Collection Agency Form

Understanding Collection Agencies

A collection agency is a business that specializes in recovering unpaid debts on behalf of creditors. These agencies often work with various types of debts, including credit card bills, medical bills, and personal loans. Collection agencies may purchase debts from original creditors at a discounted rate or work on a commission basis to collect the owed amounts. Understanding the role of collection agencies is essential for both debtors and creditors to navigate the process effectively.

Steps to Complete the Letter Validate Process

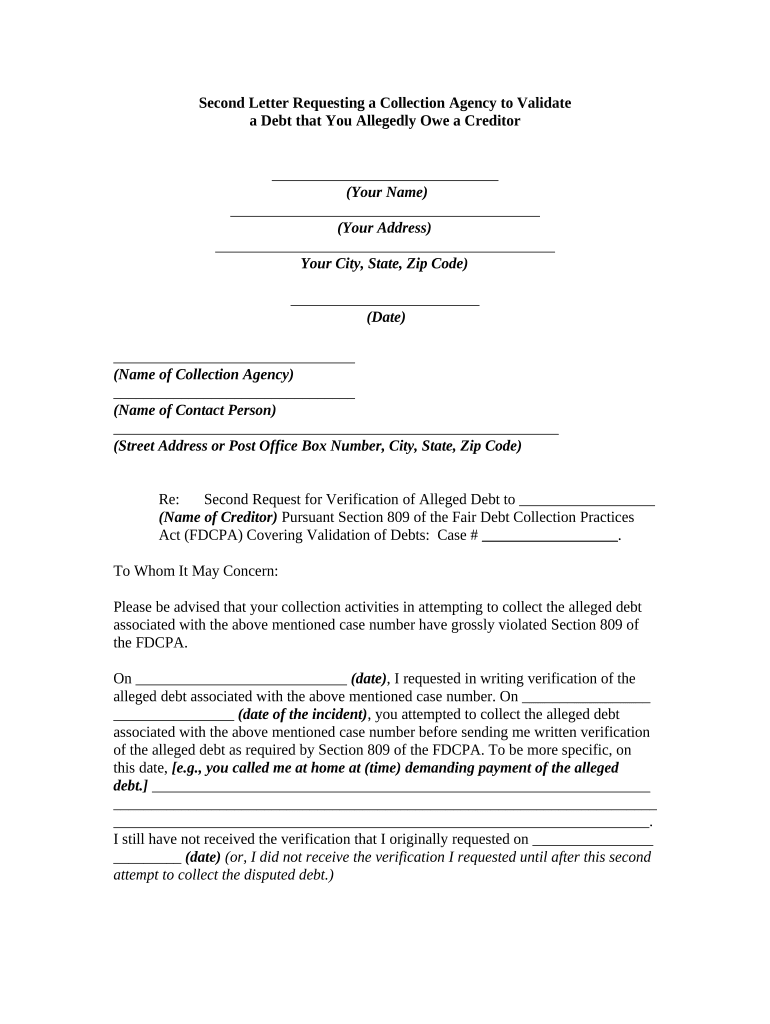

Completing the letter validate process involves several key steps to ensure that the collection agency can legally collect the debt. First, the debtor should receive a validation notice, which must include specific information about the debt, such as the amount owed and the name of the creditor. Next, the debtor should review the information carefully. If there are discrepancies or if the debtor believes the debt is not valid, they should respond within thirty days to dispute the claim. This response can help protect the debtor's rights and clarify any misunderstandings regarding the debt.

Legal Use of Collection Agencies

Collection agencies must adhere to various laws and regulations when collecting debts. The Fair Debt Collection Practices Act (FDCPA) outlines permissible practices and prohibits abusive behaviors. For example, agencies cannot call debtors at unreasonable hours or use threats to collect a debt. Understanding these legal protections is crucial for debtors to ensure their rights are upheld during the collection process.

Key Elements of a Collection Agency Letter

A letter from a collection agency should contain several essential elements to be considered valid. These include the name of the creditor, the amount owed, and a statement informing the debtor of their rights under the FDCPA. Additionally, the letter should provide instructions on how to dispute the debt and the timeframe in which the debtor can respond. Ensuring these elements are present helps validate the collection agency's claim and protects the debtor's rights.

Examples of Using Collection Agencies

Collection agencies can be utilized in various scenarios, such as when a business has outstanding invoices from clients who have not paid. For instance, a medical facility may engage a collection agency to recover unpaid medical bills from patients. In such cases, the agency would send a letter validate to the debtor, outlining the debt and offering an opportunity to resolve the issue. This process helps businesses recover lost revenue while adhering to legal standards.

State-Specific Rules for Collection Agencies

Each state in the U.S. has its own regulations governing the practices of collection agencies. These laws may dictate how agencies can communicate with debtors, the time limits for collecting debts, and the types of fees that can be charged. It is important for both debtors and creditors to be aware of these state-specific rules to ensure compliance and protect their rights during the collection process.

Quick guide on how to complete collection agency

Complete Collection Agency effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Collection Agency on any device using the airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Collection Agency with ease

- Locate Collection Agency and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of your documents or hide sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether it be email, SMS, invite link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Collection Agency to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to letter validate with airSlate SignNow?

To letter validate using airSlate SignNow, simply upload your document and utilize our intuitive eSignature tools to prepare it for signature. Our platform ensures that all-letter validations are securely completed, conforming to legal standards for electronic signatures. This process guarantees both authenticity and compliance.

-

How can letter validation benefit my business?

Letter validation with airSlate SignNow streamlines your document signing process, enhancing efficiency and ensuring compliance with legal requirements. By automating the validation process, businesses can save time and reduce errors, ultimately improving user experience and boosting productivity. You'll also gain peace of mind knowing your documents are securely signed and archived.

-

Is there a fee for using the letter validate feature?

While airSlate SignNow offers various pricing plans, the letter validate feature is included in all tiers of our service. These plans are designed to accommodate different business needs and budgets, providing cost-effective solutions to streamline document processes. Explore our pricing page for detailed information on subscription options.

-

Can I integrate letter validation with other applications?

Yes, airSlate SignNow allows seamless integration with numerous applications, enabling you to incorporate letter validation into your existing workflows. Popular integrations include Google Workspace, Salesforce, and more, ensuring you can manage document signing efficiently and effectively. This flexibility helps to enhance productivity across your organization.

-

What security measures are in place for letter validation?

airSlate SignNow prioritizes security, utilizing industry-standard encryption to protect your documents during the letter validation process. Additionally, our platform complies with legal regulations, ensuring that your digital signatures are secure and trusted by all parties involved. Rest assured, your data and documents are safeguarded against unauthorized access.

-

How does the letter validation feature work for mobile users?

The mobile experience of airSlate SignNow allows users to letter validate documents on-the-go effortlessly. With a mobile-friendly interface, users can upload documents and collect signatures from any location, ensuring that business processes remain uninterrupted. This convenience makes it easy to manage urgent signing needs right from your smartphone.

-

What type of documents can I letter validate?

airSlate SignNow supports a wide array of document types for letter validation, including PDFs, Word documents, and more. This versatility ensures you can manage all your agreements, contracts, and letters effectively through our platform. By supporting various formats, we cater to the diverse needs of our users.

Get more for Collection Agency

- 2185 form

- Missouri mo form

- Facility plan or engineering report review request form

- Questionnaire form

- Financial information that is not provided through this form will be obtained by the dnr mo

- Missouri mo 101531405 form

- Missouri certification form

- Application for certificate of withdrawal of foreign limited form

Find out other Collection Agency

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself