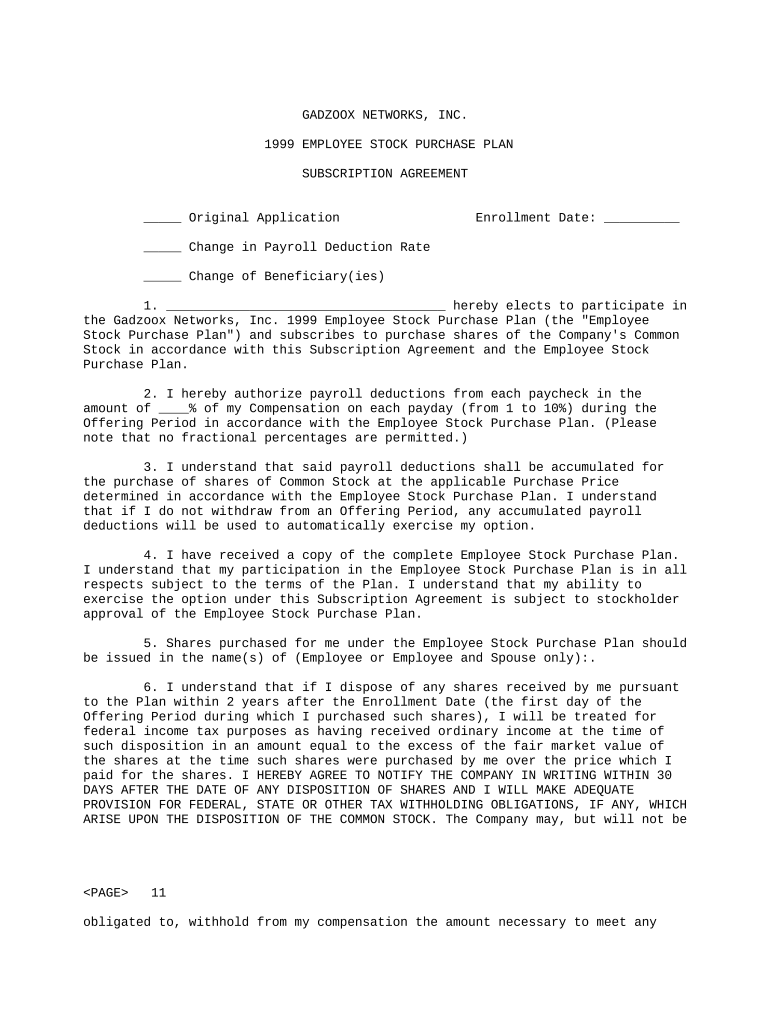

Employee Purchase Plan Form

What is the Employee Purchase Plan

The employee purchase plan is a program that allows employees to buy company stock at a discounted rate. This plan is designed to encourage employee ownership and align their interests with the company's performance. Typically, employees can purchase shares through payroll deductions, making it a convenient option for many. The specifics of the plan can vary by company, including eligibility criteria, purchase limits, and the duration of the offering period.

How to use the Employee Purchase Plan

Using the employee purchase plan involves several straightforward steps. First, employees need to confirm their eligibility, which may depend on factors such as tenure or employment status. Next, interested employees should enroll in the plan during the designated enrollment period. Once enrolled, employees can set up payroll deductions to fund their stock purchases. Finally, employees will receive shares according to the terms of the plan, typically at a predetermined discount.

Legal use of the Employee Purchase Plan

For an employee purchase plan to be legally valid, it must comply with relevant regulations, including the Securities Act and Internal Revenue Code provisions. The plan should clearly outline the terms and conditions, including the pricing mechanism and any restrictions on the sale of shares. Ensuring compliance with these legal frameworks protects both the company and its employees, providing clarity and security in stock transactions.

Key elements of the Employee Purchase Plan

Several key elements define an employee purchase plan. These include:

- Discount Rate: The percentage discount offered to employees on the stock price.

- Offering Period: The timeframe during which employees can purchase shares.

- Eligibility Criteria: Requirements that employees must meet to participate in the plan.

- Purchase Limits: Caps on the number of shares an employee can buy within a specified period.

- Withdrawal Terms: Conditions under which employees can withdraw from the plan or sell their shares.

Steps to complete the Employee Purchase Plan

Completing the employee purchase plan involves a series of steps that ensure a smooth process for employees. Initially, employees should review the plan documents to understand the terms. After confirming eligibility, employees can enroll during the enrollment period, typically by filling out a form. Once enrolled, they need to set up payroll deductions, which will automatically fund their stock purchases. Finally, employees should monitor their accounts to track their stock holdings and any relevant updates regarding the plan.

Eligibility Criteria

Eligibility criteria for the employee purchase plan can vary by company but generally include factors such as employment status, duration of service, and sometimes job level. Some companies may require employees to have completed a specific period of employment before they can participate. Understanding these criteria is crucial for employees who wish to take advantage of the benefits offered by the plan.

Quick guide on how to complete employee purchase plan

Effortlessly Prepare Employee Purchase Plan on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Employee Purchase Plan on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

How to Edit and eSign Employee Purchase Plan with Ease

- Obtain Employee Purchase Plan and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Employee Purchase Plan and guarantee outstanding communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an employee purchase plan?

An employee purchase plan is a program that allows employees to buy company products or services at a discounted rate. This plan encourages staff engagement and loyalty while providing them access to products they might not otherwise purchase.

-

How does the employee purchase plan work?

Typically, an employee purchase plan allows employees to select products or services they wish to buy at a reduced price. The process is made simple through platforms like airSlate SignNow, where employees can easily sign and complete their purchase agreements electronically.

-

What are the main benefits of implementing an employee purchase plan?

Implementing an employee purchase plan can boost employee morale and retention, as it offers financial benefits. Additionally, it can enhance teamwork and improve employee relationships by providing them with exclusive access to your company’s offerings.

-

Is there a cost associated with the employee purchase plan?

While the employee purchase plan typically offers discounts, there may be associated costs in program administration. However, leveraging tools like airSlate SignNow can streamline this process, making it cost-effective and easy to manage.

-

What features should I look for in an employee purchase plan?

Key features of an effective employee purchase plan include easy enrollment, clear discount structures, and seamless electronic signing capabilities. airSlate SignNow offers a robust eSign platform that can simplify the document signing process for employees and employers alike.

-

How can I integrate an employee purchase plan with our existing HR systems?

Integrating an employee purchase plan with existing HR systems can be managed through APIs and customizable workflows. With airSlate SignNow's integration capabilities, you can effectively connect your HR software and ensure smooth operation across all platforms.

-

Can an employee purchase plan enhance employee engagement?

Yes, an employee purchase plan signNowly enhances employee engagement by providing them with valuable benefits that align with their interests. When employees feel valued and appreciated, as they do with such plans, overall productivity and job satisfaction often improve.

Get more for Employee Purchase Plan

- Publications and forms missouri department of labor mo

- 1490 patients request for medical payment form

- Child information recordward preschool

- This cover page is intended to facilitate the online completion of these forms using adobe reader

- Fillable online confidential pediatric intake form www

- Subdomain finder scan of ilovepdfcom c99nl form

- Form cg1capital gains tax return 2020 capital gains tax return 2020

- Form 11 2020 tax return and self assessment for the year

Find out other Employee Purchase Plan

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure