Self Employed Independent Contractor Form

What is the Self Employed Independent Contractor

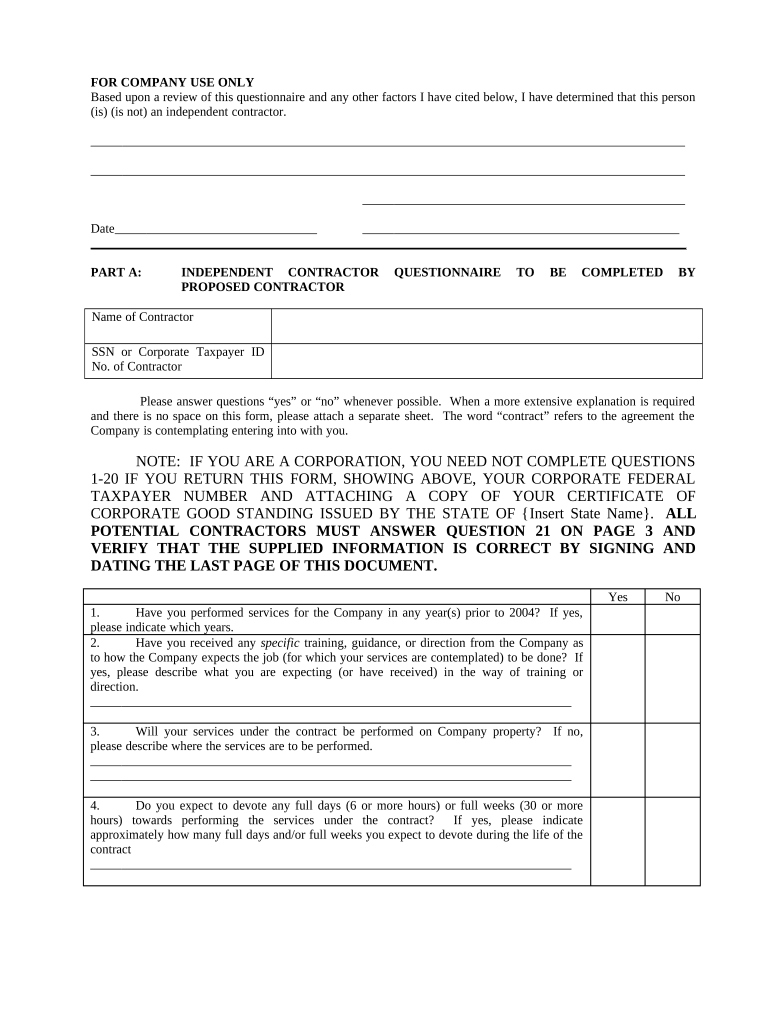

The self employed independent contractor is an individual who provides services to clients or businesses without being classified as an employee. This classification allows for greater flexibility and autonomy in work arrangements. Independent contractors typically operate under a contract that outlines the terms of their services, payment, and responsibilities. Unlike traditional employees, they are responsible for their own taxes, benefits, and business expenses.

Steps to complete the Self Employed Independent Contractor

Completing the self employed independent contractor form involves several key steps. First, gather all necessary information, including your personal details, business name, and tax identification number. Next, accurately fill out the form, ensuring all sections are completed to avoid delays. After filling out the form, review it for accuracy and completeness. Finally, submit the form electronically or via mail, depending on the requirements of the entity requesting it. Utilizing a reliable eSignature tool can streamline this process and ensure legal compliance.

Legal use of the Self Employed Independent Contractor

The legal use of the self employed independent contractor form is essential for establishing a formal agreement between the contractor and the client. This form serves as a record of the services provided and the terms agreed upon. To ensure that the form is legally binding, it must comply with relevant laws, such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a trusted eSignature platform can help maintain compliance and provide a secure method for signing and storing documents.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for self employed independent contractors regarding tax obligations. Contractors must report their income using Schedule C (Form 1040) and may be required to pay self-employment tax. It is crucial for independent contractors to maintain accurate records of their earnings and expenses to ensure compliance with IRS regulations. Understanding these guidelines can help contractors manage their tax responsibilities effectively and avoid potential penalties.

Required Documents

When filling out the self employed independent contractor form, certain documents may be required to support your application. These documents can include proof of identity, such as a driver's license or Social Security card, and any relevant business licenses or permits. Additionally, having financial records, such as bank statements or invoices, can help substantiate your income and expenses. Ensuring you have all necessary documentation can facilitate a smoother application process.

Form Submission Methods

The self employed independent contractor form can be submitted through various methods, including online, by mail, or in person. Many organizations prefer electronic submissions due to their speed and efficiency. When submitting online, ensure that you use a secure platform to protect your information. If submitting by mail, consider using a trackable service to confirm receipt. In-person submissions may be required in certain situations, so it's important to check the specific requirements of the requesting entity.

Penalties for Non-Compliance

Failing to comply with the requirements related to the self employed independent contractor form can result in significant penalties. The IRS may impose fines for late submissions or inaccurate reporting of income. Additionally, clients may withhold payments or terminate contracts if the proper documentation is not provided. Understanding the potential consequences of non-compliance can help independent contractors prioritize their responsibilities and maintain good standing with clients and tax authorities.

Quick guide on how to complete self employed independent contractor 497334741

Complete Self Employed Independent Contractor effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Self Employed Independent Contractor on any platform using airSlate SignNow apps available for Android or iOS and streamline any document-related process today.

The simplest way to modify and eSign Self Employed Independent Contractor without hassle

- Find Self Employed Independent Contractor and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Customize and eSign Self Employed Independent Contractor while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the best eSignature solution for a self employed independent contractor?

For a self employed independent contractor, airSlate SignNow is an excellent eSignature solution. It provides a user-friendly interface that allows you to send and sign documents easily. Additionally, it offers a range of features tailored to meet the unique needs of contractors, ensuring efficient and professional document management.

-

How much does airSlate SignNow cost for self employed independent contractors?

The pricing for airSlate SignNow is very competitive, making it a cost-effective option for self employed independent contractors. Affordable plans are available that cater specifically to individual professionals. This means you can access powerful eSigning features without exceeding your budget.

-

What features does airSlate SignNow offer for self employed independent contractors?

airSlate SignNow provides a variety of features designed for self employed independent contractors, including customizable templates, in-person signing, and mobile access. These features streamline your workflow, allowing you to send documents for signature quickly and manage everything from any device. This ensures you stay efficient and organized.

-

Can self employed independent contractors integrate airSlate SignNow with other tools?

Yes, airSlate SignNow offers seamless integrations with various tools that self employed independent contractors commonly use. Whether it's project management software, CRMs, or cloud storage services, you can easily connect them to enhance your workflow. This integration capability helps you keep your processes aligned and efficient.

-

How can airSlate SignNow benefit self employed independent contractors?

For self employed independent contractors, using airSlate SignNow can signNowly enhance productivity. By digitizing your signing process, you can save time and eliminate the hassle of printing and scanning documents. This leads to quicker turnaround times, giving you a competitive edge in your work.

-

Is airSlate SignNow secure for self employed independent contractors?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents signed by a self employed independent contractor are protected. With advanced encryption and compliance with legal standards, you can trust that your sensitive information remains safe throughout the signing process.

-

How easy is it to use airSlate SignNow for a self employed independent contractor?

Using airSlate SignNow is incredibly straightforward for self employed independent contractors, even for those with minimal tech experience. The platform’s intuitive design allows you to create, send, and manage documents seamlessly. You can start eSigning in no time, allowing you to focus more on your business.

Get more for Self Employed Independent Contractor

Find out other Self Employed Independent Contractor

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure