Independent Worker Form

What is the Independent Worker

The term "independent worker" refers to individuals who operate their own businesses or work on a contract basis without being tied to a single employer. This category includes self-employed contractors who provide services across various industries, such as construction, consulting, and creative fields. Independent workers enjoy flexibility in their work schedules and the ability to choose their clients, but they also bear the responsibility of managing their own taxes and business expenses.

Key Elements of the Independent Worker

Understanding the key elements of an independent worker's role is essential for both the worker and the clients they serve. Key elements include:

- Autonomy: Independent workers have the freedom to make decisions regarding their work processes and client relationships.

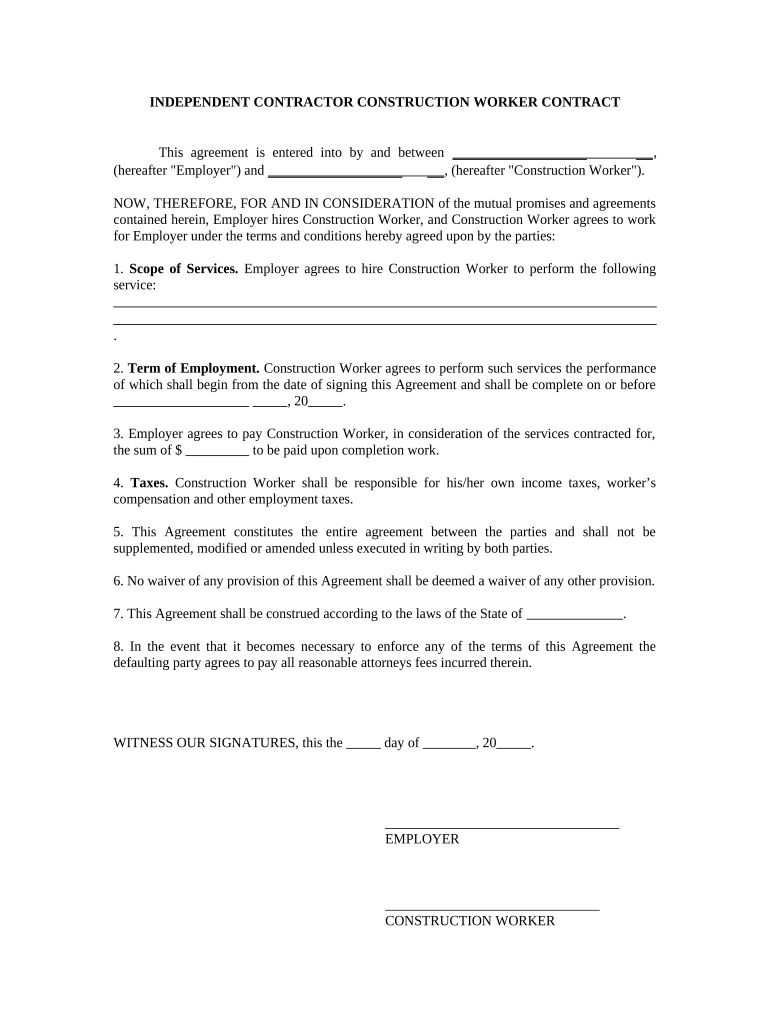

- Contractual Agreements: They typically operate under a self employed contract that outlines the terms of service, payment, and responsibilities.

- Tax Responsibilities: Independent workers must manage their own tax filings, including self-employment taxes and estimated payments.

- Business Expenses: They can claim deductions for business-related expenses, which can include materials, travel, and home office costs.

Steps to Complete the Independent Worker Contract

Completing a self employed contract involves several important steps to ensure clarity and legal compliance. Here’s a straightforward process:

- Identify the Parties: Clearly state the names and contact information of both the independent worker and the client.

- Define the Scope of Work: Outline the specific services to be provided, including timelines and deliverables.

- Payment Terms: Specify the payment amount, schedule, and method of payment.

