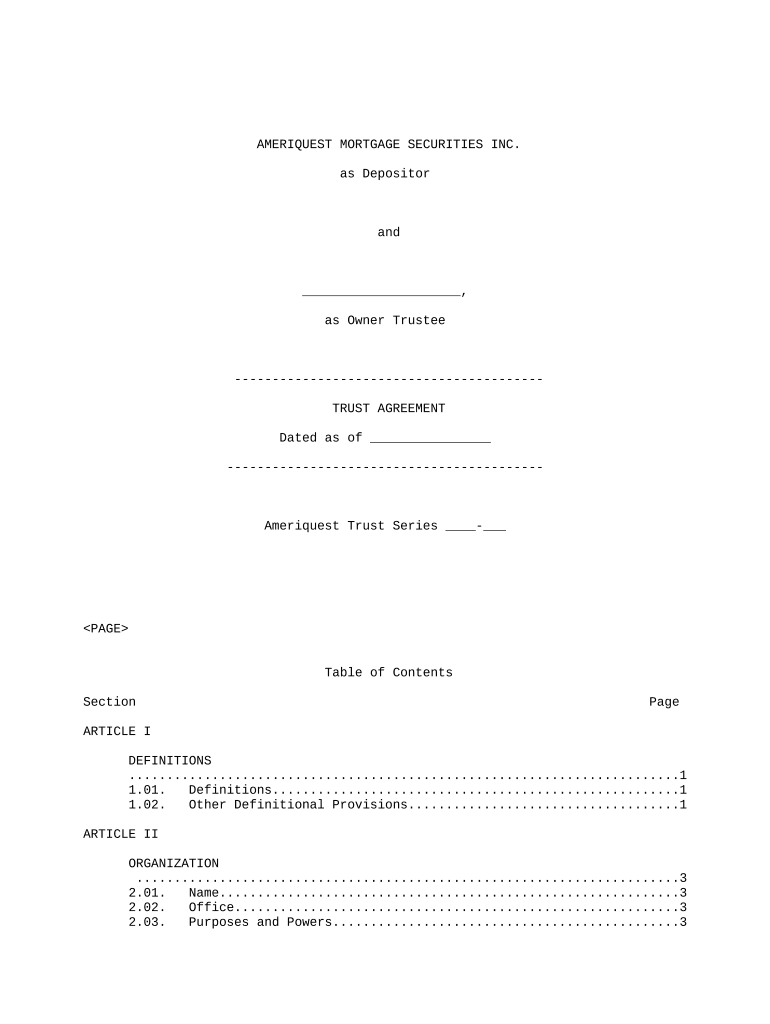

Trust Agreement Mortgage Form

What is the Trust Agreement Mortgage

A trust agreement mortgage is a legal document that establishes a trust to secure a loan for real estate. In this arrangement, the borrower places their property into a trust, which acts as collateral for the mortgage. This type of mortgage can provide benefits such as asset protection and estate planning advantages. By creating a trust, the borrower can ensure that their property is managed according to their wishes, even in the event of incapacity or death.

How to use the Trust Agreement Mortgage

Using a trust agreement mortgage involves several steps. First, the borrower must establish a trust, which requires selecting a trustee and defining the terms of the trust. Next, the borrower applies for a mortgage, providing the lender with the trust documents. Once approved, the property is transferred into the trust, and the lender holds a lien against the trust property. This process allows the borrower to benefit from the mortgage while maintaining control over the property through the trust.

Steps to complete the Trust Agreement Mortgage

Completing a trust agreement mortgage involves a series of steps:

- Establish a trust by drafting a trust agreement with legal assistance.

- Select a trustee who will manage the trust and its assets.

- Gather necessary documentation, including financial statements and property details.

- Apply for a mortgage with a lender, presenting the trust agreement.

- Once approved, transfer the property into the trust.

- Finalize the mortgage by signing the necessary documents.

Key elements of the Trust Agreement Mortgage

Several key elements define a trust agreement mortgage. These include:

- The trust agreement, which outlines the terms and conditions of the trust.

- The mortgage note, detailing the loan amount, interest rate, and repayment terms.

- The deed of trust, which secures the mortgage against the property held in the trust.

- Information about the trustee and the beneficiaries of the trust.

Legal use of the Trust Agreement Mortgage

The legal use of a trust agreement mortgage is governed by state laws and regulations. It is essential to ensure that the trust is properly established and complies with relevant legal requirements. This includes adhering to the Uniform Trust Code and any state-specific statutes that may apply. Proper execution of the trust agreement and mortgage documents is crucial to ensure their enforceability in a court of law.

Required Documents

To successfully complete a trust agreement mortgage, several documents are typically required:

- The trust agreement outlining the terms of the trust.

- Identification and financial documentation of the borrower.

- Property deed and any existing mortgage documents.

- Loan application and supporting financial statements.

Quick guide on how to complete trust agreement mortgage

Complete Trust Agreement Mortgage effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Trust Agreement Mortgage on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The simplest way to modify and eSign Trust Agreement Mortgage without effort

- Obtain Trust Agreement Mortgage and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from a device of your preference. Modify and eSign Trust Agreement Mortgage to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust agreement mortgage?

A trust agreement mortgage is a legal arrangement where a borrower transfers the title of their property into a trust, allowing a third party to hold the title as security for the mortgage. This setup can provide additional protection for both lenders and borrowers while ensuring that the terms of the mortgage agreement are met. Understanding how a trust agreement mortgage works is essential for anyone considering this financial option.

-

How can airSlate SignNow help with trust agreement mortgages?

airSlate SignNow simplifies the process of managing trust agreement mortgages by allowing users to easily create, send, and eSign necessary documents. With its user-friendly interface, you can streamline your workflow and ensure all parties involved can access documents securely. This efficiency reduces delays and enhances communication throughout the mortgage process.

-

What features does airSlate SignNow offer for trust agreement mortgages?

airSlate SignNow offers features like customizable templates, collaborative editing, and secure eSigning, which are beneficial for managing trust agreement mortgages. The platform also provides document tracking and reminders, ensuring that all parties stay on schedule. These features streamline the mortgage process while maintaining compliance and security.

-

What are the benefits of using airSlate SignNow for trust agreement mortgages?

Using airSlate SignNow for your trust agreement mortgage needs offers numerous benefits, including cost-effectiveness, time savings, and a reduced need for physical paperwork. The electronic signing process helps eliminate unnecessary delays and enables you to finalize agreements quickly. Additionally, it ensures that your documents are securely stored and easily retrievable whenever needed.

-

Can I integrate airSlate SignNow with other tools for managing trust agreement mortgages?

Yes, airSlate SignNow can be integrated with various tools and applications to enhance your workflow for managing trust agreement mortgages. It supports integrations with popular platforms such as CRM systems, cloud storage services, and project management tools. These integrations can help you maintain a seamless workflow and improve overall efficiency in handling mortgage documents.

-

Is there a cost associated with using airSlate SignNow for trust agreement mortgages?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be budget-friendly, especially for businesses handling multiple trust agreement mortgages. Pricing plans are flexible and cater to different needs, allowing you to choose one that fits your budget. Consider the savings on time and paperwork when evaluating the overall value of the service.

-

How secure is the airSlate SignNow platform for handling trust agreement mortgages?

The airSlate SignNow platform employs advanced security measures to protect your data while managing trust agreement mortgages. All documents are encrypted during transmission and storage, ensuring confidentiality and compliance with legal standards. Users can also implement multi-factor authentication to provide an added layer of security.

Get more for Trust Agreement Mortgage

Find out other Trust Agreement Mortgage

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament