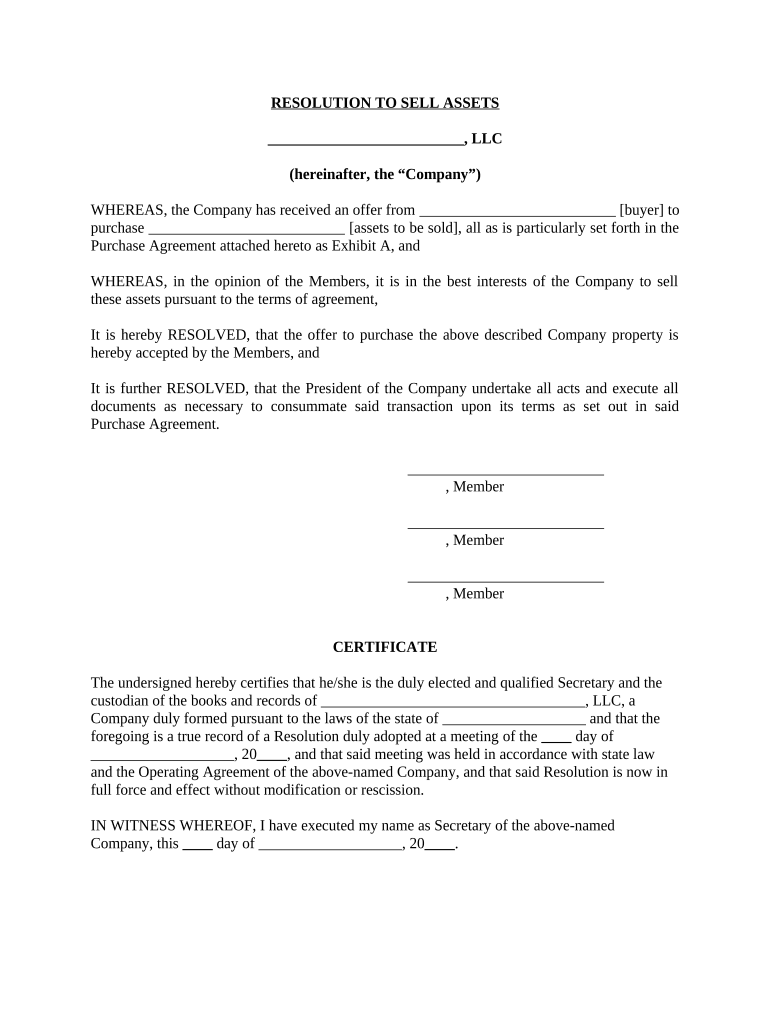

Llc Assets Form

What is the LLC Assets

The term "LLC assets" refers to the properties, funds, and other resources owned by a Limited Liability Company (LLC). These assets can include tangible items such as real estate, equipment, and inventory, as well as intangible assets like trademarks, patents, and goodwill. Understanding the nature and value of LLC assets is crucial for various business operations, including taxation, compliance, and financial reporting.

How to Use the LLC Assets

Utilizing LLC assets effectively involves proper management and documentation. Business owners should maintain accurate records of all assets, including acquisition dates, values, and depreciation. This information is vital for financial statements and tax filings. Additionally, LLC assets can be leveraged for securing loans or attracting investors, as they demonstrate the company's financial stability and growth potential.

Steps to Complete the LLC Assets

Completing documentation related to LLC assets typically involves several key steps:

- Identify all assets owned by the LLC, categorizing them into tangible and intangible assets.

- Assess the value of each asset, which may require professional appraisals for certain items.

- Document the ownership and any relevant agreements or contracts associated with the assets.

- Ensure compliance with state and federal regulations regarding asset reporting.

Legal Use of the LLC Assets

LLC assets must be used in accordance with legal requirements to protect the limited liability status of the company. This means that personal and business assets should be kept separate to avoid piercing the corporate veil. Additionally, any transactions involving LLC assets should be properly documented and conducted at arm's length to ensure compliance with tax laws and regulations.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how LLC assets should be reported for tax purposes. LLCs are typically treated as pass-through entities, meaning that income and losses are reported on the owners' personal tax returns. It is essential to accurately report any gains or losses from the sale or depreciation of LLC assets to comply with IRS regulations and avoid penalties.

Required Documents

When managing LLC assets, several documents are essential for legal and financial purposes. These include:

- Operating agreements that outline the management and ownership of the LLC.

- Asset purchase agreements for any acquisitions.

- Tax returns that reflect the income and expenses associated with LLC assets.

- Financial statements that provide an overview of the LLC's financial health.

Eligibility Criteria

To effectively manage and utilize LLC assets, it is important to understand the eligibility criteria for forming an LLC. Generally, any individual or group of individuals can form an LLC as long as they comply with state regulations. This includes filing the necessary formation documents and paying applicable fees. Additionally, the LLC must have a legitimate business purpose and adhere to ongoing compliance requirements to maintain its status.

Quick guide on how to complete llc assets

Prepare Llc Assets effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Llc Assets on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Llc Assets effortlessly

- Find Llc Assets and click Get Form to commence.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Llc Assets to ensure outstanding communication at every step of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are LLC assets and how are they protected?

LLC assets refer to the property, cash, and other valuables owned by a Limited Liability Company. They are protected from personal liability, meaning that if the LLC faces legal issues or debts, the owners' personal assets typically remain safe. This ensures that your LLC assets are shielded, allowing you to operate your business confidently.

-

How can airSlate SignNow help manage LLC assets?

airSlate SignNow streamlines the management of LLC assets by enabling efficient document signing and workflows. You can easily create, send, and track important contracts and agreements related to your LLC assets. This not only saves time but also ensures that your asset management processes are compliant and organized.

-

What pricing options are available for using airSlate SignNow with LLC assets?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs, including LLCs. You can choose from monthly or annual subscriptions, with features that cater specifically to managing LLC assets. This allows you to control costs while accessing necessary tools for efficient document management.

-

Are there any features in airSlate SignNow specifically designed for LLC asset management?

Yes, airSlate SignNow includes features such as custom templates, secure signing, and document storage that are ideal for managing LLC assets. You can store and access all your asset-related documents in one secure location, ensuring easy retrieval when needed. This enhances overall efficiency in handling LLC-related transactions.

-

Can I integrate airSlate SignNow with other tools for LLC asset tracking?

Absolutely! airSlate SignNow integrates seamlessly with popular business tools like Google Workspace, Salesforce, and others. This allows for streamlined asset tracking and management of LLC assets by connecting your documentation and workflow systems. Integrations simplify processes, ensuring all your LLC asset data is in sync.

-

What are the benefits of eSigning documents for LLC assets?

eSigning documents related to LLC assets offers several benefits, including increased efficiency and security. With airSlate SignNow, you can complete transactions remotely without the need for physical signatures, expediting the process. Additionally, it provides a secure audit trail that protects your LLC assets during agreements.

-

How secure is airSlate SignNow for managing LLC assets?

Security is a top priority at airSlate SignNow, which implements advanced encryption protocols to protect your documents, including those concerning LLC assets. You can rest assured that your sensitive information is safe from unauthorized access. Regular security updates further enhance the protection of your LLC asset management processes.

Get more for Llc Assets

- Template invoice for personal services prepared for santa form

- Declaration of undergraduate minorcertificate campus at plymouth form

- Agenda building standards commission for fort worth texas form

- Bakery food slogans 76 form

- Contact us honors program in medical education feinberg school of form

- Medical verification for air conditioner request ball state form

- Get the 96 545 motor vehicle dealers special inventory form

- Uic questionnaire form

Find out other Llc Assets

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements