Limited Liability Company Make Form

What is the Limited Liability Company?

A Limited Liability Company (LLC) is a popular business structure in the United States that combines the benefits of both corporations and partnerships. It provides personal liability protection for its owners, known as members, while allowing for flexible management and tax options. This means that members are typically not personally responsible for business debts or liabilities, protecting their personal assets. Additionally, an LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, offering various tax advantages.

Key elements of the Limited Liability Company

Understanding the essential components of an LLC is crucial for effective management and compliance. Key elements include:

- Members: The owners of the LLC, who can be individuals or other business entities.

- Operating Agreement: A document that outlines the management structure, member roles, and operational procedures of the LLC.

- Limited Liability Protection: Members are shielded from personal liability for business debts and claims.

- Pass-Through Taxation: Profits and losses can be reported on members' personal tax returns, avoiding double taxation.

Steps to complete the Limited Liability Company

Establishing an LLC involves several steps to ensure compliance with state laws. The process generally includes:

- Select a Name: Choose a unique name that complies with state naming requirements.

- File Articles of Organization: Submit this document to the appropriate state agency, detailing the LLC’s structure and purpose.

- Create an Operating Agreement: Draft this internal document to outline management and operational guidelines.

- Obtain Necessary Licenses and Permits: Ensure compliance with local regulations by acquiring any required business licenses.

- Apply for an EIN: Obtain an Employer Identification Number from the IRS for tax purposes.

Legal use of the Limited Liability Company

To maintain the legal status of an LLC, it is essential to adhere to specific regulations and requirements. This includes:

- Filing annual reports as mandated by the state.

- Maintaining a separate bank account for the LLC to uphold liability protection.

- Complying with state and federal tax obligations.

- Keeping accurate records of all business transactions and decisions.

State-specific rules for the Limited Liability Company

Each state in the U.S. has its own regulations governing LLCs, which can affect formation, management, and tax obligations. Important aspects to consider include:

- Formation Fees: Vary by state and can include filing fees and publication requirements.

- Annual Reporting: Some states require annual or biennial reports to be filed, often with associated fees.

- Tax Treatment: States may impose different tax structures on LLCs, impacting overall tax liability.

Required Documents

When forming an LLC, several key documents are necessary to ensure compliance and proper establishment. These typically include:

- Articles of Organization: The primary document filed with the state to officially create the LLC.

- Operating Agreement: Although not always required, this document is crucial for outlining the management structure and member responsibilities.

- Employer Identification Number (EIN): Required for tax purposes, especially if the LLC has employees.

