Partnership Interest Assignment PDF Form

What is the Partnership Interest Assignment Pdf

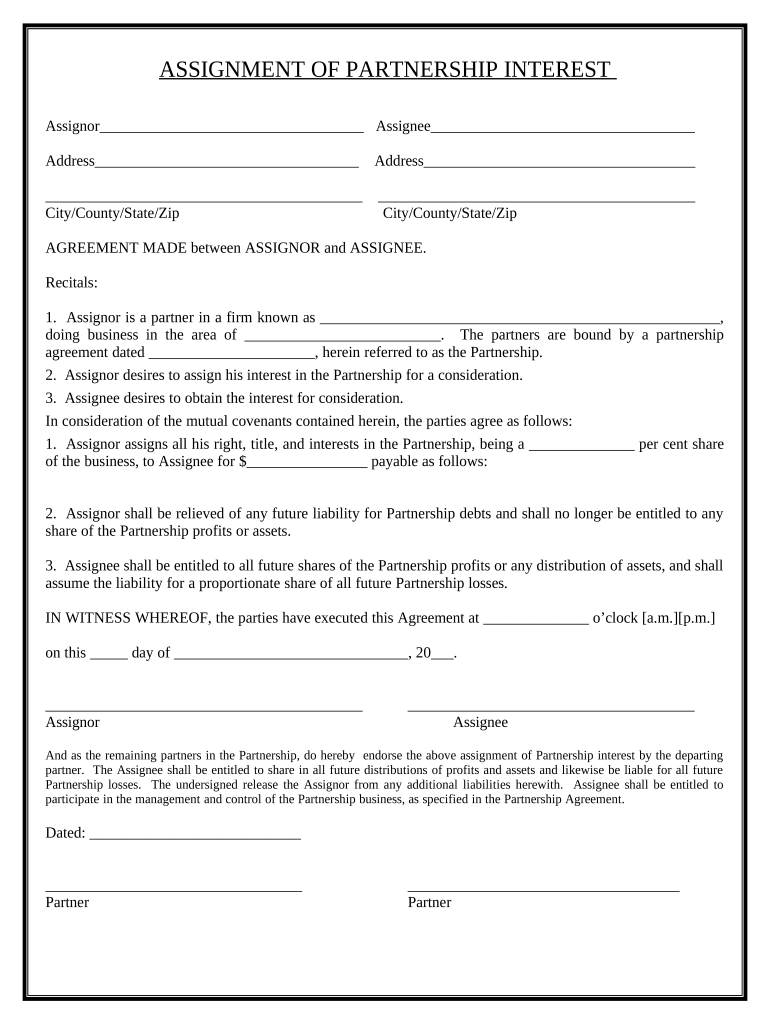

The Partnership Interest Assignment Pdf is a legal document used to transfer an individual's ownership interest in a partnership to another party. This form serves as a formal record of the assignment, detailing the terms under which the interest is transferred. It is essential for maintaining accurate partnership records and for ensuring that all parties involved understand the terms of the transfer. The document typically includes information such as the names of the assignor and assignee, the percentage of interest being transferred, and any conditions or restrictions related to the transfer.

How to use the Partnership Interest Assignment Pdf

Using the Partnership Interest Assignment Pdf involves several straightforward steps. First, ensure that you have the latest version of the form. Next, fill in the required fields, including the names and addresses of both the assignor and assignee, as well as the specific details of the interest being assigned. After completing the form, both parties should review it for accuracy. Once confirmed, the assignor must sign the document, and it may require notarization depending on state laws. Finally, distribute copies of the signed document to all relevant parties and retain a copy for your records.

Steps to complete the Partnership Interest Assignment Pdf

Completing the Partnership Interest Assignment Pdf requires careful attention to detail. Follow these steps:

- Obtain the correct version of the Partnership Interest Assignment Pdf.

- Fill in the names and addresses of the assignor and assignee.

- Specify the percentage of partnership interest being assigned.

- Include any conditions or restrictions related to the assignment.

- Sign the document in the presence of a notary if required.

- Distribute copies to all parties involved.

Legal use of the Partnership Interest Assignment Pdf

The legal use of the Partnership Interest Assignment Pdf is governed by state laws regarding partnership agreements. To ensure that the assignment is legally binding, it is crucial to comply with any specific requirements outlined in the partnership agreement and state statutes. This may include obtaining consent from other partners or adhering to specific notice requirements. Proper execution of the document, including signatures and notarization if necessary, will help protect the interests of all parties involved and ensure the assignment is enforceable in a court of law.

Key elements of the Partnership Interest Assignment Pdf

Several key elements must be included in the Partnership Interest Assignment Pdf to ensure its validity:

- Names and addresses: Clearly state the names and addresses of both the assignor and assignee.

- Percentage of interest: Specify the exact percentage of partnership interest being transferred.

- Conditions of transfer: Include any conditions or limitations that apply to the assignment.

- Signatures: Ensure that both parties sign the document, with notarization if required.

- Date: Record the date of the assignment to establish a timeline.

Examples of using the Partnership Interest Assignment Pdf

There are various scenarios in which the Partnership Interest Assignment Pdf may be utilized. For instance, a partner may wish to sell their interest to a new investor, or they may want to transfer their share to a family member for estate planning purposes. Additionally, partnerships may use this form when restructuring their ownership or when a partner retires and wishes to exit the business. Each of these situations requires careful completion of the assignment form to ensure that the transfer is legally recognized and properly documented.

Quick guide on how to complete partnership interest assignment pdf

Effortlessly Prepare Partnership Interest Assignment Pdf on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, amend, and eSign your documents without delays. Manage Partnership Interest Assignment Pdf on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Steps to Revise and eSign Partnership Interest Assignment Pdf with Ease

- Obtain Partnership Interest Assignment Pdf and click on Get Form to initiate the process.

- Utilize the provided tools to fill out your form.

- Highlight important sections of your documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or misfiled documents, frustrating form hunts, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Revise and eSign Partnership Interest Assignment Pdf and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an interest form assignment in the context of airSlate SignNow?

An interest form assignment allows users to create and manage forms that can capture important information from clients or team members. With airSlate SignNow, this process is simplified, ensuring that all data is efficiently gathered and stored electronically. This tool is especially useful for streamlining communication and maintaining organized records.

-

How does airSlate SignNow facilitate the interest form assignment process?

airSlate SignNow provides an intuitive interface for designing and assigning interest forms. Users can easily customize templates to suit their specific needs, making the interest form assignment process efficient. Additionally, real-time collaboration features ensure that multiple users can contribute, enhancing teamwork and reducing response time.

-

What are the pricing options for using airSlate SignNow for interest form assignments?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Each plan includes features for interest form assignment, along with other functionalities such as eSignature capabilities. This flexibility allows businesses to choose a plan based on their volume and usage requirements.

-

Can I integrate airSlate SignNow with other tools for managing interest form assignments?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations enhance the interest form assignment process by enabling users to manage documents and track responses in real-time across platforms. This connectivity supports workflows and improves overall efficiency.

-

What are the key benefits of using airSlate SignNow for interest form assignments?

Using airSlate SignNow for interest form assignments offers several benefits, including enhanced productivity, reduced paperwork, and improved data accuracy. The platform ensures that forms are completed quickly and securely, streamlining the entire process. Additionally, the eSigning feature helps expedite approvals, making it ideal for fast-paced environments.

-

Is it easy to customize interest form assignments in airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly tools that allow you to customize your interest form assignments with ease. Whether you need to change the layout, add fields, or adjust settings, the drag-and-drop interface makes it straightforward. This flexibility ensures that your forms can meet diverse needs across different contexts.

-

What security measures does airSlate SignNow implement for interest form assignments?

airSlate SignNow prioritizes the security of your interest form assignments by implementing robust encryption and compliance protocols. All documents are securely stored, ensuring that sensitive information remains confidential. Additionally, user authentication measures protect against unauthorized access, giving you peace of mind.

Get more for Partnership Interest Assignment Pdf

- Georgia science and engineering fair engage georgia form

- Georgia science teachers association awards application form

- Camp staff application pathfinder lodge vpccministries form

- Severance trucking bill of lading form

- Employee information amp

- Please attach a resum if not specified on the resum form

- Marching band sponsorship letter form

- Umt scholarship program for us public high school seniors form

Find out other Partnership Interest Assignment Pdf

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement