Farm Rent Forms

What is the farm rental agreement form?

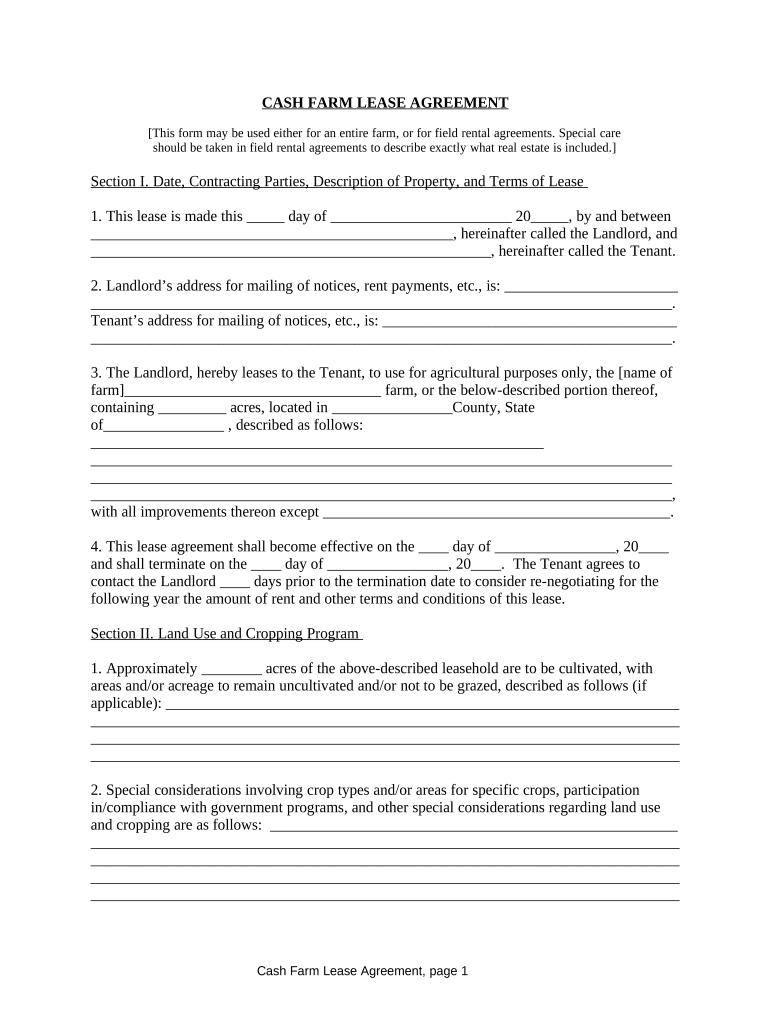

The farm rental agreement form is a legal document that outlines the terms and conditions under which a landlord allows a tenant to use agricultural land for farming purposes. This form typically includes essential details such as the duration of the lease, rental payment amounts, and responsibilities of both parties. It serves as a binding contract that protects the interests of both the landlord and the tenant, ensuring clarity and mutual understanding regarding the use of the property.

Key elements of the farm rental agreement form

Several critical components should be included in a farm rental agreement form to ensure it is comprehensive and legally binding. These elements typically encompass:

- Parties involved: Names and contact information of the landlord and tenant.

- Description of the property: Detailed information about the land being rented, including location and size.

- Term of the lease: Start and end dates of the rental period.

- Payment terms: Amount of rent, due dates, and acceptable payment methods.

- Use of the property: Specific agricultural activities permitted on the land.

- Maintenance responsibilities: Duties of both parties regarding upkeep and repairs.

- Termination conditions: Guidelines for ending the lease early or renewing it.

Steps to complete the farm rental agreement form

Completing the farm rental agreement form involves several straightforward steps to ensure accuracy and compliance with legal standards. Follow these steps:

- Gather necessary information: Collect details about the property, parties involved, and rental terms.

- Fill out the form: Input all required information clearly and accurately.

- Review the document: Both parties should thoroughly read the agreement to confirm all terms are correct.

- Sign the agreement: Ensure that both landlord and tenant sign the document, either physically or electronically, to validate it.

- Distribute copies: Provide copies of the signed agreement to all parties for their records.

Legal use of the farm rental agreement form

The farm rental agreement form is legally binding when it meets specific criteria set forth by state and federal laws. To ensure its legal standing, the document must include the essential elements mentioned earlier, and both parties must willingly sign it. Additionally, the agreement should comply with relevant agricultural laws and regulations in the state where the property is located. Understanding these legal requirements helps protect both the landlord's and tenant's rights in case of disputes.

How to obtain the farm rental agreement form

Obtaining a farm rental agreement form can be done through various methods. Many agricultural organizations, legal websites, and local government offices provide templates that can be customized to meet specific needs. Additionally, legal professionals specializing in agricultural law can assist in drafting a tailored agreement that adheres to state regulations. It is crucial to ensure that the form used is up-to-date and compliant with current laws to avoid potential issues.

State-specific rules for the farm rental agreement form

Each state in the United States may have unique regulations governing farm rental agreements. These rules can affect various aspects, such as lease duration, tenant rights, and property usage. It is essential for both landlords and tenants to familiarize themselves with their state's specific requirements to ensure the agreement is enforceable. Consulting with a local attorney or agricultural extension office can provide valuable insights into these regulations.

Quick guide on how to complete farm rent forms

Prepare Farm Rent Forms effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Farm Rent Forms on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Farm Rent Forms seamlessly

- Locate Farm Rent Forms and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Farm Rent Forms and ensure efficient communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a farm rental agreement form?

A farm rental agreement form is a legal document that outlines the terms and conditions of renting agricultural land. It typically includes details about rental duration, payment terms, land usage, and responsibilities of both the landlord and tenant. Using a standardized farm rental agreement form ensures that both parties are protected and understand their obligations.

-

How can I create a farm rental agreement form using airSlate SignNow?

Creating a farm rental agreement form with airSlate SignNow is simple and intuitive. You can start by selecting a template from our extensive library, customize it to fit your specific needs, and then fill in the relevant details. Once completed, you can easily send it for eSignature, streamlining the entire rental agreement process.

-

Are there any costs associated with using the farm rental agreement form?

Yes, while airSlate SignNow offers various pricing plans, the cost of using a farm rental agreement form is generally included in your subscription. We provide affordable options tailored to your business needs, allowing you to manage multiple documents efficiently. Check our pricing page for specific details on plans and features.

-

What features does airSlate SignNow offer for farm rental agreement forms?

airSlate SignNow includes several features for farm rental agreement forms, such as customizable templates, secure eSignature options, and document tracking. You can collaborate with multiple users, ensure compliance with electronic signature laws, and access forms from any device at any time. These features enhance the efficiency and reliability of managing your agreements.

-

Can I integrate the farm rental agreement form with other applications?

Absolutely! airSlate SignNow allows seamless integration with various applications, including CRM systems and cloud storage services. This means you can easily manage and share your farm rental agreement forms without switching between platforms. Integration enhances productivity and keeps your workflows organized.

-

What are the benefits of using a digital farm rental agreement form?

Using a digital farm rental agreement form streamlines the entire process, saving you time and reducing paperwork. You can send, sign, and manage the document electronically, which makes it convenient and secure. Additionally, it allows for faster turnaround times, helping you finalize agreements and start your farming operations sooner.

-

Is the farm rental agreement form legally binding?

Yes, a properly executed farm rental agreement form is legally binding, provided it is signed in accordance with the relevant laws. airSlate SignNow ensures your electronic signatures comply with legal standards, making your agreements valid and enforceable. Always consult a legal expert to verify that your specific agreement meets all jurisdictional requirements.

Get more for Farm Rent Forms

- Aa1a form

- Instructions application for employment department of state form

- Paperwork reduction act supporting statement department of form

- Form pers282 ampquotemployment application templateroller

- Date of birthssn form

- How to write a building description iowa department of form

- Form lb183 ampquotplace in service reportampquot michigan

- Csd form

Find out other Farm Rent Forms

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now