- Include Legal Clauses: Add clauses related to confidentiality, termination, and liability to protect both parties.

- Signatures: Ensure both parties sign the contract to make it legally binding.

Legal Use of the Independent Worker Contract

For a self employed contract to be legally valid, it must comply with relevant laws and regulations. Key legal considerations include:

- Compliance with State Laws: Each state may have specific laws governing independent contractor relationships, so it is important to be aware of these regulations.

- eSignature Validity: Electronic signatures are legally binding in the U.S. when they meet the requirements set forth by the ESIGN Act and UETA.

- Clear Terms: Contracts should be clear and unambiguous to avoid disputes and ensure enforceability in court.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for independent workers regarding tax obligations. Key points include:

- Self-Employment Tax: Independent workers are responsible for paying self-employment tax, which covers Social Security and Medicare.

- Quarterly Estimated Taxes: They must file estimated tax payments quarterly to avoid penalties.

- Deductions: Independent workers can deduct ordinary and necessary business expenses, which can significantly reduce taxable income.

Required Documents

When working as an independent worker, certain documents are essential for both compliance and operational efficiency. These include:

- Self Employed Contract: A formal agreement detailing the terms of service between the worker and the client.

- IRS Form W-9: This form is used to provide taxpayer information to clients.

- Invoices: Detailed invoices that outline services rendered and payment terms are crucial for record-keeping and tax purposes.

Quick guide on how to complete independent worker

Complete Independent Worker effortlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Independent Worker on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Independent Worker without any hassle

- Locate Independent Worker and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize essential parts of your files or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Independent Worker to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a self employed contract?

A self employed contract is a legal agreement that outlines the terms of work between a freelancer or contractor and a client. It specifies responsibilities, payment terms, and the duration of the project, providing clarity and protection for both parties.

-

How can airSlate SignNow help with self employed contracts?

airSlate SignNow simplifies the process of creating and signing self employed contracts through its user-friendly eSigning platform. You can easily upload your contract templates, send them for signatures, and track the status in real-time, ensuring that all agreements are completed efficiently.

-

Is there a cost to using airSlate SignNow for self employed contracts?

Yes, airSlate SignNow offers various pricing plans depending on your needs. You can choose a plan that best fits your business requirements, ensuring that managing self employed contracts remains a cost-effective solution without compromising on features.

-

What features does airSlate SignNow offer for managing self employed contracts?

airSlate SignNow provides several features for self employed contracts, including customizable templates, secure eSigning, document sharing, and automated reminders. These features make the process smooth and help you maintain organization while ensuring timely contract execution.

-

Can I integrate airSlate SignNow with other tools for self employed contracts?

Yes, airSlate SignNow offers integrations with popular platforms like Google Drive, Salesforce, and Dropbox, enhancing your workflow for self employed contracts. These integrations allow seamless document management and help you keep all your files in one place.

-

What are the benefits of using airSlate SignNow for self employed contracts?

Using airSlate SignNow for self employed contracts streamlines the signing process, ensures legal compliance, and saves time. Its robust security features protect sensitive information, while convenient mobile access allows you to manage contracts on-the-go.

-

How secure is airSlate SignNow for handling self employed contracts?

AirSlate SignNow prioritizes security, employing advanced encryption and secure cloud storage for all documents, including self employed contracts. This ensures that your sensitive information is protected against unauthorized access and data bsignNowes.

Get more for Independent Worker

- Volunteer management system design and academiaedu form

- Chapter 7 rd 108 2018 2021 fill and sign printable form

- Limited power of attorney for specific motor vehiclevessel form

- Cristalextendedblogspotcom202104application for duplicate registration certificate form

- Vr 008 fill and sign printable template onlineus form

- Application for change of address on valid texas driver form

- 22pdf vsa 17a application for certificate of title and form

- I need a clearance letter from new york so i can get my form

Find out other Independent Worker

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF