Living Trust for Husband and Wife with One Child Utah Form

What is the Living Trust For Husband And Wife With One Child Utah

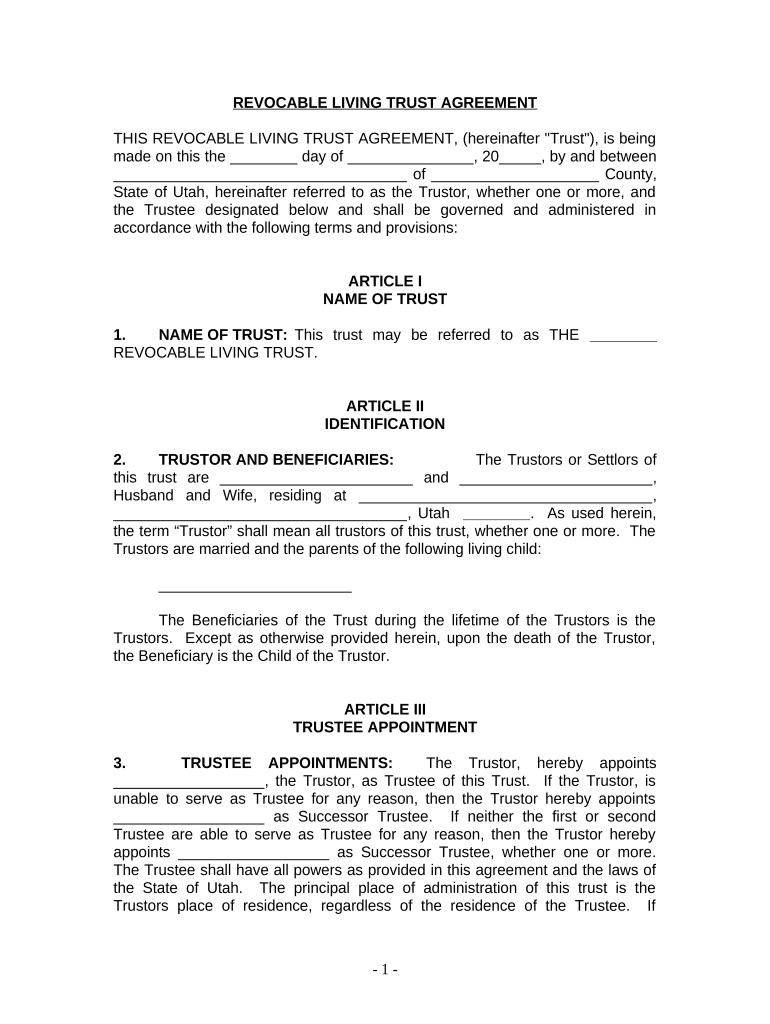

A living trust for husband and wife with one child in Utah is a legal arrangement that allows couples to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This type of trust can help avoid the lengthy probate process, ensuring a smoother transition of assets to the surviving spouse and child. It typically includes provisions for both spouses and outlines specific instructions regarding the care and financial support of the child. Establishing this trust can provide peace of mind, knowing that family assets are protected and distributed according to the couple's wishes.

Key Elements of the Living Trust For Husband And Wife With One Child Utah

Several key elements define a living trust for husband and wife with one child in Utah:

- Trustees: The couple usually serves as the initial trustees, managing the trust assets while they are alive.

- Beneficiaries: The surviving spouse and child are typically named as beneficiaries, ensuring they receive the trust assets upon the couple's passing.

- Asset Management: The trust outlines how assets are managed and distributed, including provisions for the child's education and support.

- Revocability: This type of trust is often revocable, allowing the couple to make changes as their circumstances evolve.

Steps to Complete the Living Trust For Husband And Wife With One Child Utah

Completing a living trust for husband and wife with one child in Utah involves several important steps:

- Identify Assets: List all assets that will be included in the trust, such as real estate, bank accounts, and investments.

- Choose Trustees: Decide who will manage the trust, typically the couple themselves, and designate successor trustees.

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including beneficiaries and asset distribution.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legality.

- Fund the Trust: Transfer ownership of the identified assets into the trust to ensure they are managed according to the trust terms.

Legal Use of the Living Trust For Husband And Wife With One Child Utah

The legal use of a living trust for husband and wife with one child in Utah allows for the seamless transfer of assets upon death, avoiding probate. This trust is recognized by state law, provided it meets specific legal requirements. It can also be utilized to manage assets in the event of incapacity, ensuring that the couple's wishes are honored even if they cannot make decisions themselves. The trust document must comply with Utah state laws to be enforceable, which includes proper execution and notarization.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Utah

Utah has specific rules governing living trusts that couples should be aware of:

- Notarization: Trust documents must be notarized to be legally binding in Utah.

- Property Transfer: Assets must be properly transferred into the trust to ensure they are covered by its terms.

- Trustee Responsibilities: Trustees have a fiduciary duty to manage the trust in the best interest of the beneficiaries.

- Tax Considerations: Couples should consider potential tax implications when establishing a trust, including property taxes and estate taxes.

How to Obtain the Living Trust For Husband And Wife With One Child Utah

Obtaining a living trust for husband and wife with one child in Utah can be accomplished through several methods:

- Legal Assistance: Consulting with an estate planning attorney can provide tailored advice and ensure compliance with state laws.

- Online Resources: Various online platforms offer templates and tools to create a living trust, though legal guidance is recommended for accuracy.

- Financial Institutions: Some banks and financial advisors offer estate planning services, including the creation of living trusts.

Quick guide on how to complete living trust for husband and wife with one child utah

Complete Living Trust For Husband And Wife With One Child Utah effortlessly on any device

Web-based document management has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and without delays. Manage Living Trust For Husband And Wife With One Child Utah on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Living Trust For Husband And Wife With One Child Utah with ease

- Locate Living Trust For Husband And Wife With One Child Utah and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow provides expressly for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Living Trust For Husband And Wife With One Child Utah and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Utah?

A Living Trust For Husband And Wife With One Child in Utah is a legal document that allows couples to manage their assets and ensure a smooth transfer of property to their child upon their passing. This trust can help avoid probate, maintain privacy, and provide specific instructions for asset distribution. Establishing this trust is a proactive step in estate planning, catering to the unique needs of Utah residents.

-

What are the benefits of setting up a Living Trust For Husband And Wife With One Child in Utah?

Setting up a Living Trust For Husband And Wife With One Child in Utah provides several benefits, including avoiding lengthy probate processes and reducing estate taxes. Additionally, it ensures that your child's needs are met after your passing, offering peace of mind to parents. A living trust also allows for greater control over how assets are managed and distributed.

-

How much does a Living Trust For Husband And Wife With One Child in Utah cost?

The cost of establishing a Living Trust For Husband And Wife With One Child in Utah can vary widely based on the complexity of your estate and the services included. Generally, legal fees range from a few hundred to several thousand dollars. However, many find that the long-term benefits and savings from avoiding probate can far outweigh the initial costs.

-

How does a Living Trust differ from a will in Utah?

A Living Trust For Husband And Wife With One Child in Utah differs from a will primarily in how assets are managed after death. Unlike a will, which goes through probate, a living trust allows for immediate transfer of assets to beneficiaries without court involvement. This difference can lead to faster, smoother transitions in estate management.

-

Can I change my Living Trust For Husband And Wife With One Child in Utah?

Yes, you can modify or revoke your Living Trust For Husband And Wife With One Child in Utah as your circumstances or wishes change. It's essential to keep your trust updated to reflect any life changes, such as the birth of additional children or changes in financial status. Working with a legal professional can ensure changes are made correctly and efficiently.

-

Is a Living Trust For Husband And Wife With One Child in Utah necessary if I already have a will?

While having a will is essential, a Living Trust For Husband And Wife With One Child in Utah can provide additional benefits that a will cannot, such as avoiding probate. A trust offers more control over asset distribution and can expedite the process for your beneficiaries. Many find that combining a will with a living trust creates a comprehensive estate planning strategy.

-

What assets can be included in a Living Trust For Husband And Wife With One Child in Utah?

You can include various assets in a Living Trust For Husband And Wife With One Child in Utah, such as real estate, bank accounts, investments, and personal property. The flexibility of a living trust allows you to specify which assets are to be managed and distributed according to your wishes. Ensuring all relevant assets are part of the trust will facilitate easier transitions for your beneficiaries.

Get more for Living Trust For Husband And Wife With One Child Utah

Find out other Living Trust For Husband And Wife With One Child Utah

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple