Independent Contractor Payment Form

What is the independent contractor payment?

The independent contractor payment refers to the compensation provided to individuals who work on a contractual basis rather than as full-time employees. This payment structure is common in various industries, allowing businesses to hire skilled professionals for specific projects without the obligations associated with traditional employment. Independent contractors typically submit invoices detailing their services, and payments are made according to the agreed-upon terms. Understanding the nature of these payments is crucial for both contractors and businesses to ensure compliance with tax regulations and contractual agreements.

Steps to complete the independent contractor payment

Completing the independent contractor payment involves several key steps to ensure accuracy and compliance. First, the contractor should provide a detailed invoice outlining the services rendered, including dates, hours worked, and agreed rates. Next, the business must verify the invoice against the contract terms and confirm the completion of the work. Once approved, the payment can be processed through the chosen method, whether via direct deposit, check, or electronic payment systems. It is essential to maintain clear records of all transactions for tax purposes and future reference.

Legal use of the independent contractor payment

Legal compliance is vital when handling independent contractor payments. Businesses must adhere to IRS guidelines regarding the classification of workers to avoid misclassification issues. Proper documentation, including contracts and invoices, should be maintained to substantiate the nature of the working relationship. Additionally, payments made to contractors may require the issuance of a Form 1099-NEC if they exceed a specified threshold within a tax year. Understanding these legal requirements helps protect both parties and ensures smooth financial transactions.

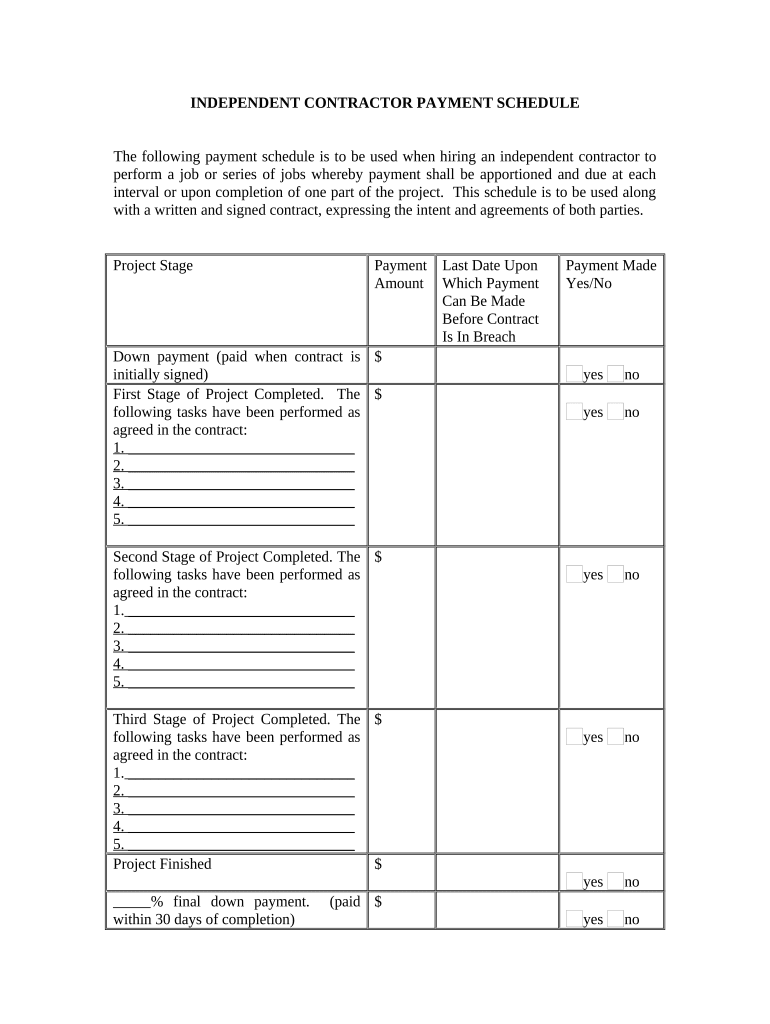

Key elements of the independent contractor payment

The key elements of the independent contractor payment include the agreed-upon rate, payment schedule, and method of payment. It is crucial to establish these elements in the initial contract to avoid misunderstandings. The payment rate can be hourly, per project, or based on milestones achieved. The payment schedule should outline when payments are due, whether upon completion, monthly, or at specific intervals. Finally, the method of payment should be clearly defined, including options like bank transfers, checks, or digital payment platforms, to ensure timely and secure transactions.

IRS guidelines

The IRS provides specific guidelines regarding independent contractor payments, primarily focusing on the classification of workers and tax obligations. Businesses must determine whether a worker qualifies as an independent contractor or an employee based on factors such as control over work, financial arrangements, and the relationship's nature. Contractors are responsible for reporting their income and may need to pay self-employment taxes. It is essential for both contractors and businesses to understand these guidelines to ensure compliance and avoid penalties.

Required documents

When processing independent contractor payments, certain documents are essential to maintain compliance and transparency. Key documents include the contractor's invoice, which details the services provided and the payment amount. A signed contract outlining the terms of the engagement is also necessary for clarity. Additionally, businesses may need to collect a W-9 form from the contractor to obtain their taxpayer identification number for tax reporting purposes. Keeping these documents organized aids in financial record-keeping and tax preparation.

Penalties for non-compliance

Failing to comply with regulations surrounding independent contractor payments can result in significant penalties for businesses. Misclassification of workers may lead to back taxes, fines, and interest charges from the IRS. Additionally, if a business does not issue required tax forms, such as the 1099-NEC, it may face penalties for failing to report income accurately. Maintaining proper documentation and adhering to IRS guidelines is crucial to mitigate these risks and ensure a compliant working relationship with independent contractors.

Quick guide on how to complete independent contractor payment 497337216

Prepare Independent Contractor Payment easily on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Independent Contractor Payment on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Independent Contractor Payment with ease

- Obtain Independent Contractor Payment and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Move past issues of lost or misfiled documents, exhausting document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Independent Contractor Payment and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's solution for independent contractor payment?

airSlate SignNow provides a streamlined platform to send and eSign documents, which includes features tailored for independent contractor payment. By using our solution, businesses can efficiently manage contracts and payments to their independent contractors, ensuring timely and secure transactions.

-

How does airSlate SignNow enhance independent contractor payment processing?

With airSlate SignNow, independent contractor payment processing is simplified through automated workflows and electronic signatures. This means less paperwork and faster processing times, allowing businesses to focus more on their core operations rather than administrative tasks.

-

What are the pricing plans available for using airSlate SignNow for independent contractor payments?

airSlate SignNow offers a variety of pricing plans to accommodate businesses of all sizes looking to facilitate independent contractor payment. Each plan provides different levels of features, ensuring that you only pay for what you need for effective contract and payment management.

-

Can airSlate SignNow integrate with other payment platforms?

Yes, airSlate SignNow can integrate seamlessly with various payment platforms, enhancing the overall experience for independent contractor payment. This integration allows for real-time payment tracking and efficient fund transfers, making the payment process much smoother for businesses.

-

How secure is the independent contractor payment process with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure servers to protect sensitive information involved in the independent contractor payment process. This ensures that both your business and contractors can engage in transactions with confidence.

-

What features does airSlate SignNow offer for managing independent contractor agreements?

airSlate SignNow offers robust features such as customizable templates and automated reminders for managing independent contractor agreements. These tools help ensure that due dates for payments and renewals are never overlooked, streamlining the entire contractor management process.

-

How can businesses track independent contractor payment status with airSlate SignNow?

Businesses can easily track independent contractor payment status using airSlate SignNow's dashboard, which provides real-time updates on document statuses. This feature enhances transparency and ensures that all parties are informed about payment timelines.

Get more for Independent Contractor Payment

Find out other Independent Contractor Payment

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT