Expense Report Form

What is the Expense Report

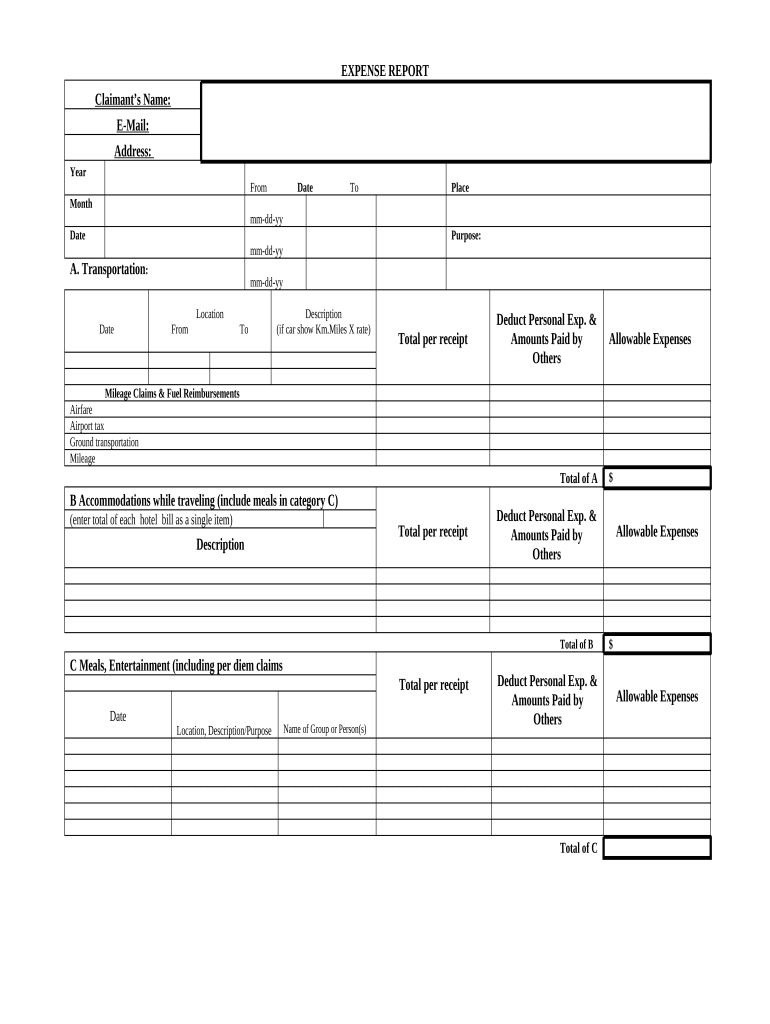

An expense report is a document used by employees to itemize and record expenses incurred during business activities. It serves as a formal request for reimbursement from the employer. Typically, the report includes details such as the date of the expense, the nature of the expense, the amount spent, and any necessary receipts or documentation. Expense reports are essential for maintaining accurate financial records and ensuring compliance with company policies and tax regulations.

How to use the Expense Report

Using an expense report involves several straightforward steps. First, gather all receipts and documentation related to business expenses. Next, fill out the expense report form with accurate details, including the date, amount, and purpose of each expense. Ensure to categorize expenses correctly, such as travel, meals, or supplies. After completing the form, submit it to your supervisor or the finance department for approval. Keep a copy for your records to track your submissions and reimbursements.

Steps to complete the Expense Report

Completing an expense report requires careful attention to detail. Follow these steps for an effective submission:

- Collect all relevant receipts and documentation for expenses.

- Choose the appropriate expense report form provided by your employer.

- Fill in your personal information, including your name and employee ID.

- List each expense, including the date, amount, and description.

- Attach copies of receipts for verification.

- Review the report for accuracy and completeness.

- Submit the report to the designated approver.

Key elements of the Expense Report

Understanding the key elements of an expense report can enhance its effectiveness. Important components include:

- Date: The date when the expense was incurred.

- Amount: The total cost associated with each expense.

- Description: A brief explanation of the expense's purpose.

- Category: Classification of the expense, such as travel or meals.

- Receipts: Documentation that supports the reported expenses.

Legal use of the Expense Report

Expense reports must comply with various legal and tax regulations. Employers are required to maintain accurate records for tax purposes, and employees must ensure that all claimed expenses are legitimate and necessary for business operations. Misrepresentation of expenses can lead to legal consequences, including penalties from the IRS. Therefore, it is crucial to adhere to company policies and federal guidelines when submitting an expense report.

Filing Deadlines / Important Dates

Filing deadlines for expense reports can vary by organization, but it is essential to submit reports promptly to ensure timely reimbursement. Many companies require expense reports to be submitted within a specific timeframe, such as within 30 days of incurring the expense. Additionally, be aware of any fiscal year-end deadlines that may affect the reporting of expenses for tax purposes. Staying informed about these dates helps maintain compliance and avoid delays in reimbursement.

Quick guide on how to complete expense report 497334826

Prepare Expense Report effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it in the cloud. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Expense Report on any device using airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

How to modify and eSign Expense Report without any hassle

- Find Expense Report and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Expense Report to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Expense Report in airSlate SignNow?

An Expense Report in airSlate SignNow is a digital document that allows users to track and submit their business expenses effortlessly. The platform simplifies the process by enabling users to capture receipts, input expense details, and obtain necessary approvals electronically.

-

How does airSlate SignNow streamline the Expense Report process?

airSlate SignNow streamlines the Expense Report process by providing templates and customizable workflows. Users can create and manage Expense Reports with ease, reducing time spent on paperwork and ensuring compliance with company policies.

-

What features does airSlate SignNow offer for managing Expense Reports?

Key features of airSlate SignNow for managing Expense Reports include electronic signatures, automated approval workflows, and integration with accounting software. These features enhance efficiency and accuracy in expense management.

-

Is there a mobile app for submitting Expense Reports?

Yes, airSlate SignNow offers a user-friendly mobile app that allows users to submit their Expense Reports on the go. Users can take photos of receipts, fill out expense details, and sign documents seamlessly from their mobile devices.

-

How can Expense Reports be integrated with other software?

airSlate SignNow allows easy integration with various accounting and financial management software, making it simple to sync Expense Reports directly. This integration helps enhance data accuracy and reduces manual entry errors.

-

What is the pricing structure for airSlate SignNow's Expense Reports?

airSlate SignNow offers flexible pricing plans tailored to fit different business sizes and needs. Users can choose from monthly or annual billing options, ensuring that managing Expense Reports remains cost-effective for any organization.

-

Can multiple users collaborate on Expense Reports using airSlate SignNow?

Yes, airSlate SignNow supports collaboration among multiple users on Expense Reports. Team members can work together, share documents, and provide approvals in real-time, ensuring a smooth and efficient expense management process.

Get more for Expense Report

Find out other Expense Report

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free