Self Employed Utility Services Contract Form

What is the Self Employed Utility Services Contract

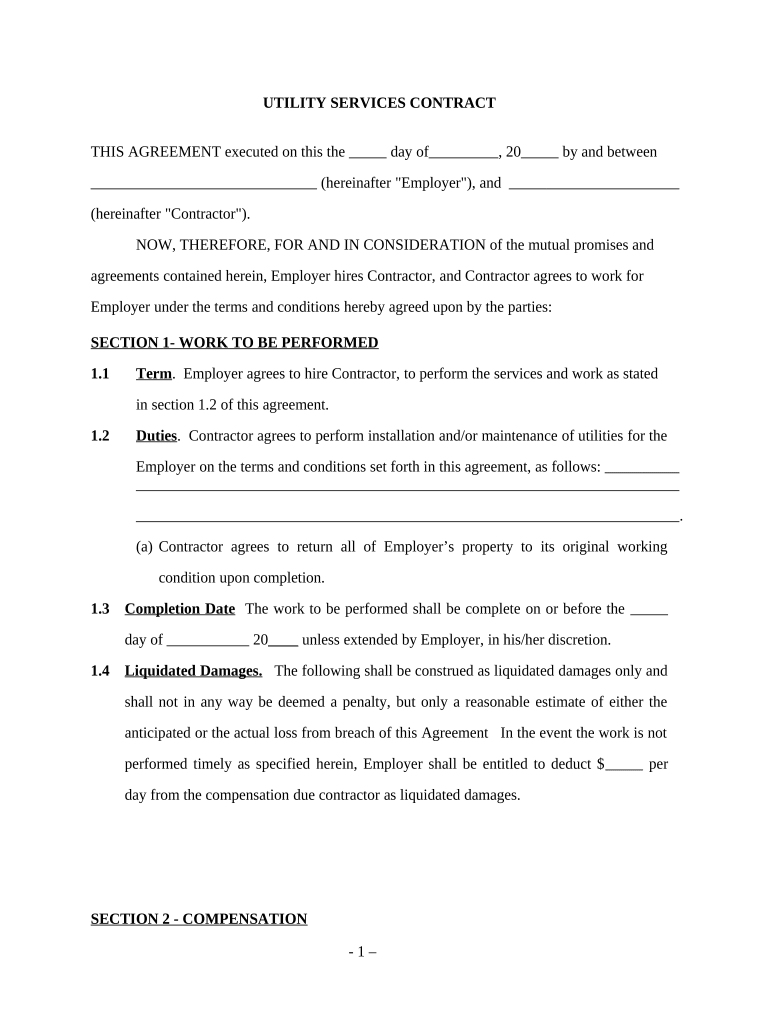

The Self Employed Utility Services Contract is a legal document that outlines the terms and conditions between a self-employed individual and a client for utility services. This contract typically includes details such as the scope of work, payment terms, duration of the contract, and responsibilities of both parties. It serves to protect the rights of both the service provider and the client by clearly defining expectations and obligations.

How to use the Self Employed Utility Services Contract

Using the Self Employed Utility Services Contract involves several steps. First, both parties should review the terms to ensure mutual understanding and agreement. Next, the contract should be filled out with accurate information regarding the services to be provided, payment details, and any specific conditions that may apply. Once completed, both parties should sign the contract, ideally using a secure electronic signature solution to ensure its legal validity.

Key elements of the Self Employed Utility Services Contract

Several key elements are essential in a Self Employed Utility Services Contract. These include:

- Scope of Work: A detailed description of the services to be provided.

- Payment Terms: Information on how and when payments will be made.

- Duration: The length of time the contract will be in effect.

- Termination Clause: Conditions under which either party may terminate the contract.

- Liability and Insurance: Provisions regarding liability and any required insurance coverage.

Steps to complete the Self Employed Utility Services Contract

Completing the Self Employed Utility Services Contract involves a systematic approach:

- Gather necessary information about the services and parties involved.

- Fill in the contract with accurate details, ensuring clarity in each section.

- Review the contract for any errors or omissions.

- Both parties should sign the document using a secure electronic signature.

- Distribute copies of the signed contract to all parties for their records.

Legal use of the Self Employed Utility Services Contract

The legal use of the Self Employed Utility Services Contract hinges on its compliance with relevant laws and regulations. To be legally binding, it must include essential elements such as signatures from both parties and a clear outline of the terms. Utilizing a reputable eSignature platform can enhance the contract's legality by providing an electronic certificate and ensuring compliance with laws like ESIGN and UETA.

State-specific rules for the Self Employed Utility Services Contract

State-specific rules may affect the Self Employed Utility Services Contract, as different states have varying laws regarding contracts and service agreements. It is important for both parties to be aware of their state’s regulations, which may dictate specific requirements for contract language, signatures, and enforceability. Consulting with a legal professional familiar with local laws can provide additional guidance.

Quick guide on how to complete self employed utility services contract

Effortlessly Prepare Self Employed Utility Services Contract on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Administer Self Employed Utility Services Contract on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

Steps to Edit and eSign Self Employed Utility Services Contract with Ease

- Find Self Employed Utility Services Contract and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive details using the tools specific to airSlate SignNow for that function.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Self Employed Utility Services Contract to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Self Employed Utility Services Contract?

A Self Employed Utility Services Contract is a formal agreement that outlines the terms and conditions of services provided by self-employed individuals in the utility sector. This contract helps clarify expectations, payment terms, and service delivery schedules. Utilizing airSlate SignNow for this contract ensures that all parties can easily eSign and manage the document efficiently.

-

How can I create a Self Employed Utility Services Contract using airSlate SignNow?

Creating a Self Employed Utility Services Contract with airSlate SignNow is simple and user-friendly. You can start by selecting an existing template or creating your own document from scratch. The platform allows you to customize the contract by adding specific details before sending it for eSignature.

-

What are the benefits of using airSlate SignNow for a Self Employed Utility Services Contract?

Using airSlate SignNow for your Self Employed Utility Services Contract offers numerous benefits, including faster document turnaround times and enhanced security for your sensitive information. Additionally, the platform provides tracking features that allow you to see who has signed the contract and when. This streamlined process saves time and improves overall efficiency.

-

Is there a cost associated with using airSlate SignNow for a Self Employed Utility Services Contract?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans vary depending on the features you need, ensuring you can choose the right package for your specific requirements regarding a Self Employed Utility Services Contract. Check the pricing page for detailed information about subscription options.

-

Can I integrate airSlate SignNow with other tools for managing a Self Employed Utility Services Contract?

Absolutely! airSlate SignNow allows seamless integrations with numerous productivity tools, CRMs, and cloud storage solutions. This capability helps streamline your workflow by connecting all your resources when managing a Self Employed Utility Services Contract and enhancing collaboration among team members and clients.

-

What features does airSlate SignNow offer for handling a Self Employed Utility Services Contract?

airSlate SignNow provides a comprehensive suite of features perfect for managing a Self Employed Utility Services Contract. Key features include advanced document editing, multiple eSignature options, templates for quick setup, and real-time notifications. These tools simplify the contract management process and ensure compliance.

-

How secure are my Self Employed Utility Services Contracts with airSlate SignNow?

Security is a top priority for airSlate SignNow. All documents, including Self Employed Utility Services Contracts, are protected using industry-standard encryption. Additionally, the platform provides detailed audit trails and authentication options, ensuring that your contracts remain confidential and secure throughout the signing process.

Get more for Self Employed Utility Services Contract

- 2021 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

- As of 12720 this new version of the it 4 combines and replaces the following forms it 4 previous version it 4nr it 4 mil and it

- Wwwirsgovpubirs soiinternal revenue service instructions for form 990 pf

- Get the free about form 8949internal revenue service irsgov

- Form 1099 int rev january 2022 interest income

- 1120 pol u s income tax return for certain political form

- Form 7200 rev april 2021 internal revenue service

- Wwwirsgovadvocatereports to congressreports to congressinternal revenue service irs tax forms

Find out other Self Employed Utility Services Contract

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure