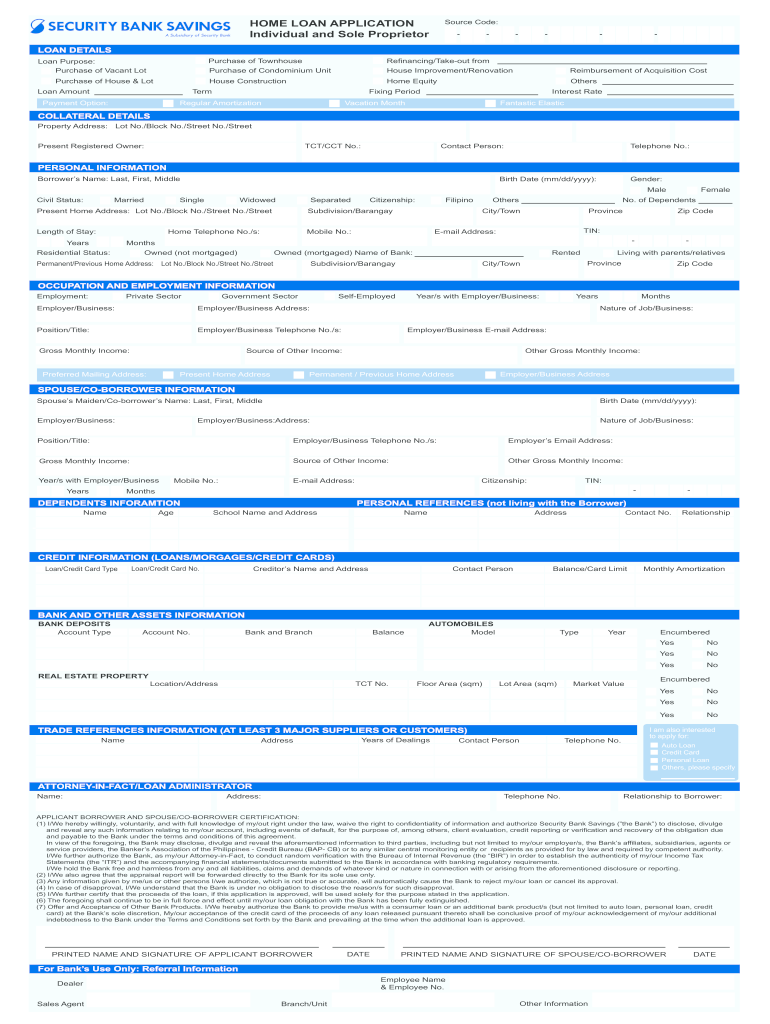

Security Bank of the Philippines Home Loan Application Form

Understanding the Security Bank Home Loan Application Form

The Security Bank home loan application form is a crucial document for individuals seeking to secure a mortgage. This form collects essential information about the applicant, including personal details, financial status, and property information. It is designed to assess the eligibility of the applicant for a home loan and to streamline the approval process. Understanding the components of this form can significantly enhance the chances of a successful application.

Steps to Complete the Security Bank Home Loan Application Form

Completing the Security Bank home loan application form involves several key steps:

- Gather necessary documents: Collect all required documentation, such as proof of income, identification, and property details.

- Fill out personal information: Accurately provide your name, address, and contact details.

- Detail financial information: Include your income, expenses, and any existing debts to give a clear picture of your financial health.

- Provide property information: Describe the property you intend to purchase, including its value and location.

- Review and submit: Double-check all entries for accuracy before submitting the form to avoid delays.

Required Documents for the Security Bank Home Loan Application

To successfully complete the Security Bank home loan application, certain documents are necessary. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, such as a driver's license or passport.

- Bank statements to verify financial stability.

- Property documents, including the title deed or purchase agreement.

Legal Use of the Security Bank Home Loan Application Form

The Security Bank home loan application form must be filled out accurately to ensure its legal validity. Providing false information can lead to penalties, including denial of the application or legal repercussions. It is essential to understand the legal implications of the information submitted and to ensure compliance with relevant regulations.

