NQO Agreement Form

What is the NQO Agreement

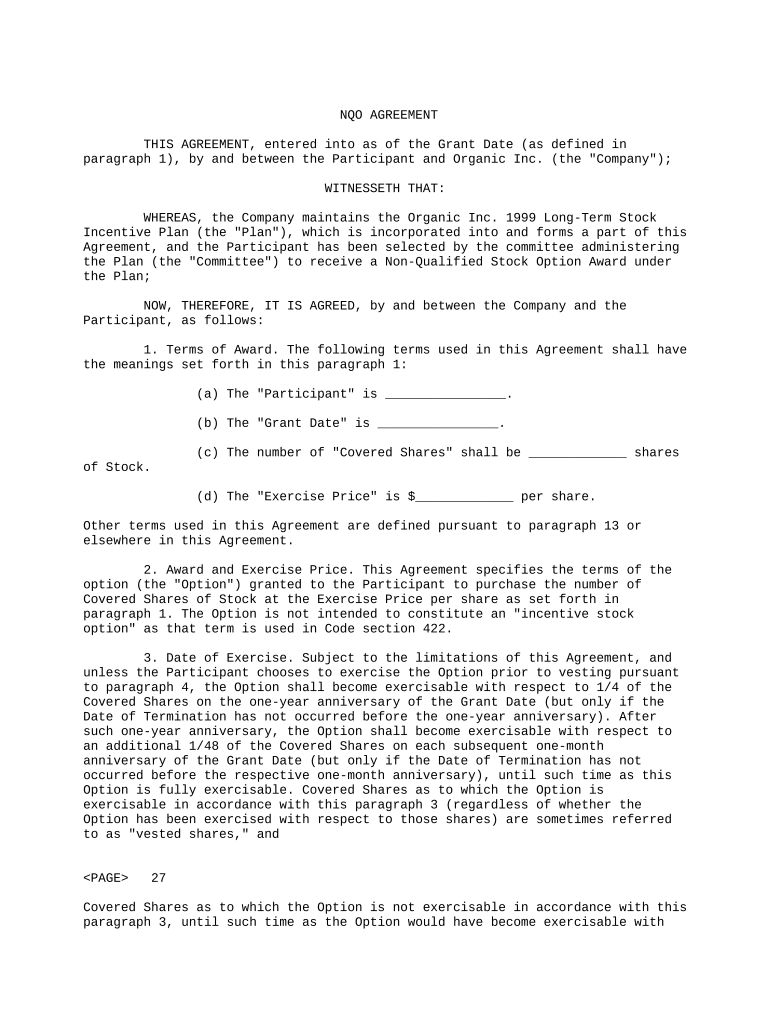

The NQO Agreement, or Non-Qualified Option Agreement, is a legal document that outlines the terms under which an employer grants stock options to employees. Unlike qualified options, non-qualified options do not meet specific IRS requirements for tax benefits. This agreement details the number of options granted, the exercise price, and the vesting schedule, providing clarity for both the employer and employee regarding their rights and obligations.

How to use the NQO Agreement

Utilizing the NQO Agreement involves several steps. First, the employer must draft the agreement, ensuring it includes all necessary terms. Once finalized, it should be presented to the employee for review and signature. After both parties have signed, the agreement becomes legally binding. It is advisable for both parties to retain copies for their records, as this document will be crucial for understanding the terms of the stock options granted.

Steps to complete the NQO Agreement

Completing the NQO Agreement requires careful attention to detail. Follow these steps:

- Draft the agreement, including key terms such as option quantity, exercise price, and vesting schedule.

- Review the document for accuracy and compliance with applicable laws.

- Present the agreement to the employee for review.

- Obtain signatures from both parties to execute the agreement.

- Distribute copies to all parties involved for their records.

Legal use of the NQO Agreement

The legal use of the NQO Agreement hinges on compliance with federal and state laws. It is essential that the agreement is drafted in accordance with the Internal Revenue Code and any relevant employment laws. Proper execution of the agreement ensures that both the employer and employee are protected under the law, minimizing the risk of disputes regarding the terms of the stock options.

Key elements of the NQO Agreement

Several key elements must be included in the NQO Agreement to ensure its effectiveness:

- Grant Date: The date on which the options are granted.

- Exercise Price: The price at which the employee can purchase the stock.

- Vesting Schedule: The timeline over which the options become available for exercise.

- Expiration Date: The date by which the options must be exercised.

- Termination Conditions: Conditions under which the agreement may terminate, such as employee resignation or termination.

Examples of using the NQO Agreement

Examples of the NQO Agreement in action include scenarios where a startup offers stock options to attract talent or a corporation uses options as part of an employee retention strategy. In both cases, the NQO Agreement serves as a clear framework for the terms of the stock options, ensuring that all parties understand their rights and obligations.

Quick guide on how to complete nqo agreement

Effortlessly Prepare NQO Agreement on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and sign your documents quickly without interruptions. Manage NQO Agreement on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Sign NQO Agreement Without Stress

- Find NQO Agreement and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your delivery method for the form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and sign NQO Agreement and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NQO Agreement and why is it important?

An NQO Agreement, or Non-Qualified Option Agreement, is essential for companies that seek to offer stock options to employees without the restrictions of qualified plans. It allows businesses to provide incentives that can enhance employee retention and motivation. Understanding this agreement is crucial for your company's financial strategy.

-

How can airSlate SignNow help with managing NQO Agreements?

airSlate SignNow streamlines the process of creating, sending, and signing NQO Agreements electronically. Our platform ensures that your agreements are secure and easily accessible, eliminating the hassles of paper-based documentation. This efficiency allows you to focus on your business growth.

-

What are the pricing options for airSlate SignNow when handling NQO Agreements?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, including those focused on NQO Agreements. You can choose from various tiers based on your needs and budget, ensuring you get the best value for your investment in electronic signing solutions. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for processing NQO Agreements?

With airSlate SignNow, you gain access to key features such as templates for NQO Agreements, automated workflows, and real-time tracking. These features not only simplify the signing process but also enhance accountability and reduce turnaround time, making your agreement management smoother and more efficient.

-

Are there integrations available for managing NQO Agreements with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various business tools and platforms, allowing you to manage NQO Agreements effortlessly. Whether you use CRM software or project management tools, our integrations ensure that your signing workflows are cohesive and unified. This compatibility saves you time and enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for NQO Agreements?

Using airSlate SignNow for NQO Agreements offers numerous benefits, including enhanced security, faster processing times, and reduced operational costs. Our platform helps you eliminate paperwork, decreasing the likelihood of errors and improving compliance. These advantages contribute to a more productive work environment.

-

Is airSlate SignNow compliant with legal standards for NQO Agreements?

Absolutely! airSlate SignNow is compliant with various legal standards and regulations for electronic signatures, ensuring that your NQO Agreements are legally binding. We prioritize security and legal compliance, giving you peace of mind when managing sensitive documents electronically.

Get more for NQO Agreement

- Charter school facilities program application california school finance authority charter school facilities program application form

- Financial statement de 926b rev 18 7 19 form

- Financial statement de 926b edd ca form

- State department of education administration of medication form

- Medicare select enrollment application quartz form

- Es 935 maryland form

- Texas health aetna employer application 51 100 employees aetna texas health aetna employer application 51 100 employees form

- C1331 leaving the uk leaving the uk pleasure craft on non uk voyages form

Find out other NQO Agreement

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement