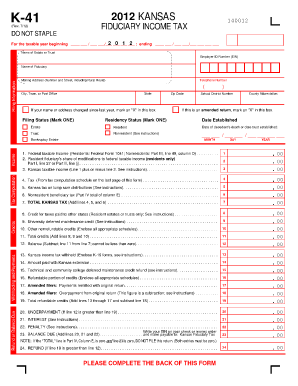

K 41 Form

What is the K 41 Form

The K 41 Form is a tax document used in the United States, primarily for reporting specific financial information to the relevant tax authorities. It is essential for individuals or entities that need to disclose certain income, deductions, or credits. Understanding the purpose and requirements of the K 41 Form is crucial for ensuring compliance with federal and state tax regulations.

How to use the K 41 Form

Using the K 41 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information that pertain to the reporting period. Next, carefully fill out the form, ensuring that all sections are completed accurately. After filling out the form, review it for any errors or omissions. Once confirmed, submit the K 41 Form according to the guidelines provided by the issuing authority, whether online, by mail, or in person.

Steps to complete the K 41 Form

Completing the K 41 Form requires attention to detail. Follow these steps for proper completion:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Fill in the financial details as required, including income sources, deductions, and credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to certify that the information provided is true and correct.

- Submit the completed form by the specified deadline to avoid penalties.

Legal use of the K 41 Form

The K 41 Form must be used in accordance with federal and state laws governing tax reporting. It is legally binding, meaning that any inaccuracies or omissions can lead to penalties or legal repercussions. Proper use of the form ensures compliance with tax obligations and helps maintain transparency with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the K 41 Form can vary based on the specific tax year and the nature of the filer. Generally, it is important to be aware of the annual filing deadline, which typically aligns with the federal tax return due date. Additionally, if extensions are needed, understanding the process for requesting an extension is crucial to avoid late penalties.

Who Issues the Form

The K 41 Form is typically issued by state tax authorities or the Internal Revenue Service (IRS), depending on the specific requirements of the form. It is important to ensure that you are using the correct version of the form issued by the appropriate authority to ensure compliance with applicable tax regulations.

Quick guide on how to complete k 41 form

Complete K 41 Form effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle K 41 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign K 41 Form without hassle

- Find K 41 Form and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign K 41 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 41 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K 41 Form?

The K 41 Form is a document used for tax purposes, often associated with reporting income and other relevant financial information. Understanding how to fill out the K 41 Form correctly is crucial for ensuring compliance with tax laws. With airSlate SignNow, you can easily manage and eSign your K 41 Form to streamline your tax filing process.

-

How does airSlate SignNow help with the K 41 Form?

airSlate SignNow enables users to easily upload, fill out, and electronically sign the K 41 Form. Our user-friendly interface simplifies the process, allowing you to manage your tax documents efficiently. Additionally, you can send the K 41 Form directly to clients or partners for their signatures, reducing turnaround time.

-

Is there a cost associated with using airSlate SignNow for the K 41 Form?

Yes, there is a cost to use airSlate SignNow, but it is a cost-effective solution compared to traditional paper-document management. Our pricing plans are designed to suit businesses of all sizes, ensuring you get great value for efficiently managing your K 41 Form and other documents. Discounts may be available for annual plans, making it even more affordable.

-

Can I integrate airSlate SignNow with other software for handling the K 41 Form?

Absolutely! airSlate SignNow supports integration with various applications such as Google Drive, Dropbox, and CRM systems. This means you can streamline your workflow by incorporating your existing tools to manage the K 41 Form and other documents seamlessly within your ecosystem.

-

What features does airSlate SignNow offer for the K 41 Form?

airSlate SignNow offers several features to enhance your experience with the K 41 Form, including template creation, electronic signatures, and automated reminders. These capabilities help you save time and reduce errors, making the document management process more efficient. The ability to track the status of your K 41 Form is also a key feature.

-

Is the K 41 Form secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We employ industry-standard encryption and secure access protocols to ensure that your K 41 Form and other sensitive documents are protected. You can eSign and share your K 41 Form with confidence, knowing that it is safeguarded against unauthorized access.

-

How user-friendly is airSlate SignNow for completing the K 41 Form?

airSlate SignNow is designed with user experience in mind, making it incredibly easy to complete the K 41 Form. Our intuitive interface means that even those who are not tech-savvy can navigate the process with ease. You can also find helpful resources and support to guide you through completing and eSigning your K 41 Form.

Get more for K 41 Form

Find out other K 41 Form

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online