Eligibility Criteria for the Security Bank Home Loan

Eligibility for a Security Bank home loan typically depends on several factors, including:

- Credit score and history.

- Income level and employment stability.

- Debt-to-income ratio.

- Age and residency status.

Meeting these criteria is essential for a successful application and can influence the loan amount and interest rates offered.

Application Process & Approval Time for the Security Bank Home Loan

The application process for a Security Bank home loan involves submitting the completed form along with the required documents. Once submitted, the bank will review the application, which may take several days to weeks, depending on the complexity of the application and the volume of requests. Staying informed about the status of your application can help manage expectations during this period.

Quick guide on how to complete home loan application form security bank

A concise manual on how to create your Security Bank Of The Philippines Home Loan Application Form

Finding the appropriate template may pose a difficulty when you are required to submit official international documents. Even when you possess the necessary form, it can be laborious to promptly fill it out in accordance with all the specifications if you utilize physical copies instead of handling everything digitally. airSlate SignNow is the web-based eSignature platform that aids you in navigating all of that. It allows you to obtain your Security Bank Of The Philippines Home Loan Application Form and swiftly complete and sign it on-site without needing to print documents again if you make an error.

Here are the procedures you need to follow to create your Security Bank Of The Philippines Home Loan Application Form with airSlate SignNow:

- Click the Acquire Form button to insert your document into our editor instantly.

- Begin with the first vacant field, enter your information, and continue with the Next feature.

- Complete the empty fields using the Cross and Check features from the panel above.

- Choose the Highlight or Line options to emphasize the most crucial information.

- Select Image and upload one if your Security Bank Of The Philippines Home Loan Application Form calls for it.

- Utilize the right-side panel to add more fields for yourself or others to complete if required.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing by clicking the Finished button and selecting your file-sharing options.

Once your Security Bank Of The Philippines Home Loan Application Form is completed, you can share it in the manner you prefer - deliver it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can securely store all your completed documents in your account, organized in folders based on your preferences. Don’t squander time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

What is the process of applying for a home loan?

Process to Apply for Home Loan10 step process while applying for a home loan:Home Loan Eligibility - As a first step to applying home loan, you should Calculate Home Loan Eligibility and estimate your budget accordingly.CIBIL Score - After assessing your budget, you should Check your CIBIL Score, so that you can be sure that you will easily get the loan approved. In case your CIBIL Score (Credit Score) is not up to the mark, you can always Improve CIBIL Score before you apply for home loan or start your home search.Evaluate Interest Rates - After assessing your loan eligibility and checking your CIBIL score, you should start comparing interest rates of various banks. You can even compare rates online through portals like Bankbazaar, deals4loan etc. Loan Application - After selecting lowest interest rates, make application to the concerned bank along with Required Documents for Home Loan.Appraisal by Bank - After you make loan application, the bank will evaluate your credit history and establish your repayment capacity based on your income, age, qualifications, experience, nature of business etc.Loan Sanction - After evaluating your application, the bank will sanction your loan and send you an offer letter mentioning the approved loan amount, interest rate offered (fixed or floating interest), tenure, EMI, mode of repayment etc. Legal Evaluation of Documents - After you accept the offer letter, you will have to submit title documents of the property (Sale Deed, Allotment Letter, Builder-Buyer Agreement etc.) in original to the bank. The bank will conduct its title inspection and if everything is found OK, bank will keep all original documents with itself until the entire loan is paid off. Valuation Check - The bank will also conduct an independent valuation of the property to assess true value of property and maximum eligible loan amount accordingly.Loan Agreement - After completing the valuation and legal check, you will be called to sign the home loan agreement. You will be given one copy for your records.Loan Disbursement - After signing the agreement, the bank will disburse the loan amount in full (in case of ready to move property) or the next instalment amount (in case of under construction property).For better understanding, I suggest that you go through this guide on Home Loan Procedure. Hope it helps!

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

What was your experience being a bank teller?

What you experience as a teller seems to vary on not only the bank you work for, but the branch you work in. For instance, my experience as a teller is probably very different than those in a lot of other bank branches because I work at a branch that has a lot of higher end clientele. We do a lot more catering and hand-holding than other branches do, and sometimes have to bend the rules a little to get things done.My day starts with me putting up my stuff in a secure area in the break room. If I’m opening, I disarm the alarms and do the morning walk-through with another teller. Then we deal with all the daily duties like getting the work together from earlier that week to send to the main office, putting together the sell for the armored truck, or auditing one of the many machines or vaults we have.I get out my drawer, boot everything up, finish putting the Nightdrops in the system, and then I wait. The morning is usually slow, so we spend a lot of time talking and trying to entertain ourselves… or trying not to fall asleep. Businesses show up a little later in the morning usually or throughout the day. And from there its an array of change orders, trying to sort out the mass of bills and checks sometimes neatly put together and sometimes crammed in a bag with such little care that it could take you 5–10 mins just to sort into some sort of order. But you get through all that and then you wait some more… and you wait some more…. and you wait some more… Given, a lot of branches are actually busy, so there is very little waiting involved, and much more trying not to lose your mind. But this is my branch.There’s a lot of checks being cashed, checks and bills being deposited, and people asking what their balance is. You get the occasional person bringing in their change to cash out. Or you get to let someone into their safe deposit box. That’s all the easy part of being a teller.The hard part is the questions you have to answer and the regulations that you have to follow. Telling people “I’m sorry I can’t do that,” and then having to try and explain why, because they don’t understand. It’s a lot of filling out forms. If I had a dollar for every slip I’ve had to fill out for someone I would’ve nearly doubled my paycheck every month. All of that is monotonous, though. And it can drive you crazy after a while. But the part of my job I really enjoy are those rare instances when I feel like I can actually really help someone. To put in the extra mile and teach someone who’s concerned about counterfeit 20s in her yard sale how to tell the difference between what’s real and what’s fake. To teach someone who doesn’t know English very well how to write out English numbers on his checks so he can pay his employees. It’s painstakingly going through every transaction with someone on their banking statement and showing them the result until they’re satisfied. It’s teaching high school kids how to fill out their first bank deposit form. It’s letting someone know their driver’s license is about to expire. It’s always been the small things that really make the job worth doing to me.But in between all of that, there are the vast arrays of paperwork that have to be done every day. Phone calls for all the check, debit card, and foreign currency orders. Followed by writing out hold logs. Trying to fill private banking’s little tasks. Occasional product phone calls can be assigned, which can take anywhere from one minute to an hour and thirty depending on the number of calls and the type. There’s filling out the occasional credit card application for a customer or a direct deposit request form. Then there’s the federal reporting forms that have to be filled out occasionally depending on the circumstance. In our branch, we also get a large amount of loan work that gets sent our way, so that takes up some time as well—completing their transactions and being essentially front-line secretaries. There are of course sales goals to fill, but at least in my bank, my job doesn’t rely on me signNowing my goal.Even with all that seriousness, some of it can be very funny. Like the truck who ran over lane 4. Or the fact that our ATM is constantly on the fritz and has a taste for eating people’s checks. Or when we’ve accidentally sent two tubes to the same lane. Or that guy who came in wanting to withdrawal $2000 in 1s for a wedding… or someone who chose to deposit an entire tub full of coin. There are days when I go home wanting to scream, and then there are days when I smile from ear to ear, but in the end, I love my job. It may not be an end game for me, but I have very few complaints. I work for a good company, and for now, that’s good enough for me.As for advice… the only thing I can tell you is… try to find joy in the small things. Be kind and people will often be kind to you.

-

How can I apply for a home loan?

