Paycheck Stub 2 Worksheet Answers Form

Key elements of the Paycheck Stub 2 Worksheet Answers

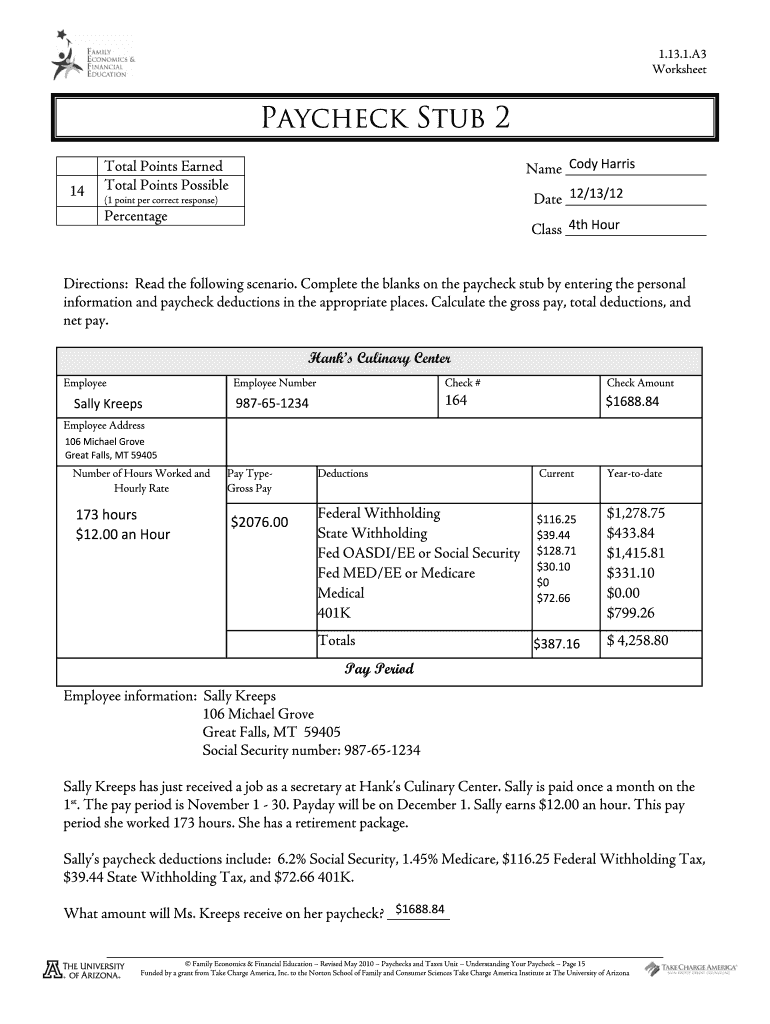

The Paycheck Stub 2 Worksheet is designed to help individuals understand their pay stubs better. Key elements typically include gross pay, net pay, deductions, and taxes withheld. Gross pay refers to the total earnings before any deductions, while net pay is what the employee takes home after deductions. Deductions can include federal and state taxes, Social Security, Medicare, health insurance, and retirement contributions. Understanding these elements is crucial for accurate financial planning and tax preparation.

Steps to complete the Paycheck Stub 2 Worksheet Answers

Completing the Paycheck Stub 2 Worksheet involves several straightforward steps. First, gather your most recent pay stub to reference the necessary information. Next, identify your gross pay and record it in the appropriate section of the worksheet. Then, list all deductions as they appear on your pay stub, including taxes and benefits. Finally, calculate your net pay by subtracting the total deductions from your gross pay. This process will give you a clear picture of your earnings and deductions.

Legal use of the Paycheck Stub 2 Worksheet Answers

The Paycheck Stub 2 Worksheet is legally recognized as a tool for understanding pay stubs and ensuring compliance with employment laws. Employers are required to provide accurate pay stubs that detail earnings and deductions. Using this worksheet can help employees verify that their pay stubs comply with legal requirements, such as the Fair Labor Standards Act, which mandates transparency in wage reporting. Proper use of this worksheet can assist in resolving discrepancies and ensuring fair compensation.

Examples of using the Paycheck Stub 2 Worksheet Answers

Examples of using the Paycheck Stub 2 Worksheet can illustrate its practical application. For instance, an employee may use the worksheet to compare their gross pay across different pay periods to identify any inconsistencies. Another example is using the worksheet to calculate the impact of changes in deductions, such as enrolling in a new health insurance plan. These examples demonstrate how the worksheet can be a valuable resource for managing personal finances and ensuring accurate reporting of earnings.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines regarding the reporting of income and deductions on pay stubs. Employees should ensure that their pay stubs reflect accurate information to comply with IRS requirements. This includes correctly reporting wages, withholding amounts, and any other deductions. Familiarity with IRS guidelines can help individuals avoid potential issues during tax filing and ensure that they are receiving the correct amount in their paychecks.

State-specific rules for the Paycheck Stub 2 Worksheet Answers

State-specific rules can significantly impact how pay stubs are generated and what information must be included. Different states may have varying requirements for deductions, such as state income tax, unemployment insurance, and workers' compensation. It is important for employees to be aware of their state's regulations to ensure compliance and accurate reporting on their pay stubs. Utilizing the Paycheck Stub 2 Worksheet can help navigate these state-specific rules effectively.

Quick guide on how to complete paycheck stub 2 d3aencwbm6zmht cloudfront

Complete Paycheck Stub 2 Worksheet Answers effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Paycheck Stub 2 Worksheet Answers on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Paycheck Stub 2 Worksheet Answers effortlessly

- Locate Paycheck Stub 2 Worksheet Answers and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Paycheck Stub 2 Worksheet Answers and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I find out my last paycheck stub for my W-2 if I am no longer an employee there?

A paycheck “stub” should have been physically attached to the check (or direct deposit notification) you received.The last paycheck you received that counts toward W-2 earnings is one that is dated closest to December 31, but not past that date. The pay stub that accompanied your check or direct deposit notification should have the pay date on it somewhere.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

Can I fill out the form for the JEE Main 2 still? How?

No! You cannot fill the form now.The official authorities allowed candidates to fill the JEE Main application forms till 1st January 2018 and submit their fees till 2nd January 2018.Now, as the last date is over, you won’t be allowed to fill the form. As you would not like to waster your whole year, you must try other Engineering Exams such as BITSAT, VITEE etc.Go for it! Good Luck!

Create this form in 5 minutes!

How to create an eSignature for the paycheck stub 2 d3aencwbm6zmht cloudfront

How to make an eSignature for your Paycheck Stub 2 D3aencwbm6zmht Cloudfront in the online mode

How to create an eSignature for the Paycheck Stub 2 D3aencwbm6zmht Cloudfront in Chrome

How to generate an electronic signature for signing the Paycheck Stub 2 D3aencwbm6zmht Cloudfront in Gmail

How to make an eSignature for the Paycheck Stub 2 D3aencwbm6zmht Cloudfront from your smart phone

How to generate an eSignature for the Paycheck Stub 2 D3aencwbm6zmht Cloudfront on iOS devices

How to make an eSignature for the Paycheck Stub 2 D3aencwbm6zmht Cloudfront on Android OS

People also ask

-

What are Paycheck Stub 2 Worksheet Answers?

Paycheck Stub 2 Worksheet Answers are essential for understanding your paycheck deductions and earnings more clearly. This worksheet helps users break down their earnings, taxes, and other deductions, ensuring accurate financial tracking. By using Paycheck Stub 2 Worksheet Answers, you can gain insights into your pay structure and plan your finances effectively.

-

How can airSlate SignNow help with Paycheck Stub 2 Worksheet Answers?

airSlate SignNow provides a user-friendly platform to easily send and eSign your Paycheck Stub 2 Worksheet Answers. Our solution streamlines the document management process, allowing you to complete and share essential financial worksheets efficiently. This ensures that all parties can review and sign documents without hassle.

-

What features does airSlate SignNow offer for managing worksheets?

With airSlate SignNow, you can utilize features such as customizable templates, electronic signatures, and secure cloud storage for your Paycheck Stub 2 Worksheet Answers. Our platform allows for real-time collaboration, making it easier for teams to work together on financial documents. Additionally, you can automate workflows to save time and reduce errors.

-

Is airSlate SignNow affordable for small businesses needing Paycheck Stub 2 Worksheet Answers?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including small businesses. By providing cost-effective solutions for managing your Paycheck Stub 2 Worksheet Answers, we ensure you get the best value without compromising on features. Explore our pricing options to find a plan that fits your budget.

-

Can I integrate airSlate SignNow with other tools for Paycheck Stub 2 Worksheet Answers?

Absolutely! airSlate SignNow integrates seamlessly with various popular applications, allowing you to manage your Paycheck Stub 2 Worksheet Answers alongside other business tools. Whether you use CRM systems, cloud storage, or collaboration platforms, our integrations enhance your workflow and streamline document management.

-

How secure is airSlate SignNow for handling financial documents like Paycheck Stub 2 Worksheet Answers?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure data storage to protect your Paycheck Stub 2 Worksheet Answers and other sensitive documents. Rest assured that your information is safe and compliant with industry standards, giving you peace of mind while managing financial paperwork.

-

What are the benefits of using airSlate SignNow for Paycheck Stub 2 Worksheet Answers?

Using airSlate SignNow to manage your Paycheck Stub 2 Worksheet Answers offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced collaboration. Our platform allows you to complete and sign documents online, saving you time and resources. Additionally, the ease of use ensures that your team can quickly adapt to the solution.

Get more for Paycheck Stub 2 Worksheet Answers

- Agreed order granting additional time to complete discovery in circuit court with third parties mississippi form

- Agreed order court form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497313616 form

- Mississippi lien form

- Mississippi authority form

- Conservatorship 497313619 form

- Petition for appointment of co conservator mississippi form

- Conservators bond mississippi form

Find out other Paycheck Stub 2 Worksheet Answers

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement