Self Employment Income Statement Template 2011-2026

What is the Self Employment Income Statement Template

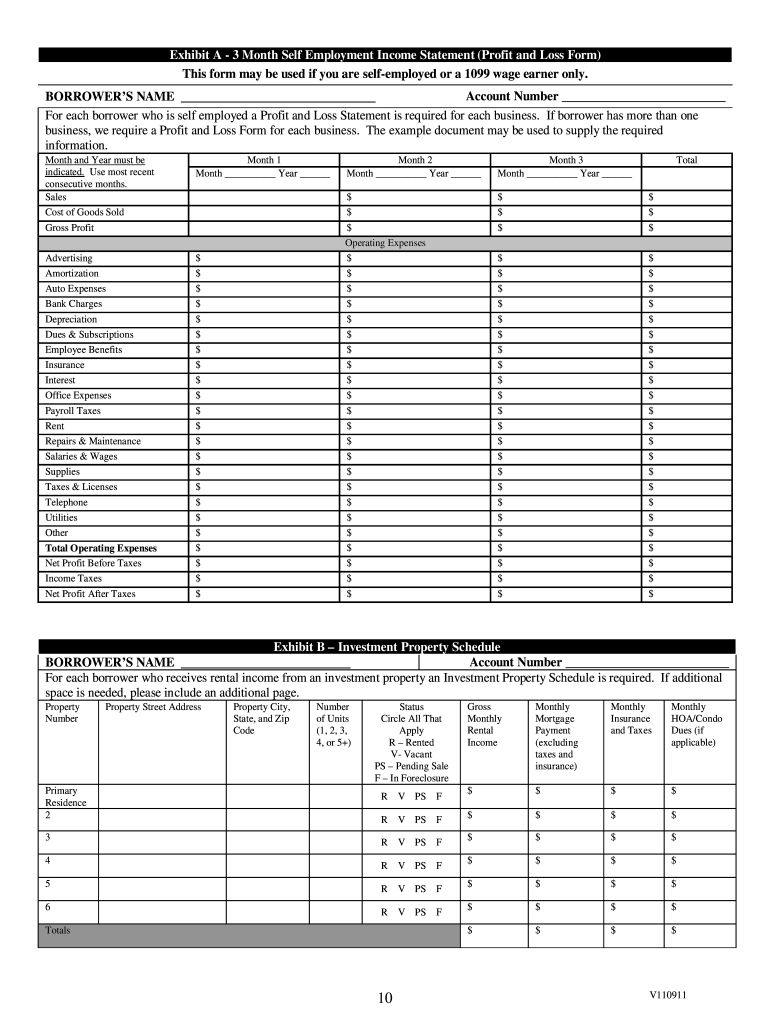

The Self Employment Income Statement Template is a crucial document for individuals who operate their own businesses. This template helps self-employed individuals track their income and expenses over a specific period, typically a month or a year. It is essential for accurately reporting earnings to the IRS and for assessing the financial health of a business. The template includes sections for various income sources, such as sales revenue and service fees, as well as categories for expenses, including operating costs, materials, and other business-related expenditures.

How to Use the Self Employment Income Statement Template

Using the Self Employment Income Statement Template involves several straightforward steps. Start by entering your business name and the reporting period at the top of the template. Next, list all sources of income, ensuring that you categorize them appropriately. Follow this by detailing your expenses, which should be organized into relevant categories. After filling out the template, review the information for accuracy. This completed statement not only aids in tax preparation but also provides insights into your business's profitability.

Steps to Complete the Self Employment Income Statement Template

Completing the Self Employment Income Statement Template requires careful attention to detail. Begin with the following steps:

- Gather all financial records, including invoices, receipts, and bank statements.

- Input your business name and the reporting period at the top of the template.

- List all income sources, ensuring to include gross amounts before any deductions.

- Detail your expenses, categorizing them into fixed and variable costs.

- Calculate your total income and total expenses, then determine your net profit or loss.

- Review the completed template for accuracy and completeness.