Applying for a quick home loans may not be the most exciting way to spend your time, but if you are like many potential homeowners, it is probably a necessary evil. If you have some knowledge of the process ahead of time, however, it will go much more smoothly.Home loan applications tend to be very long, but if you are prepared ahead of time you can finish the application procedure without breaking a sweat. Before you begin filling out the form, make sure you have available your Social Security number, information pertaining to previous employers and residences, recent pay stubs, copies of credit card and loan statements, copies of bank statements and asset information such as stocks, pension and retirement funds. Begin the form by simply filling out each line with the requested information but leave Section I, entitled Type of Mortgage and Terms of Loan, blank.Next fill out Section II, Property Information and Purpose of Loan, with any of your available information. Only fill in the subject property address line, however, after you have an accepted offer on a property. If you don't have a property yet, simply state the purpose of the loan as purchase or refinance, as well as the type of property the loan will cover (primary, secondary, or investment). Also write down all the names in which the title will be held, how the title will be held, and the source of the down payment (this is usually in cash).

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

Create this form in 5 minutes!

How to create an eSignature for the home loan application form security bank

How to create an eSignature for the Home Loan Application Form Security Bank in the online mode

How to create an electronic signature for your Home Loan Application Form Security Bank in Google Chrome

How to create an electronic signature for putting it on the Home Loan Application Form Security Bank in Gmail

How to generate an eSignature for the Home Loan Application Form Security Bank from your smart phone

How to make an electronic signature for the Home Loan Application Form Security Bank on iOS devices

How to generate an electronic signature for the Home Loan Application Form Security Bank on Android devices

People also ask

-

How does airSlate SignNow ensure bank security during document signing?

airSlate SignNow employs advanced encryption techniques and secure servers to maintain bank security. All data transmitted is encrypted using industry-standard protocols, ensuring that sensitive information remains confidential. Additionally, our platform complies with various regulatory standards to further enhance your document security.

-

What features does airSlate SignNow offer to improve bank security?

With features like two-factor authentication and secure user access controls, airSlate SignNow prioritizes bank security. These features help prevent unauthorized access to your signed documents, providing peace of mind whenever you send or receive sensitive information. Our platform is designed to meet the security needs of financial institutions.

-

Is airSlate SignNow compliant with bank security regulations?

Yes, airSlate SignNow is compliant with key bank security regulations, including GDPR and CCPA. This compliance showcases our commitment to upholding exceptional security standards, ensuring that your data is handled responsibly. We constantly update our practices to align with evolving regulatory requirements.

-

How does the pricing of airSlate SignNow reflect its commitment to bank security?

Our pricing plans are designed to deliver value while ensuring top-notch bank security features are included. With a variety of tiers, businesses can choose a plan that best fits their needs without compromising on security. Every plan includes access to robust security measures that keep your documents safe.

-

Can airSlate SignNow integrate with other tools while maintaining bank security?

Absolutely! airSlate SignNow offers seamless integrations with various applications, all while ensuring bank security is maintained. Our API and secure connection protocols allow you to connect with your existing tools without risking data vulnerabilities, making it ideal for businesses in finance.

-

What are the benefits of using airSlate SignNow for bank security?

Using airSlate SignNow not only simplifies document signing but also enhances bank security by using state-of-the-art technological safeguards. The platform helps businesses protect sensitive information, thereby building customer trust and safeguarding reputations. The ease of use combined with robust security features makes it a top choice for many organizations.

-

How does airSlate SignNow handle document security on mobile devices?

airSlate SignNow prioritizes bank security on mobile devices by utilizing secure app environments and end-to-end encryption. This means that whether you're accessing documents on a smartphone or tablet, your data is protected against unauthorized access and potential bsignNowes. Our mobile app is designed with robust security features for on-the-go document management.

Get more for Security Bank Of The Philippines Home Loan Application Form

- Support dismiss form

- Motion arbitration form

- Motion withdraw order form

- Order withdrawing november 7 1997 order mississippi form

- Order on motion to transfer mississippi form

- Answer to complaint and motion to dismiss mississippi form

- Checklist for the outdoor exhibition of fireworks codes ohio form

- Aikenco op form

Find out other Security Bank Of The Philippines Home Loan Application Form

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe