Living Trust for Husband and Wife with Minor and or Adult Children Utah Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children Utah

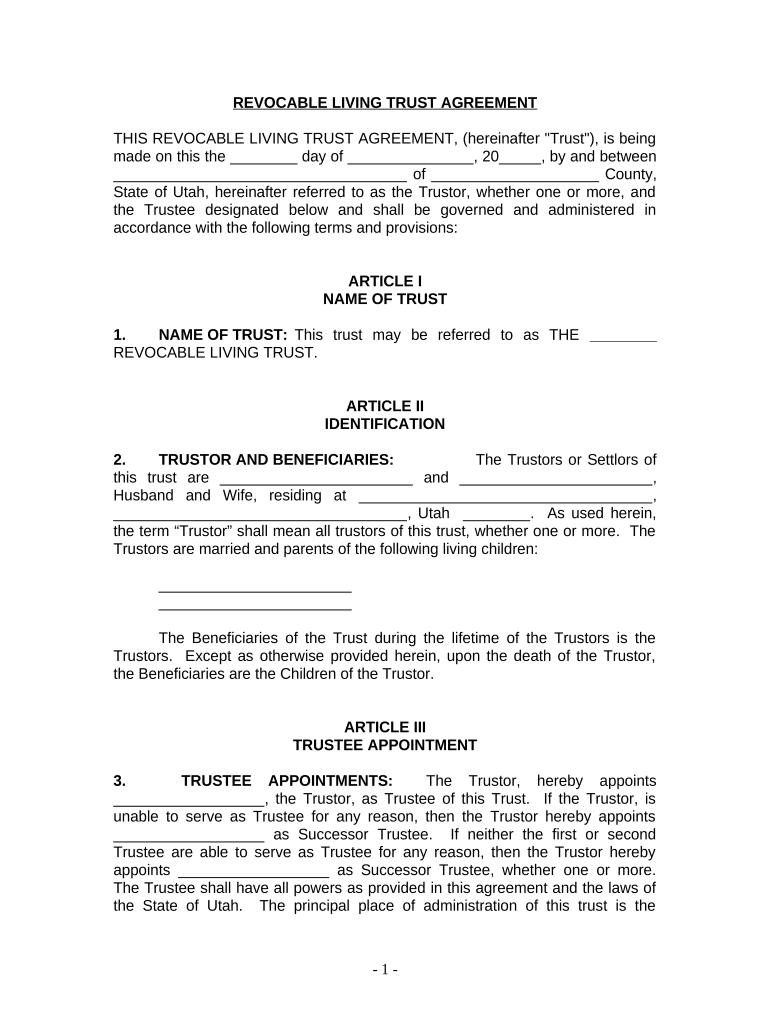

A living trust for husband and wife with minor and/or adult children in Utah is a legal arrangement that allows couples to manage their assets during their lifetime and facilitate the transfer of those assets upon death. This type of trust is particularly beneficial for couples with children, as it provides a structured way to ensure that assets are distributed according to their wishes. By establishing this trust, couples can avoid the lengthy and often costly probate process, ensuring a smoother transition for their heirs.

The trust can include various assets, such as real estate, bank accounts, and investments. It allows both spouses to act as co-trustees, giving them joint control over the assets while they are alive. Upon the death of one spouse, the surviving spouse typically continues to manage the trust, and upon the death of both, the assets are distributed to the children as outlined in the trust document.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children Utah

Several key elements define a living trust for husband and wife with minor and/or adult children in Utah:

- Trustees: Typically, both spouses serve as co-trustees, allowing them to manage the trust together.

- Beneficiaries: The couple's children, whether minor or adult, are usually named as beneficiaries, ensuring they receive the trust assets after the parents' passing.

- Asset Management: The trust outlines how assets are to be managed during the couple's lifetime and specifies distribution methods after death.

- Revocability: Most living trusts are revocable, meaning the couple can modify or dissolve the trust at any time while they are alive.

- Successor Trustees: The trust document should designate successor trustees who will take over management if both spouses pass away.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children Utah

Completing a living trust for husband and wife with minor and/or adult children in Utah involves several important steps:

- Consult an Attorney: Seek legal advice to ensure the trust meets all legal requirements and reflects your wishes.

- Gather Information: Collect details about your assets, including real estate, bank accounts, and investments.

- Draft the Trust Document: Work with your attorney to draft a trust document that outlines the terms, trustees, and beneficiaries.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary to ensure its validity.

- Fund the Trust: Transfer ownership of your assets into the trust to ensure they are managed according to the trust's terms.

- Review Regularly: Periodically review and update the trust to reflect any changes in your circumstances or wishes.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children Utah

The legal use of a living trust for husband and wife with minor and/or adult children in Utah is governed by state laws. This trust serves as a valid estate planning tool that can help avoid probate, reduce estate taxes, and provide clear instructions for asset distribution. It is important to ensure that the trust is properly executed, funded, and maintained to uphold its legal standing.

Additionally, the trust should comply with Utah's specific laws regarding trusts and estates. This includes ensuring that the trust document is clear and comprehensive, detailing the roles of trustees and beneficiaries, as well as the management and distribution of assets.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children Utah

In Utah, specific rules apply to living trusts that couples should be aware of:

- Witness Requirements: While notarization is essential, having witnesses sign the trust document may also be advisable for added legal protection.

- Property Title Transfers: To fund the trust, property titles must be changed to reflect the trust as the new owner, which requires specific documentation.

- Tax Implications: Understand the tax implications of transferring assets into the trust, as this may affect both income and estate taxes.

- Modification and Revocation: Utah law allows for the modification or revocation of a living trust as long as both spouses are alive and competent.

Quick guide on how to complete living trust for husband and wife with minor and or adult children utah

Complete Living Trust For Husband And Wife With Minor And Or Adult Children Utah effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With Minor And Or Adult Children Utah on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Utah with ease

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Utah and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or missorted files, cumbersome form searching, or errors that necessitate reprinting documents. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choosing. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Utah and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With Minor And Or Adult Children Utah?

A Living Trust For Husband And Wife With Minor And Or Adult Children Utah is a legal document that allows couples to manage and distribute their assets while providing for their children. This type of trust helps avoid probate, ensuring a smoother transition of assets upon death. It protects your family's future by establishing guidelines for asset management.

-

How does a Living Trust For Husband And Wife With Minor And Or Adult Children Utah benefit my family?

This trust provides a structured way to handle your assets, ensuring that your minor or adult children are cared for according to your wishes. By avoiding probate, your family can access funds and property more quickly. Additionally, it provides peace of mind knowing that your loved ones are financially protected.

-

What are the costs associated with creating a Living Trust For Husband And Wife With Minor And Or Adult Children Utah?

The cost of establishing a Living Trust For Husband And Wife With Minor And Or Adult Children Utah can vary based on complex needs and services offered. Typically, you can expect to spend between $1,000 to $3,000 depending on the attorney and specifics of the trust. Using online solutions may offer more cost-effective alternatives.

-

Can I customize my Living Trust For Husband And Wife With Minor And Or Adult Children Utah?

Yes, a Living Trust For Husband And Wife With Minor And Or Adult Children Utah can be tailored to meet your specific needs. You can specify how and when your children receive their inheritance and outline provisions for their care. Customizing your trust ensures it reflects your values and intentions.

-

Does a Living Trust For Husband And Wife With Minor And Or Adult Children Utah protect against creditors?

A Living Trust For Husband And Wife With Minor And Or Adult Children Utah can offer inherent protection from some creditors during your lifetime. However, it may not completely shield assets after death, depending on state laws and creditors' rights. Consulting with a legal expert can help you understand the limitations of creditor protection in your scenario.

-

Is it necessary to update my Living Trust For Husband And Wife With Minor And Or Adult Children Utah?

Yes, it is essential to review and update your Living Trust For Husband And Wife With Minor And Or Adult Children Utah as your family and financial circumstances change. Major life events, like births, deaths, or changes in assets, can necessitate amendments to ensure your trust still reflects your wishes. Regular updates can prevent complications down the road.

-

What integrations are available with my Living Trust For Husband And Wife With Minor And Or Adult Children Utah?

When using airSlate SignNow, you can integrate your Living Trust For Husband And Wife With Minor And Or Adult Children Utah with various cloud storage solutions and document management systems. This allows for easier access and management of your trust documents. Streamlining these processes ensures you can efficiently update and share your trust details as needed.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Utah

- Macromolecules in my food answer key form

- Atestado junta medica pdff form

- National housing development trust cayman form

- Bicol form college

- Ds 2019 application for j 1 status sponsorship a d f cedars sinai form

- Simply energy refund form

- Name of person renting the field form

- Rapid access prostate clinic form bon secours hospital bonsecours

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Utah

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple