Partners in Policymaking Delaware Developmental Disabilities Ddc Delaware Form

Understanding the DDC Form

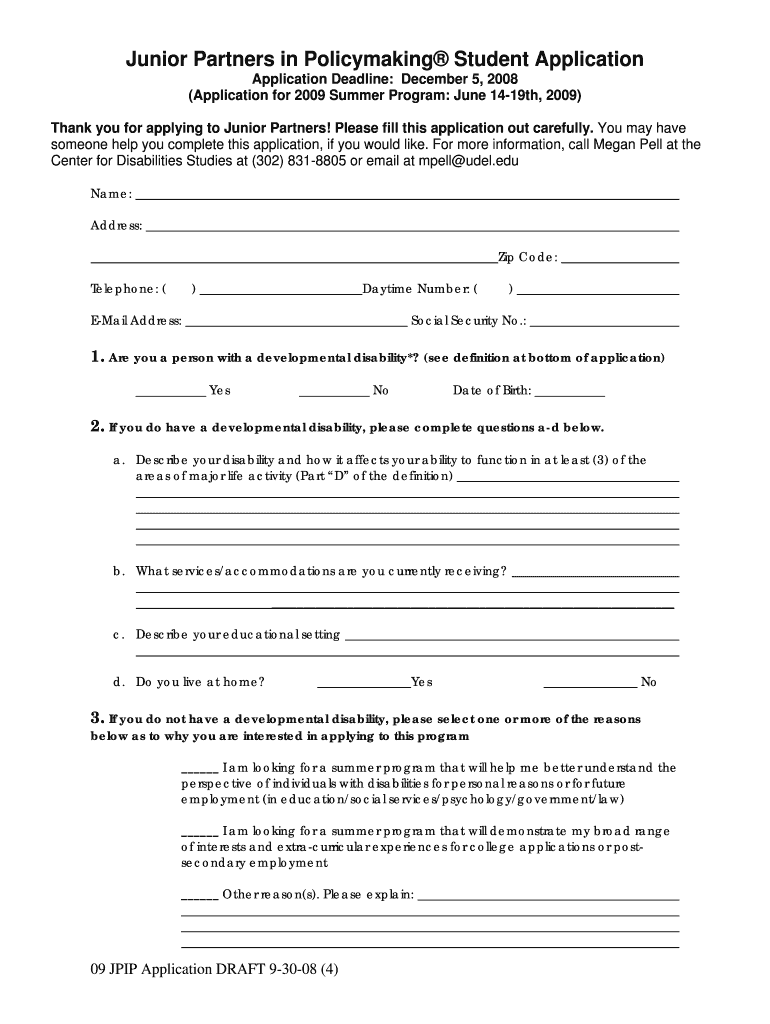

The Delaware Developmental Disabilities Council (DDC) form is a crucial document for individuals seeking to engage in the Partners in Policymaking program. This program aims to empower individuals with developmental disabilities and their families by providing them with the knowledge and skills needed to influence policy decisions. The DDC form serves as an application for participation, ensuring that applicants meet the necessary criteria to benefit from the program.

Steps to Complete the DDC Form

Filling out the DDC form involves several key steps to ensure accuracy and compliance. First, gather all required personal information, including your name, address, and contact details. Next, provide detailed information about your developmental disability, including any relevant medical or educational documentation. It is essential to clearly articulate your goals for participating in the program, as this will help the reviewing committee understand your motivations and needs. Finally, review the form for completeness and accuracy before submission.

Legal Considerations for the DDC Form

When completing the DDC form, it is important to understand the legal implications of your submission. The information provided must be truthful and accurate, as any false statements could lead to disqualification from the program or legal repercussions. The DDC form is governed by various state and federal regulations that protect the rights of individuals with disabilities. Ensuring compliance with these laws is crucial for a successful application.

Eligibility Criteria for the DDC Form

Eligibility for the DDC form is primarily based on the applicant's developmental disability status. Individuals must provide documentation that verifies their diagnosis and may also need to demonstrate their involvement in advocacy or community activities related to developmental disabilities. Additionally, applicants should be residents of Delaware and meet any age requirements set forth by the program. Understanding these criteria is vital for ensuring a smooth application process.

Obtaining the DDC Form

The DDC form can be obtained through the Delaware Developmental Disabilities Council's official website or by contacting their office directly. It is advisable to access the most current version of the form to ensure compliance with any recent updates or changes in the application process. Once you have the form, follow the outlined steps to complete it accurately.

Submission Methods for the DDC Form

After completing the DDC form, applicants have several options for submission. The form can typically be submitted online through a designated portal, mailed to the appropriate office, or delivered in person. Each submission method may have different processing times, so it is beneficial to choose the method that aligns with your timeline and preferences.

Quick guide on how to complete partners in policymaking delaware developmental disabilities ddc delaware

Effortlessly Prepare Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware on Any Device

Digital document management has surged in popularity among organizations and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Simplest Way to Edit and eSign Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware with Ease

- Find Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and eSign Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the partners in policymaking delaware developmental disabilities ddc delaware

How to make an electronic signature for the Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware online

How to create an eSignature for the Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware in Chrome

How to generate an eSignature for putting it on the Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware in Gmail

How to generate an electronic signature for the Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware right from your smart phone

How to create an eSignature for the Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware on iOS

How to make an eSignature for the Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware on Android

People also ask

-

What is a ddc form?

A ddc form is a specific document used for requesting information or authorizing transactions in various industries. With airSlate SignNow, you can easily create, send, and eSign these forms, streamlining your workflow and enhancing efficiency.

-

How can airSlate SignNow help with ddc forms?

airSlate SignNow provides an intuitive platform for managing ddc forms, allowing users to create templates, add fields, and capture signatures seamlessly. This simplifies the process and reduces the time spent on paperwork, making it ideal for businesses looking to optimize their document management.

-

Is there a cost associated with using airSlate SignNow for ddc forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan gives you access to features for managing your ddc forms, ensuring you can find an option that meets your budget and requirements.

-

What features does airSlate SignNow offer for managing ddc forms?

Key features include customizable templates for ddc forms, the ability to track document status, real-time notifications, and secure storage. These capabilities help streamline the eSigning process while ensuring your documents are managed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications to manage ddc forms?

Absolutely! airSlate SignNow offers integrations with popular software tools like Google Drive, Salesforce, and Zapier. These integrations allow you to easily manage your ddc forms alongside other business processes, enhancing productivity across different platforms.

-

What benefits can businesses expect from using ddc forms with airSlate SignNow?

Businesses can expect improved efficiency and reduced turnaround time for document approvals when using ddc forms with airSlate SignNow. The user-friendly interface and mobile accessibility also help teams collaborate seamlessly, ultimately enhancing overall productivity.

-

How secure is the storage for ddc forms in airSlate SignNow?

airSlate SignNow prioritizes security with top-tier encryption and compliance with industry standards. Your ddc forms are stored securely, ensuring that sensitive information remains protected and only accessible to authorized users.

Get more for Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware

- Saratoga form

- Employment application st johns county clerk of courts form

- St johns county case search form

- Occupational license application process st john the baptist parish form

- Tarrant county probation department form

- Tarrant county criminal form

- Tarrant county divorce downloadable forms

- Ares application forms 2004

Find out other Partners In Policymaking Delaware Developmental Disabilities Ddc Delaware

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free