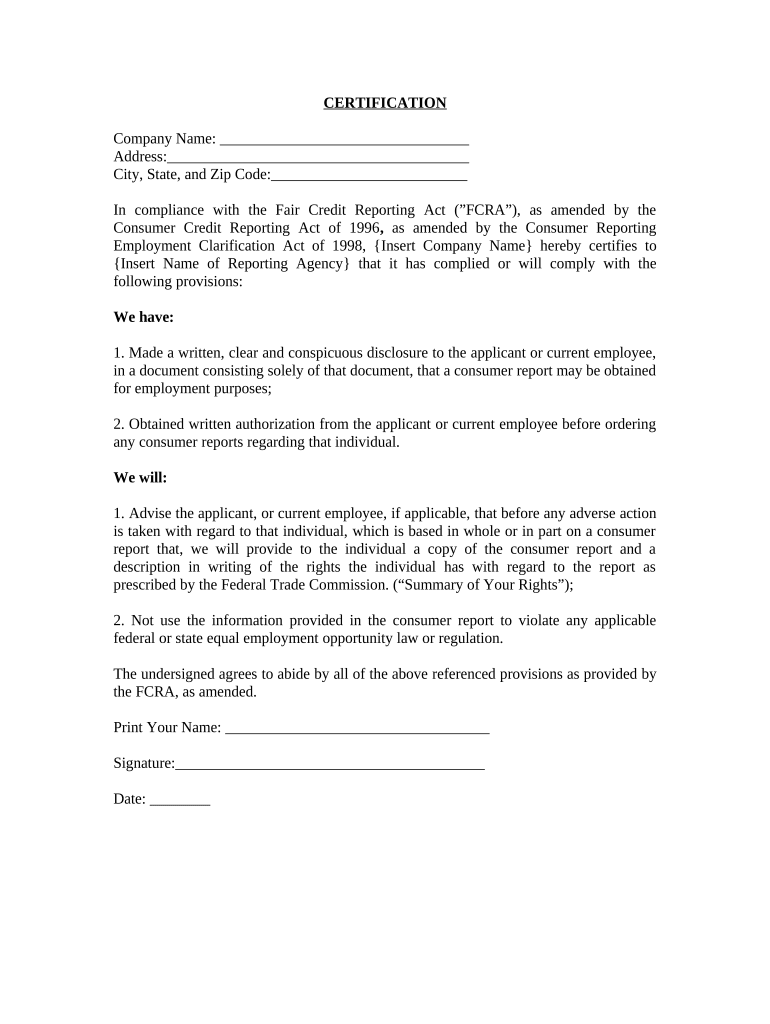

Fcra Form

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, dissemination, and use of consumer information, including consumer credit information. This law is designed to promote accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Under the FCRA, consumers have specific rights regarding their credit reports, including the right to access their reports and dispute inaccurate information. The act is crucial for maintaining trust in the financial system and ensuring consumers are protected from identity theft and misinformation.

Key Elements of the FCRA

The FCRA includes several key provisions that govern how consumer reporting agencies operate. These provisions include:

- Consumer Rights: Consumers have the right to know what information is in their credit report and to dispute any inaccuracies.

- Disclosure Requirements: Consumer reporting agencies must provide consumers with a copy of their credit report upon request.

- Limitations on Reporting: Certain negative information, such as bankruptcies, must be removed from credit reports after a specified period.

- Permissible Purposes: Agencies can only furnish consumer reports for specific purposes, such as credit applications, employment, or insurance underwriting.

Steps to Complete the FCRA

Completing the FCRA process involves several important steps to ensure compliance and accuracy. Here’s a simplified guide:

- Obtain Your Credit Report: Request a copy of your credit report from a consumer reporting agency.

- Review Your Report: Carefully examine your report for any inaccuracies or unfamiliar accounts.

- Dispute Inaccuracies: If you find errors, file a dispute with the reporting agency, providing necessary documentation.

- Follow Up: Monitor the status of your dispute and ensure corrections are made if warranted.

Legal Use of the FCRA

The FCRA outlines the legal framework for how consumer reporting agencies must operate. It specifies that agencies must ensure the information they provide is accurate and up-to-date. Additionally, the law mandates that consumers are informed when adverse actions are taken based on their credit reports, such as denial of credit or employment. Compliance with the FCRA is essential for businesses that utilize consumer reports, as violations can lead to significant penalties.

Eligibility Criteria

To utilize the protections and rights granted by the FCRA, consumers must meet certain eligibility criteria. Primarily, individuals must be residents of the United States and have a valid identification to request their credit report. Additionally, the FCRA applies to any consumer who has a credit history or has been the subject of a consumer report. Understanding these criteria ensures that consumers can effectively navigate their rights under the law.

Penalties for Non-Compliance

Non-compliance with the FCRA can result in severe penalties for consumer reporting agencies and businesses that fail to adhere to its regulations. These penalties may include:

- Monetary Fines: Agencies may face fines for each violation of the FCRA.

- Legal Action: Consumers have the right to sue for damages if they suffer harm due to violations.

- Reputational Damage: Non-compliance can lead to loss of consumer trust and damage to a company's reputation.

Quick guide on how to complete fcra

Effortlessly Prepare Fcra on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, offering the ability to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the features required to create, revise, and electronically sign your documents swiftly and seamlessly. Manage Fcra on any device using the airSlate SignNow apps for Android or iOS and enhance your document-driven tasks today.

The Optimal Method to Edit and Electronically Sign Fcra Effortlessly

- Find Fcra and then click Obtain Form to initiate the process.

- Utilize the available tools to complete your document.

- Emphasize key sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to preserve your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind the woes of lost or misplaced documents, the hassle of tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Fcra to ensure effective communication throughout your entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a consumer reporting agency?

A consumer reporting agency is an organization that collects and provides data about consumers, primarily for credit reporting purposes. These agencies help businesses assess the creditworthiness of potential customers, making them crucial for lending and financial decisions.

-

How does airSlate SignNow integrate with consumer reporting agencies?

airSlate SignNow can seamlessly integrate with various consumer reporting agencies to streamline documentation processes. This integration enables businesses to easily access consumer reports while managing eSignatures, leading to improved efficiency and compliance.

-

What features does airSlate SignNow offer for working with consumer reports?

airSlate SignNow offers features like customizable templates, automated workflows, and secure eSigning that enhance collaboration with consumer reports. By using these tools, businesses can ensure that all necessary documents are accurately handled and legally binding.

-

How does airSlate SignNow ensure security when handling consumer reports?

Security is a top priority at airSlate SignNow. The platform employs bank-level encryption and compliance with industry standards to protect sensitive data, including information from consumer reporting agencies, providing peace of mind to users.

-

What is the pricing model for airSlate SignNow?

airSlate SignNow offers a range of pricing plans to fit various business needs, including those that require integration with consumer reporting agencies. The pricing is designed to be accessible, allowing businesses of all sizes to benefit from efficient document management solutions.

-

Can airSlate SignNow help with compliance related to consumer reporting agencies?

Yes, airSlate SignNow provides tools and features that help businesses maintain compliance when interacting with consumer reporting agencies. By ensuring that all eSigned documents are securely stored and readily accessible, airSlate SignNow supports regulatory adherence.

-

What benefits do businesses gain by using airSlate SignNow with consumer reporting agencies?

By using airSlate SignNow in conjunction with consumer reporting agencies, businesses can enhance their document management processes, reduce turnaround times, and increase accuracy. This leads to better decision-making and improved customer experience.

Get more for Fcra

Find out other Fcra

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors