Utah Statement Form

What is the Utah Statement Form

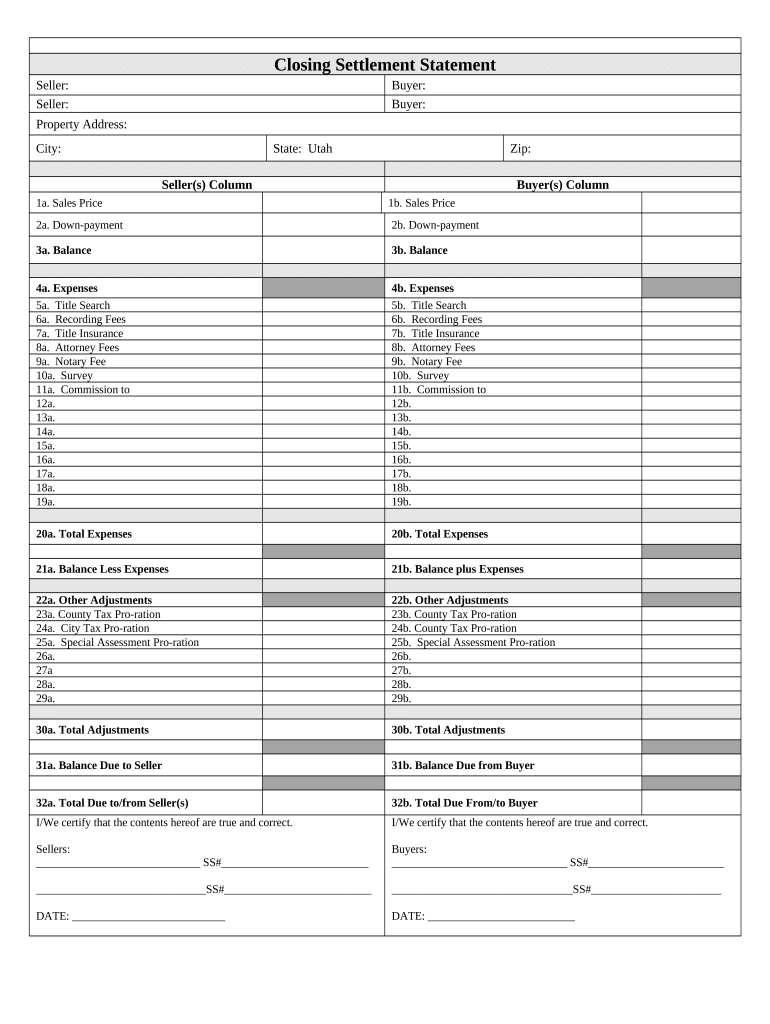

The Utah Statement Form is a legal document used primarily for various declarations and statements required by the state of Utah. This form is often utilized in situations involving financial disclosures, legal proceedings, or other official matters where a formal statement is necessary. It serves as a means for individuals or businesses to provide essential information to governmental agencies or other parties, ensuring compliance with state regulations.

How to use the Utah Statement Form

Using the Utah Statement Form involves several steps to ensure that the information provided is accurate and complete. First, obtain the form from an official source, such as the state government website or authorized offices. Next, carefully read the instructions accompanying the form to understand the requirements. Fill out the form with the necessary details, ensuring all information is truthful and up-to-date. After completing the form, it may need to be signed and dated, depending on the specific requirements outlined in the instructions.

Steps to complete the Utah Statement Form

Completing the Utah Statement Form requires attention to detail. Follow these steps:

- Access the form from an official source.

- Review the instructions thoroughly to understand what information is needed.

- Fill in your personal or business details as required.

- Double-check all entries for accuracy and completeness.

- Sign and date the form if required.

- Submit the form according to the specified submission methods.

Legal use of the Utah Statement Form

The legal use of the Utah Statement Form is crucial for ensuring that the information provided is recognized by courts and government agencies. To be legally binding, the form must meet specific criteria, including proper completion and signature. Additionally, it is important to comply with relevant state laws regarding the submission and handling of such documents. Utilizing a reliable digital platform can enhance the security and validity of the form, ensuring compliance with eSignature laws.

Key elements of the Utah Statement Form

Key elements of the Utah Statement Form typically include:

- Identification of the individual or entity submitting the form.

- Clear statement of the information being declared.

- Signature of the individual or authorized representative.

- Date of submission.

- Any required attachments or supporting documents.

Form Submission Methods

The Utah Statement Form can usually be submitted through various methods, depending on the specific requirements. Common submission methods include:

- Online submission via the state’s official website or authorized platforms.

- Mailing the completed form to the designated office.

- In-person submission at local government offices.

Quick guide on how to complete utah statement form

Easily create Utah Statement Form on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct template and safely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Utah Statement Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Utah Statement Form effortlessly

- Obtain Utah Statement Form and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Utah Statement Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Utah statement form and how can airSlate SignNow help with it?

A Utah statement form is an essential document used in various business transactions. airSlate SignNow simplifies the process by allowing users to easily create, send, and eSign these forms online. Our platform ensures that your Utah statement form is handled efficiently, saving you time and reducing the chances of errors.

-

How much does it cost to use airSlate SignNow for my Utah statement form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can start with a free trial to test the features, and our paid plans are competitively priced to ensure you can manage your Utah statement forms cost-effectively. Contact our sales team for detailed pricing information and find the best option for your organization.

-

What features does airSlate SignNow offer for Utah statement forms?

airSlate SignNow provides a variety of features to streamline the management of Utah statement forms. These include customizable templates, secure eSigning, automated reminders, and document tracking. With these tools, you can enhance your workflow and ensure your forms are completed quickly and accurately.

-

Are there any integrations available to help manage Utah statement forms?

Yes, airSlate SignNow integrates seamlessly with popular tools such as Google Drive, Dropbox, and Microsoft Office. These integrations allow you to easily upload, edit, and send your Utah statement forms without leaving your favorite applications. This convenience can signNowly improve your productivity and document management workflow.

-

Is airSlate SignNow compliant with regulatory standards for Utah statement forms?

Absolutely! airSlate SignNow complies with industry regulations and standards, ensuring that your Utah statement forms meet legal requirements. We prioritize the security and integrity of your documents, providing peace of mind that your information is protected throughout the eSigning process.

-

Can I customize my Utah statement form using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Utah statement form to fit your business needs. You can add your branding, modify fields, and create unique workflows tailored to your requirements. This flexibility makes it easy to align your documents with your organizational standards.

-

How can I track the status of my Utah statement forms sent through airSlate SignNow?

Tracking the status of your Utah statement forms is simple with airSlate SignNow. Our platform provides real-time updates on the progress of your documents, allowing you to see who has viewed or signed the form. This feature helps you stay informed and manage your document workflow effectively.

Get more for Utah Statement Form

Find out other Utah Statement Form

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now