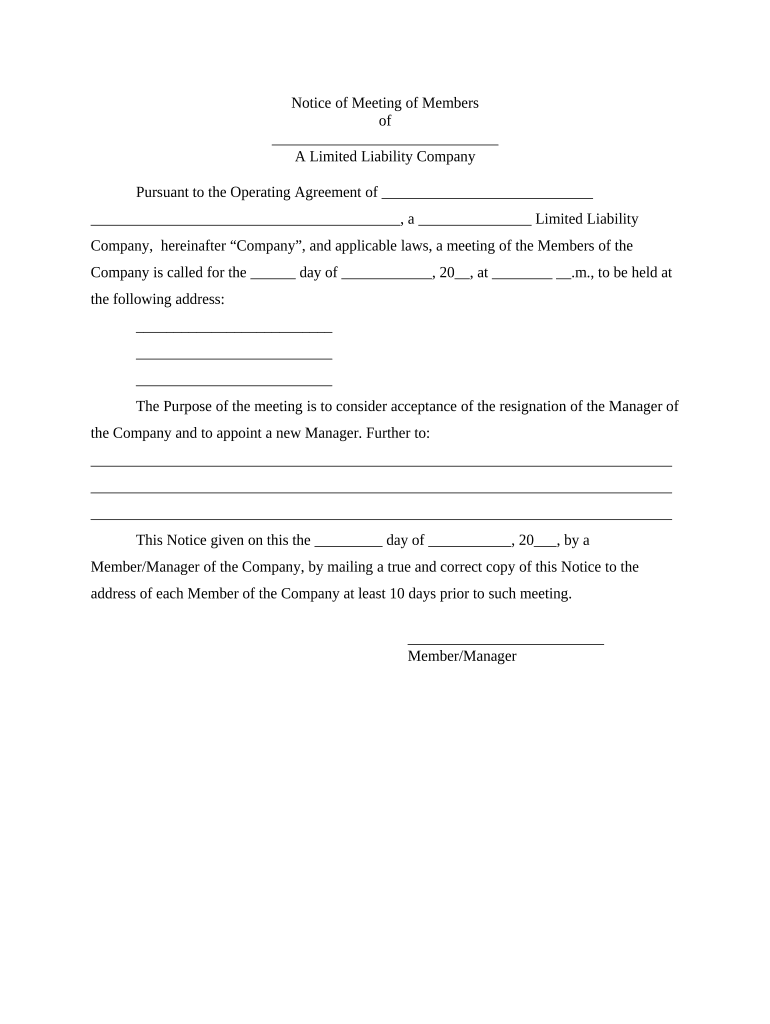

Quick guide on how to complete limited liability company make 497337457

Easily Prepare Limited Liability Company Make on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly solution to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents promptly without any delays. Handle Limited Liability Company Make on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Limited Liability Company Make Effortlessly

- Locate Limited Liability Company Make and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using the tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Limited Liability Company Make and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an LLC resignation agreement?

An LLC resignation agreement is a document that allows a member of a limited liability company to formally resign from their position. This agreement outlines the terms of resignation and helps ensure a smooth transition of responsibilities. It is essential for maintaining proper records and compliance within the LLC.

-

How can I create an LLC resignation agreement using airSlate SignNow?

You can easily create an LLC resignation agreement using airSlate SignNow by accessing our document templates feature. Simply select the LLC resignation agreement template, customize it with relevant details, and send it for eSignature. Our platform streamlines the document creation process, making it hassle-free.

-

Are there any costs associated with using airSlate SignNow for LLC resignation agreements?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit different business needs. You can choose from various subscription options, which generally offer unlimited document signing and access to templates like the LLC resignation agreement. Review our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for managing LLC resignation agreements?

airSlate SignNow includes several features designed to make managing LLC resignation agreements efficient. Key features include eSignature capabilities, document storage, customizable templates, and automated reminders. These tools help streamline your workflow and ensure that all necessary steps are completed promptly.

-

What benefits do I get from using airSlate SignNow for LLC resignation agreements?

Using airSlate SignNow for your LLC resignation agreements allows for a faster, more secure signing process. It saves time by eliminating the need for paper documents and manual signatures while providing legal validity. Moreover, the platform's user-friendly interface makes it easy for all parties involved.

-

Is it legally binding to use airSlate SignNow for my LLC resignation agreement?

Yes, LLC resignation agreements signed through airSlate SignNow are considered legally binding. The platform complies with eSignature laws, ensuring that your electronic signatures hold the same weight as traditional handwritten ones. This gives you confidence in the validity of your resignation agreements.

-

Can I integrate airSlate SignNow with other business tools for LLC resignation agreements?

Absolutely! airSlate SignNow offers various integrations with popular business tools, enhancing your workflow when handling LLC resignation agreements. You can connect with platforms like Google Drive, Dropbox, and CRM systems to streamline document management and storage.

Get more for Limited Liability Company Make

- Events official website speaker anthony rendon representing form

- Reference form pe09pdffillercom

- Professional engineer engagement record and reference form professional engineer engagement record and reference form

- Application for certificate of review minor review city of form

- Parentguardian statement of permission and release of claims form

- Law offices of robert david malove phone number yelp form

- Interim report draft 09 10 08 v2doc form

- Application for certificate of review form

Find out other Limited Liability Company Make

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure