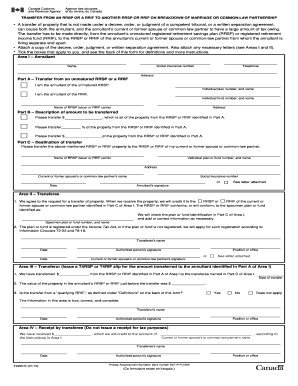

T2220 Form

What is the T2220?

The T2220 is a tax form used in Canada, specifically designed for reporting certain deductions related to employment expenses. This form is essential for employees who incur expenses while performing their job duties and seek reimbursement or deductions on their tax returns. Understanding the T2220 is crucial for ensuring compliance with tax regulations and maximizing potential refunds.

Steps to complete the T2220

Completing the T2220 requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather all necessary documents, including receipts for expenses incurred.

- Fill out your personal information at the top of the form, including your name and address.

- List the employment expenses you wish to claim, ensuring you categorize them correctly.

- Provide the total amounts for each category of expenses, ensuring they align with your receipts.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the T2220

The T2220 is legally recognized as a valid document for claiming employment-related expenses. To ensure its legal standing, it must be filled out accurately and submitted in accordance with the Canada Revenue Agency (CRA) guidelines. This form must be supported by appropriate documentation, such as receipts, to validate the claimed expenses. Failure to comply with these requirements may result in penalties or disallowance of claims.

Examples of using the T2220

Using the T2220 can vary based on individual circumstances. Here are a few examples:

- A teacher who purchases classroom supplies can use the T2220 to claim those expenses.

- A salesperson who travels for work can report travel-related costs, such as fuel and lodging, on the T2220.

- Employees who work from home may claim a portion of their home office expenses using this form.

Required Documents

To complete the T2220 accurately, several documents are necessary:

- Receipts for all claimed expenses, which must be kept for at least six years.

- Your employment contract or agreement, which may outline reimbursable expenses.

- Any additional documentation that supports your claims, such as mileage logs for travel expenses.

Filing Deadlines / Important Dates

Filing the T2220 should align with the annual tax return deadlines. Typically, the deadline for individual tax returns in Canada is April 30. However, if you are self-employed, the deadline extends to June 15. It is important to submit the T2220 along with your tax return to ensure that your claims are processed in a timely manner.

Quick guide on how to complete t2220

Complete T2220 effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documentation, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary for creating, editing, and electronically signing your documents swiftly without delays. Manage T2220 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign T2220 with ease

- Find T2220 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign T2220 and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2220

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t2220 completed example?

A t2220 completed example is a visual representation of the t2220 form filled out correctly. It helps users understand how to accurately complete their own forms and is essential for ensuring compliance with tax regulations.

-

How can airSlate SignNow assist with completing a t2220?

airSlate SignNow simplifies the process of filling out a t2220 by providing templates and an intuitive interface. Users can easily edit, sign, and store their completed t2220 forms securely within the platform.

-

Is airSlate SignNow cost-effective for businesses needing a t2220 completed example?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for businesses of all sizes. This makes it easier for companies to access necessary tools, like a t2220 completed example, without breaking the budget.

-

What features does airSlate SignNow offer for managing t2220 forms?

airSlate SignNow provides powerful features such as document templates, electronic signatures, and secure cloud storage. These functionalities enable users to create, edit, and store their t2220 completed examples efficiently.

-

Can I integrate airSlate SignNow with other software to manage t2220 forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing users to manage their t2220 forms alongside other essential business tools. This enhances productivity and streamlines workflows.

-

What are the benefits of using a t2220 completed example from airSlate SignNow?

Using a t2220 completed example from airSlate SignNow can signNowly reduce errors and ensure accuracy. It also speeds up the submission process, helping businesses stay compliant with tax regulations more efficiently.

-

How secure is airSlate SignNow when handling t2220 forms?

airSlate SignNow prioritizes security, offering advanced encryption and compliance with industry standards. Users can trust that their t2220 completed examples and other sensitive information are safely protected.

Get more for T2220

- Post field training program guide volume 1 10 field lib post ca form

- U s dod form dod dd 2626 download

- Pes payroll paperwork pdf form

- Application for occupancy february arizona association of form

- Mconline form

- Blank fillable da form 1687

- Whitby campus form

- Pptc 153 e adult general passport application for canadians 16 years of age or over applying in canada or the usa 780422799 form

Find out other T2220

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document