Worker Independent Form

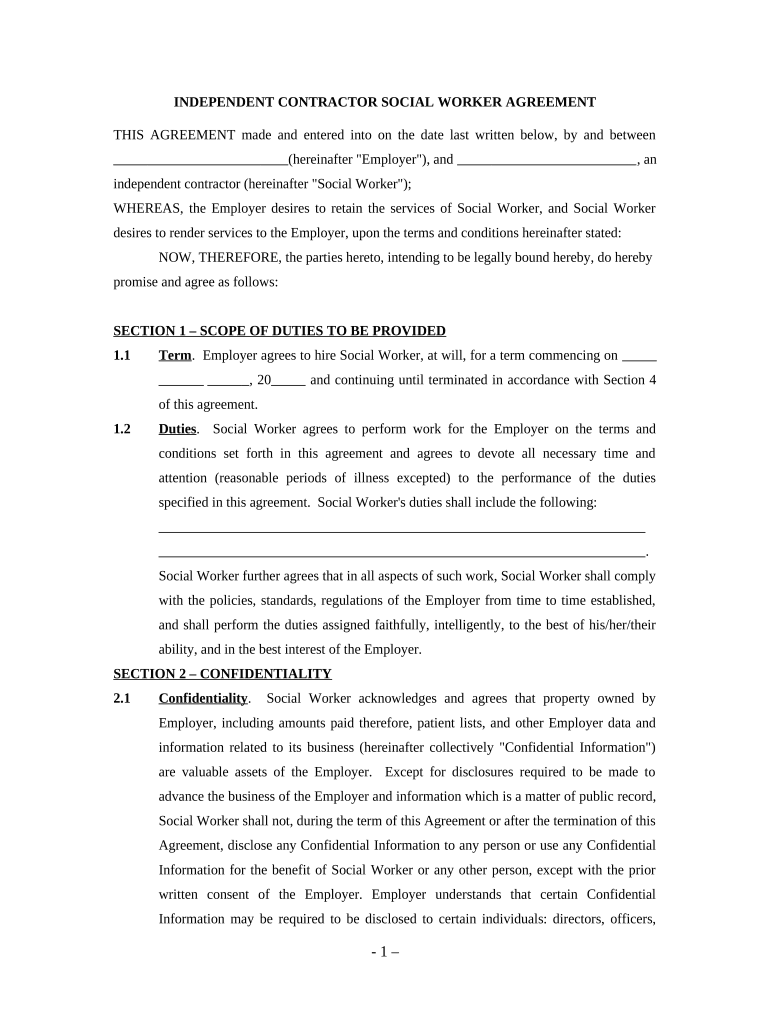

What is the Worker Independent Form

The worker independent form serves as a crucial document for individuals who operate as independent contractors or freelancers. This form outlines the terms of engagement between the worker and the hiring entity, detailing the scope of work, payment terms, and responsibilities. It is essential for ensuring clarity and mutual understanding in business relationships, particularly in the gig economy where traditional employment structures are less prevalent.

How to use the Worker Independent Form

Using the worker independent form involves several key steps. First, gather all necessary information, including the worker's personal details and the specifics of the job. Next, fill out the form accurately, ensuring that all terms are clearly defined. Once completed, both parties should review the document for accuracy and completeness before signing. Utilizing an electronic signature solution can streamline this process, making it easier to store and share the completed form securely.

Steps to complete the Worker Independent Form

Completing the worker independent form requires careful attention to detail. Follow these steps:

- Begin by entering the worker's full name and contact information.

- Clearly define the scope of work, including specific tasks and deliverables.

- Outline the payment structure, including rates, payment methods, and due dates.

- Include any additional terms or conditions relevant to the engagement.

- Both parties should review the form for accuracy before signing.

- Utilize a secure electronic signature platform to finalize the document.

Legal use of the Worker Independent Form

The legal validity of the worker independent form hinges on several factors. It must be completed in compliance with relevant laws and regulations, including those governing independent contractors. Both parties should ensure that the terms are fair and clearly articulated to avoid disputes. Additionally, using a reputable electronic signature service can enhance the form's legal standing by providing an audit trail and ensuring compliance with eSignature laws.

Key elements of the Worker Independent Form

Several key elements must be included in the worker independent form to ensure it serves its intended purpose effectively:

- Identification of Parties: Clearly state the names and contact information of both the worker and the hiring entity.

- Scope of Work: Define the tasks and deliverables expected from the worker.

- Payment Terms: Specify the payment amount, method, and schedule.

- Duration: Indicate the length of the engagement and any deadlines.

- Confidentiality Clauses: Include any necessary confidentiality agreements to protect sensitive information.

Examples of using the Worker Independent Form

The worker independent form can be applied in various scenarios, including:

- A graphic designer contracted to create marketing materials for a business.

- A freelance writer hired to produce content for a website.

- An IT consultant engaged to provide technical support for a project.

In each case, the form helps establish clear expectations and protects the rights of both parties involved.

Quick guide on how to complete worker independent form

Effortlessly Prepare Worker Independent Form on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it on the internet. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents quickly and without hassle. Manage Worker Independent Form across any platform with airSlate SignNow's Android or iOS applications, and simplify your document-related tasks today.

How to Effortlessly Edit and eSign Worker Independent Form

- Locate Worker Independent Form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Worker Independent Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a worker independent form and how does it relate to airSlate SignNow?

A worker independent form is a document that outlines the relationship between a worker and a business, ensuring clarity on independent contractor status. With airSlate SignNow, you can easily create, send, and eSign these forms securely, streamlining the onboarding process for independent workers.

-

How does airSlate SignNow simplify the signing of worker independent forms?

airSlate SignNow simplifies the signing process by providing a user-friendly platform that allows users to send, sign, and manage worker independent forms electronically. This eliminates the need for printing, scanning, or mailing, saving time and reducing errors in the documentation.

-

What are the pricing options for airSlate SignNow when it comes to worker independent forms?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Each plan includes access to features for creating and managing worker independent forms, ensuring you get the best value based on your company’s needs.

-

Can I integrate airSlate SignNow with other tools for handling worker independent forms?

Yes, airSlate SignNow integrates seamlessly with various popular applications such as Google Drive, Dropbox, and CRM systems. This integration capability allows you to manage your worker independent forms alongside other business processes without any hassle.

-

What features does airSlate SignNow offer for managing worker independent forms?

airSlate SignNow provides robust features for managing worker independent forms, including customizable templates, automated reminders, and real-time tracking of document status. These tools ensure that all parties are informed and deadlines are met efficiently.

-

How does airSlate SignNow enhance security for worker independent forms?

Security is a top priority at airSlate SignNow. The platform employs industry-standard encryption and secure access controls, ensuring that your worker independent forms are kept confidential and protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for worker independent forms over traditional methods?

Using airSlate SignNow for worker independent forms offers numerous benefits over traditional methods, such as enhanced efficiency, reduced costs, and improved accuracy. By digitizing the process, businesses can respond more quickly to contractors and maintain a clear record of agreements.

Get more for Worker Independent Form

- 3medocx state of wisconsin circuit court county in the form

- Pdf icwa 005 info information sheet on indian child

- Organization of virginia state government secretary of the form

- State form 4162 r20 6 19

- Ds 82 2020 2021 fill and sign printable template online form

- Application for a us passport united states department form

- White looks at books at the read about programs from form

- Project next generation brochure illinois secretary of state 577251516 form

Find out other Worker Independent Form

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure