Llc Formation

What is the LLC Formation

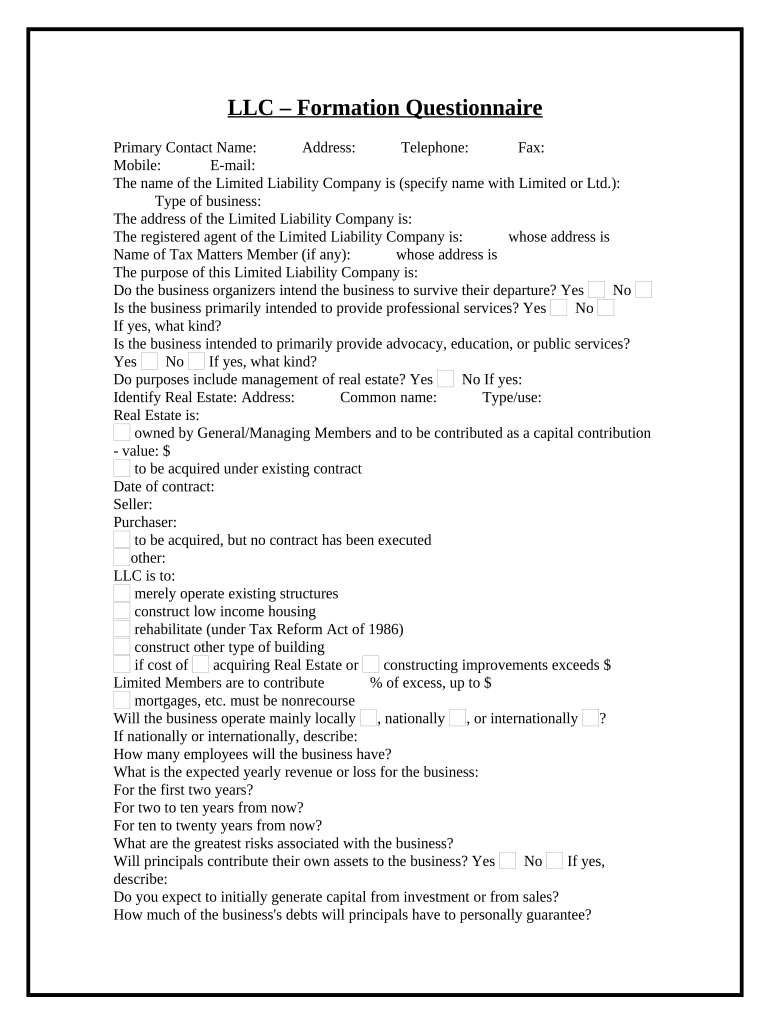

The LLC formation refers to the process of creating a Limited Liability Company (LLC), a popular business structure in the United States. An LLC combines the flexibility of a partnership with the liability protection of a corporation. This structure protects personal assets from business debts and liabilities, making it an appealing choice for many entrepreneurs. The formation process typically involves filing articles of organization with the state, paying a filing fee, and adhering to specific state regulations.

Steps to Complete the LLC Formation

Completing the LLC formation involves several key steps to ensure compliance with state laws. Here’s a general outline of the process:

- Choose a unique name for your LLC that complies with your state’s naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the articles of organization with the appropriate state agency, usually the Secretary of State.

- Pay the required filing fee, which varies by state.

- Create an operating agreement that outlines the management structure and operating procedures of the LLC.

- Obtain any necessary licenses or permits to operate legally.

Legal Use of the LLC Formation

The legal use of the LLC formation is crucial for ensuring that the business operates within the law. An LLC must adhere to state-specific regulations, including maintaining proper records and filing annual reports. The formation provides legal protection, separating personal assets from business liabilities. This means that in the event of a lawsuit or debt, personal assets are generally not at risk, provided that the LLC is properly maintained.

Required Documents

To successfully form an LLC, certain documents are required. These typically include:

- Articles of Organization: The primary document filed with the state to establish the LLC.

- Operating Agreement: Although not required in all states, this document outlines the management structure and operational guidelines.

- Employer Identification Number (EIN): Obtained from the IRS for tax purposes, necessary if the LLC has more than one member or hires employees.

State-Specific Rules for the LLC Formation

Each state in the U.S. has its own specific rules and regulations regarding LLC formation. It is essential to understand these rules to ensure compliance. For instance, some states may require a publication of the LLC formation in a local newspaper, while others may have different naming conventions or additional fees. Checking with the Secretary of State’s office in the relevant state can provide clarity on these requirements.

Eligibility Criteria

To form an LLC, certain eligibility criteria must be met. Generally, the following conditions apply:

- The LLC must have at least one member, who can be an individual or another business entity.

- All members must be of legal age, typically eighteen years or older.

- The chosen name for the LLC must be distinguishable from existing entities in the state.

Application Process & Approval Time

The application process for LLC formation involves submitting the articles of organization to the state and waiting for approval. The time frame for approval can vary significantly by state, ranging from a few days to several weeks. Factors influencing this timeline include the volume of applications being processed and the specific requirements of the state. It is advisable to check the state’s website for estimated processing times and any additional steps that may be required.

Quick guide on how to complete llc formation

Complete Llc Formation effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Llc Formation on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and eSign Llc Formation effortlessly

- Find Llc Formation and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mismanaged documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Llc Formation and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is LLC formation and why is it important?

LLC formation refers to the process of registering a Limited Liability Company, which provides personal liability protection for owners while allowing flexible management. It's important because it helps separate personal assets from business liabilities, ensuring your personal finances are safe if the business encounters legal issues.

-

How does airSlate SignNow assist with LLC formation?

airSlate SignNow simplifies the LLC formation process by allowing users to manage and eSign all necessary documents electronically. This saves time and ensures that your LLC formation paperwork is completed accurately and efficiently, making the entire process hassle-free.

-

What are the costs associated with LLC formation through airSlate SignNow?

The costs of LLC formation via airSlate SignNow are competitive and depend on the specific services you select, such as document templates and eSigning features. Our pricing model is designed to offer a cost-effective solution without compromising on quality, giving you excellent value for your LLC formation needs.

-

What features does airSlate SignNow provide for LLC formation?

airSlate SignNow offers features like customizable document templates, secure eSigning, and collaboration tools to facilitate the LLC formation process. These features enhance productivity and make it easier for businesses to complete the necessary paperwork accurately and quickly.

-

How can airSlate SignNow improve the efficiency of my LLC formation?

With airSlate SignNow, the efficiency of your LLC formation is improved through automated workflows and electronic signatures, signNowly reducing turnaround time. This allows you to focus on other important aspects of your business while ensuring that your LLC formation is handled seamlessly.

-

Are there integrations available for LLC formation with airSlate SignNow?

Yes, airSlate SignNow integrates with various platforms, enabling easy access to documents and enhancing the LLC formation process. These integrations streamline workflows and allow you to manage LLC formation collaterals effectively within the tools you already use.

-

What benefits does eSigning offer during LLC formation?

eSigning simplifies the LLC formation process by eliminating the need for printing, scanning, or mailing documents. This not only speeds up the process but also ensures that your LLC formation documents are secure and legally binding.

Get more for Llc Formation

- Dlo order form

- The p53 gene and cancer answers fill online printable form

- Reasons for delays in getting your biopsy and cytology test form

- The applicable limits of liability and are subject to the retentions form

- Lightning affidavit 312732324 form

- Non physician health care professionals application for claims made professional liability insurance new business form

- Physicians and surgeons application for claims kammco form

- Truck driver expenses worksheet form

Find out other Llc Formation

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online