Key Elements of the Self Employment Income Statement Template

The Self Employment Income Statement Template comprises several key elements that are vital for effective financial reporting. These include:

- Income Section: This section captures all revenue streams, including sales and services rendered.

- Expense Section: This includes categories such as rent, utilities, supplies, and other operational costs.

- Net Profit or Loss: The difference between total income and total expenses, indicating the financial outcome for the reporting period.

- Signature Line: A space for the individual to sign, affirming the accuracy of the information provided.

IRS Guidelines

It is essential to adhere to IRS guidelines when completing the Self Employment Income Statement Template. The IRS requires self-employed individuals to report their income accurately and to keep detailed records of all business transactions. This documentation is crucial for tax purposes, as it supports the figures reported on tax returns. Familiarizing yourself with IRS regulations related to self-employment income can help ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for self-employed individuals. Typically, self-employed individuals must file their income tax returns by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, estimated tax payments are generally due quarterly, on the 15th of April, June, September, and January. Keeping track of these dates helps ensure timely submissions and avoids penalties.

Quick guide on how to complete 3 month self employment income statement form

The optimal method to locate and endorse Self Employment Income Statement Template

Across the entirety of your organization, ineffective workflows related to document approval can consume signNow working time. Signing documents such as Self Employment Income Statement Template is an essential element of operations across various sectors, which is why the efficiency of each agreement’s process has a substantial impact on the company’s overall productivity. With airSlate SignNow, endorsing your Self Employment Income Statement Template is straightforward and rapid. This platform grants you access to the most current version of nearly any form. Even better, you can sign it right away without the need for additional software on your computer or printing any physical copies.

Steps to obtain and endorse your Self Employment Income Statement Template

- Browse our library by category or utilize the search bar to locate the form you require.

- Inspect the form preview by clicking Learn more to verify it’s the correct one.

- Hit Get form to commence editing immediately.

- Fill out your form and include any relevant details using the toolbar.

- Upon completion, click the Sign tool to endorse your Self Employment Income Statement Template.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as necessary.

With airSlate SignNow, you have everything required to manage your documents effectively. You can locate, fill out, modify, and even send your Self Employment Income Statement Template all within a single tab without any complications. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I emigrate to Spain?

Having recently made the permanent move to Granada, Spain from the UK as an Irish and EU citizen, I can help with some of the surprises we came up against. Unfortunately, even for an EU citizen, it's not as easy as packing up and moving to Spain. Bear with me as I take you through the details:Acquiring NIE Certification. This is a certificate giving you a 'Foreigner's Identifying Number' for up to a 3 month period. Beyond 3 months, you are required to get a Resident Card. Get the NIE immediately - you need it for opening a bank account, to get a SIM (even prepay), for any online transaction, for receiving packages from the postman (I know), for signing a rental contract, for anything really. So as soon as you arrive in your desired location, before looking for flats, before exploring the city, go straight to your local Immigration Office and pick up the form EX-15 to apply for the NIE. (No, it's not available online and neither is any of this process which, amongst many other reasons, makes it very frustrating.) Official government page about this application.Along with picking up the EX-15 form, make sure you talk to someone in the office (our experience is that they only speak Spanish) and ask what is required for applying for the NIE. Don't trust what the internet says or even what I'm telling you here - you need to verify with them in that particular office and double-check, get them to write it down for you. Because next time you go back, they may say something else entirely and you can show them this piece of paper. (Still not guaranteed to work but it helps keep them accountable.) Before leaving the office, make sure to set an appointment for returning the completed form. They don't automatically do this and it's astonishing because they expect you to have an appointment when you return so make sure to ask for one. The appointments are generally one month in advance so this is why you need to go as early as possible. If you tell them you need the NIE urgently, they may let you back without an appointment if you beg but we arrived at 8am and didn't get seen until 1:30pm so be prepared to sit around.Now that you have the form, go to an internet cafe/locutorio and make at least one copy of it (so you can start on one and not make mistakes on the original). NOW MAKE COPIES OF EVERYTHING. Copy your passport at least 10x, your latest Pay Slips, your latest Bank Statement, etc. When filling out forms, scan every completed form back onto a USB Stick. CARRY A COPY OF EVERYTHING WITH YOU AT ALL TIMES. A copy of your passport, NIE Cert when you get it, your Resident Card when you get it; have it all with you - you'd be surprised how often you're asked for these documents. To apply for the NIE Cert we needed:Original passportCopy of passportCompleted EX-15 form - here's an English translation form but you'll need to submit the Spanish one they give you.Copy of completed EX-15 formThey also say they need some sort of 'communication' of the reason you need an NIE but this was just to open a bank account for us so we didn't have anything to show for it and that was fine. Submission Appointment: Upon returning to the office with the required forms on your appointed day and time, they take the forms for processing and you are asked to come back after 7 calendar days to pick up the NIE Certificate. No appointment necessary for this one, just show up when you can (morning preferable because you need the bank to be open).Pick-up Day (7-days later): When you return to pick up the NIE Cert, check in at the desk and they will give you a form to bring to the bank. You need to go to any bank (hopefully there's one close by that they can direct you to) and pay in cash for the NIE Cert and acquire a stamp of proof of payment, approx. €16. Bring this back to the office. Now you have your NIE Certificate!!! Write this number down immediately on your hand, tattoo it on your body, make it your phone background, you will need it for every transaction you do going forward for the next 3 months. Don't leave the Immigration Office just yet!! Before you leave, make sure to ask them what you need to apply for a Resident Card. Remember to double-check their response, get them to write it down, give you any forms you need and get that appointment too!Next, Acquiring Resident Card: This is the card you need if you plan to reside in Spain longer than 3 months (or beyond the expiry date of your NIE Cert). For this application, you should be in possession of a form and a document explaining what other documentation they'll require for your specific application. This changes according to your nationality and your purpose for residing in Spain. For us, as self-employed EU citizens, NOT registering our business in Spain, we each had to apply as an 'inactive person with sufficient resources and health insurance'. This means we filled out the EX-18 for EU citizens. (English translation version.)To apply for the Resident Card we needed:Original passport2 x copies of passport (form says 1 but they insist you have 2!)Completed EX-18 formCopy of EX-18 form (they actually didn't ask us for this in the end)Proof of sufficient resources* - for this we printed a bank statement for each person applyingProof of health insurance** - document from our health provider stating start date and cover details (ideally in Spanish) - print out ALL the documentation your Health Provider sends you as our cards weren't sufficient for some reason. They wanted to see all the conditions of the plan. Who cares about your privacy, right? *Proof of sufficient resources - nowhere in any documentation or from speaking with anyone in the Immigration Office is it clear what exactly constitutes 'sufficient' resources for your planned stay in Spain. We had indicated that we will be residing here for a year and we had saved money to do so, so showing a bank statement with that money in it was 'sufficient'. This easily covered rent for a year and what we calculated as our expected daily expenses although how that tallied with what the Immigration Office expected to see, I've no idea. [Update] I got a vague answer on this that they are looking for incoming deposits of only €5,500 annually. Even though we are not earning a salary at the moment, they insisted on seeing deposits coming into each of our bank accounts over the past 3 months. Thankfully we had this from previous employment but it's laughable as surely the current amount in the account is more important that the money I received months ago, have long ago spent and so no longer have! We actually ended up getting one of our applications rejected since we only submitted one bank account statement for both applications with (what we calculated as) sufficient funds for 2 people. The 2nd person's application was rejected since their name needs to be on the account or otherwise prove they are a dependent or married to the account owner. Since our marriage certificate (which I had with me anticipating this issue!) was in Italian and not an apostille or 'certified/notarised', they could not accept it. [Thankfully we dashed to a locutorio, printed out the last 3 months of bank statements under his name and since it also had some incoming deposits from a previous employment, we were allowed submit that on the spot instead of coming back for another dreaded appointment with another dreaded interviewer that would change the requirements yet again!]**Proof of health insurance - we made the mistake of not researching this one quite sufficiently. We assumed (after which I kick myself every time, in Spain you NEVER assume, you always check and double-check) that the European Health Insurance Card we received from paying our taxes in the UK for years would suffice as Health Insurance (as it does for visitors or students but not for those planning to stay for a year). We actually did ask the Immigration Office if this card was sufficient and they told us 'yes' but when it came to actually submitting the application, we were refused on these grounds and had to wait another month for another appointment. There is a public Health Insurance option in Spain but we can't take advantage of it until we have a Resident Card and have lived here for a year (and probably paid taxes for a year). So in the meantime, we acquired Private Health Insurance from SANITAS who clearly stated on their website that they could provide assistance and contracts in English, access to English-speaking medical staff and best of all, ensure that it was sufficient for the Residency Application. For two of us, we are paying approx. €80/month for a year contract. Submission Appointment: Upon returning to the office with the oh-so-many required (and many not!) forms on your appointed day and time, they take the forms for processing and give you another form to bring to the bank. You need to go to any bank and pay €10.80, getting a stamp as proof of payment. Bring this form directly back to the office. Now you have your Spanish Resident Card!! ...Oh boy is it so anticlimactic...it's not even plastic or laminated but a piece of green paper with a stamp and a start date. I'm quite sure I'm going to lose it before I even get home. And now the doubt sets in, after all that rigmarole and 7 separate visits to the Immigration Office, as I question why do I even need this thing again?!!Image: Supporting document to the EX-18 form. Shows you what supporting documentation is required according to your type of status in applying for a Resident Card.

-

Is it easy to get a Chinese tourist visa?

Generally, yes as long as you submit a complete list of documents to the nearest Chinese Embassy from where you are based.The basic requirements are:1) Original passport that is valid for at least another 6 months with at least one blank visa page, a photocopy of the passport's information/photo page and emergency contact page;2) Visa Application Form of the People's Republic of China which should be legibly and truthfully filled out. (Must be filled up in capital letters. Do not leave anything blank. Write N/A if the item is not applicable to you);3) 2 colored ID photos which must comply with the required photo specifications; and4) Bank Certificate of Deposit Balance (including the past 6 months bank statement) and the receipt for payment of this certificate.You may also want to submit supporting documents:Supporting documents are those which prove your financial capacity to travel and to stay at the People’s Republic of China and those which show your intent to go back to your country.1) For employees- Income Tax Return Form and Certificate of Employment (detailing the salary and the length of employment)2) For self-employed/digital nomads- BIR-stamped Income Tax Return Form3) For businessmen- Business Registration Certificate4) For students- School ID and Enrollment Form/Receipt5) For those who have obtained a Chinese visa before- Submit a photocopy of the visa, and if the visa is on your old passport, you should also submit the old passportNOTE: Bring other relevant documents proving your economic condition/employment/study such as land/condominium title, car registration, etc., other documents supporting your travel to China, or those explaining the travel purpose (if applicable).See this article for more details: How To Apply For A Chinese Tourist Visa

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

For a Canadian visitor visa application, do we need to have a booked flight ticket?

Booked flight ticket isn’t one of the requirements when applying for a Visitor Visa for Canada but it is highly encouraged to submit one to prove your purpose of travel. You basically need the following documents:1) Valid passport. With a remaining one year validity. Scan the bio-page;2) Duly accomplished Form IMM5257. This is the Application for Visitor Visa Form. Fill it out digitally and truthfully. (This works on Internet Explorer and the latest signNow version);3) Duly accomplished Form 5645. This requires your Family Information which shall also be filled out digitally;4) 2 passport size photos (35mm x 45mm). Must be photographed within the last six months. See complete photo specifications here;5) Proof of income/financial capability. This shall include Bank Certificate/Bank Statement within the last 4 months, Certificate of Employment and Income Tax Return (for employees, self-employed and digital nomads), School Records such as Enrollment Receipt/Certificate (For Students), Business Permits (for business owners), as well as Condominium/Car/Land Titles (if any).6) Affidavit of Support. This only applies if somebody else is paying for your trip. Also, attach his/her proof of financial capability;7) Travel history. Scanned copy of your visas (whether valid or expired) as well as entry/exit stamps. Make sure just to put everything in 1 file; AND8) Purpose of Travel. Your flight and hotel reservations and day-to-day itinerary.Check out this article to know more: How To Apply For A Canadian Tourist Visa

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the F-1 visa app job info if I own a business? What docs must I provide (certificate of incorporation, etc.)?

Part 1: Filling Out DS-160, If You Are A BusinessmanDS-160 online application is the first and foremost important step in the visa application process. While completing DS-160 form online you will need to provide details about your current employment and previous five years work history.If you are a businessman/self-employed you will need to select that from the drop-down menuProvide complete address of your business locationEnter your approximate monthly income in local currency after expensesWrite a short description of your businessPart 2: Supporting DocumentsIf you are not self financing your study you will not need any documents. But having these supporting documents doesn’t hurt.In case your are the sponsor of your tuition and living expenses, you should bring all available documents to your visa interview, including but not limited to:Proof of business ownership (Article of Organization/Incorporation/Business License, By Laws, Operating Agreement)Evidence of your approximate monthly incomeBank statement of last six monthsRecent 3 years tax return documentsA signed and stamped letter from the company stating that the company will sponsor your expenses

Create this form in 5 minutes!

How to create an eSignature for the 3 month self employment income statement form

How to make an eSignature for the 3 Month Self Employment Income Statement Form online

How to create an eSignature for the 3 Month Self Employment Income Statement Form in Google Chrome

How to generate an electronic signature for putting it on the 3 Month Self Employment Income Statement Form in Gmail

How to generate an electronic signature for the 3 Month Self Employment Income Statement Form right from your smart phone

How to make an electronic signature for the 3 Month Self Employment Income Statement Form on iOS

How to generate an eSignature for the 3 Month Self Employment Income Statement Form on Android devices

People also ask

-

What are profit and loss forms?

Profit and loss forms are financial documents that summarize the revenues, costs, and expenses incurred during a specific period. They are essential for assessing a company's profitability and financial health, helping businesses to make informed decisions based on their financial performance.

-

How can airSlate SignNow help me with profit and loss forms?

airSlate SignNow allows you to create, send, and eSign profit and loss forms effortlessly. Our user-friendly interface combined with electronic signature capabilities streamlines the process, making it easier for you to obtain the necessary approvals and keep your financial documentation organized.

-

Are there any costs associated with using airSlate SignNow for profit and loss forms?

While airSlate SignNow offers various pricing plans, our service remains cost-effective for businesses of all sizes. You can select a plan that fits your needs, allowing you to efficiently manage profit and loss forms without overspending on unnecessary features.

-

What features do you offer for managing profit and loss forms?

Our platform provides a range of features for managing profit and loss forms, including customizable templates, secure storage, and collaboration tools. Additionally, you can track document status in real-time and integrate with other accounting software for a streamlined workflow.

-

Can I integrate airSlate SignNow with my existing accounting software for profit and loss forms?

Yes, airSlate SignNow offers integrations with popular accounting tools and software, enabling you to generate and manage profit and loss forms seamlessly. These integrations help you synchronize financial data, ensuring that your forms reflect accurate and up-to-date information.

-

What are the benefits of using airSlate SignNow for profit and loss forms?

Using airSlate SignNow for profit and loss forms simplifies the process of document management and eSignatures. This not only saves time but also enhances accuracy and compliance, allowing you to focus on analyzing your financial data rather than getting bogged down in paperwork.

-

Is it easy to create profit and loss forms with airSlate SignNow?

Creating profit and loss forms with airSlate SignNow is incredibly easy thanks to our intuitive interface and pre-built templates. You can customize these templates quickly to suit your business's specific needs, and you can start managing your financial documents immediately without any complicated training.

Get more for Self Employment Income Statement Template

- Complaint mississippi 497314116 form

- Motion change venue 497314118 form

- Opposition motion form

- Defendant admission form

- Memorandum motion form

- Memorandum brief in opposition to motion to transfer cause to chancery court mississippi form

- 2nd grade end of year assessment form

- Arkansas better chance program manual form

Find out other Self Employment Income Statement Template

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online