Door Contractor Agreement Self Employed Form

What is the Door Contractor Agreement Self Employed

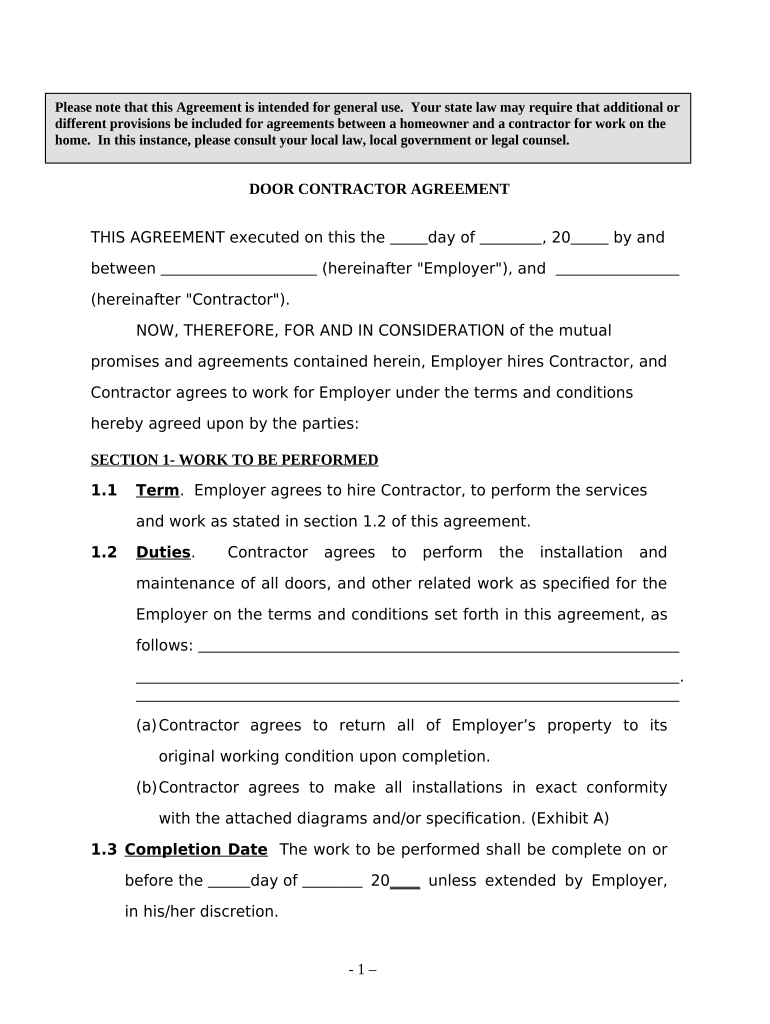

The Door Contractor Agreement Self Employed is a legal document that outlines the terms and conditions between a contractor and a client for door installation or repair services. This agreement specifies the scope of work, payment terms, and responsibilities of both parties. It is designed to protect the interests of both the contractor and the client, ensuring clarity and mutual understanding of the project requirements.

Key elements of the Door Contractor Agreement Self Employed

Several key elements are essential in a Door Contractor Agreement Self Employed. These include:

- Scope of Work: Clearly defines the services to be provided, including installation, repairs, or maintenance.

- Payment Terms: Outlines the total cost, payment schedule, and methods of payment.

- Timeline: Specifies the start and completion dates for the project.

- Liability and Insurance: Addresses liability issues and requires proof of insurance to protect against potential damages.

- Termination Clause: Details the conditions under which either party can terminate the agreement.

Steps to complete the Door Contractor Agreement Self Employed

Completing the Door Contractor Agreement Self Employed involves several steps to ensure all necessary information is accurately included. Follow these steps:

- Gather all relevant information about the project, including client details and service specifications.

- Draft the agreement using a template or create one from scratch, ensuring all key elements are included.

- Review the document for clarity and completeness, making adjustments as necessary.

- Both parties should read the agreement thoroughly before signing to ensure mutual understanding.

- Sign the agreement electronically or in person, ensuring that both parties retain a copy for their records.

Legal use of the Door Contractor Agreement Self Employed

The Door Contractor Agreement Self Employed is legally binding when executed correctly. To ensure its legality, both parties must agree to the terms and sign the document. Compliance with relevant state laws and regulations is crucial, as these can vary across jurisdictions. The use of electronic signatures is valid under the ESIGN and UETA acts, provided that the signing process meets specific requirements.

How to use the Door Contractor Agreement Self Employed

Using the Door Contractor Agreement Self Employed effectively involves understanding its purpose and ensuring proper execution. This document serves as a foundation for the working relationship between the contractor and the client. It should be presented before any work begins, allowing both parties to discuss and negotiate terms. Once signed, it acts as a reference point throughout the project, helping to resolve any disputes that may arise.

Quick guide on how to complete door contractor agreement self employed

Complete Door Contractor Agreement Self Employed effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly solution compared to conventional printed and signed papers, allowing you to locate the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to prepare, adjust, and eSign your documents quickly and without complications. Handle Door Contractor Agreement Self Employed on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Door Contractor Agreement Self Employed with ease

- Locate Door Contractor Agreement Self Employed and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Door Contractor Agreement Self Employed and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Door Contractor Agreement Self Employed?

A Door Contractor Agreement Self Employed is a legally binding document that outlines the terms and conditions between a door contractor and their clients. This agreement ensures that both parties understand their obligations, including scope of work, payment terms, and deadlines, providing clarity and protection for self-employed contractors.

-

How can I create a Door Contractor Agreement Self Employed using airSlate SignNow?

With airSlate SignNow, creating a Door Contractor Agreement Self Employed is simple and efficient. You can choose from customizable templates, fill in your specific details, and eSign the document instantly, ensuring that the agreement is both professional and legally binding.

-

What pricing options are available for using airSlate SignNow for Door Contractor Agreements?

airSlate SignNow offers flexible pricing options to accommodate self-employed contractors. You can choose from monthly or annual subscription plans, allowing you to access features tailored to creating and managing your Door Contractor Agreement Self Employed at a competitive price.

-

What features does airSlate SignNow offer for managing Door Contractor Agreements?

airSlate SignNow provides several robust features for managing Door Contractor Agreements, including eSigning, document templates, and automated workflows. These features streamline the process, making it easy for self-employed contractors to create, send, and track their agreements efficiently.

-

Are there any benefits to using airSlate SignNow for my Door Contractor Agreement Self Employed?

Using airSlate SignNow for your Door Contractor Agreement Self Employed offers multiple benefits. It simplifies the signing process, improves document security, and enhances collaboration between contractors and clients, ensuring that agreements are stored securely and accessible at any time.

-

Can I integrate airSlate SignNow with other tools for my Door Contractor Agreement?

Yes, airSlate SignNow offers integrations with various tools and applications, enhancing your ability to manage your Door Contractor Agreement Self Employed. You can connect it with CRM platforms, project management tools, and cloud storage services to streamline your workflow.

-

Is airSlate SignNow legally compliant for Door Contractor Agreements?

Absolutely! airSlate SignNow is designed to meet the legal requirements for eSigning documents, including Door Contractor Agreements Self Employed. All electronic signatures are legally binding and comply with eSignature laws, ensuring the validity of your agreements.

Get more for Door Contractor Agreement Self Employed

- Illinois silver star license plates request form

- Hospital er physicians form

- Illinois certification for hearing impaired license plates form

- Illinois korean war veteran license plates request form

- Connecticut department of motor vehicles ct business one form

- Pdf request pertaining to military records niagara county form

- Wwwdmvvirginiagovwebdocpdffor hire intrastate operating authority certificate license form

- Out of state vin verification form department of

Find out other Door Contractor Agreement Self Employed

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now