Income Tax Clearance Form

What is the Income Tax Clearance Form

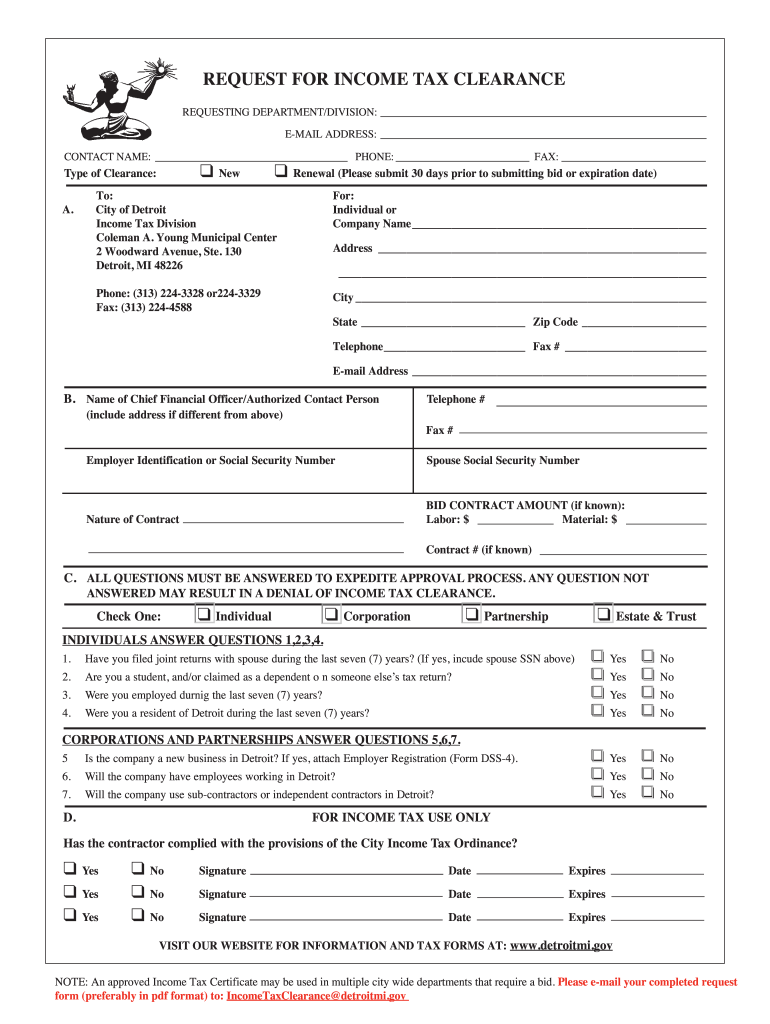

The Income Tax Clearance Form is an official document issued by the tax authority that certifies an individual or business has met all tax obligations. This form is often required for various transactions, such as applying for loans, securing government contracts, or completing real estate transactions. It serves as proof that the taxpayer is in good standing with the IRS or state tax agency, ensuring there are no outstanding tax liabilities.

How to obtain the Income Tax Clearance Form

To obtain the Income Tax Clearance Form, taxpayers can follow a straightforward process. First, they should contact their local tax authority or visit their official website to find the specific requirements for requesting the form. Typically, taxpayers may need to provide identification details, such as their Social Security number or Employer Identification Number (EIN). Some states allow online requests, while others may require submission via mail or in person.

Steps to complete the Income Tax Clearance Form

Completing the Income Tax Clearance Form involves several key steps. Begin by carefully reading the instructions provided with the form to ensure accurate completion. Next, fill in personal information, including your name, address, and tax identification number. It is crucial to report any income and tax payments accurately. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Key elements of the Income Tax Clearance Form

The Income Tax Clearance Form includes several essential elements that must be accurately filled out. Key components typically include:

- Taxpayer Information: This includes the full name, address, and tax identification number.

- Tax Year: Specify the tax year for which the clearance is requested.

- Declaration: A statement confirming that all tax obligations have been met.

- Signature: The taxpayer's signature is required to validate the form.

Legal use of the Income Tax Clearance Form

The legal use of the Income Tax Clearance Form is significant, as it serves as a formal declaration of a taxpayer's compliance with tax laws. This form can be required during various legal and financial transactions, such as applying for business licenses, securing loans, or participating in government contracts. It is vital for taxpayers to ensure that the form is accurately completed and submitted to avoid any legal repercussions or delays in their transactions.

Required Documents

When applying for an Income Tax Clearance Form, certain documents may be required to verify the taxpayer's identity and tax status. Commonly required documents include:

- Proof of Identity: Such as a driver's license or passport.

- Tax Returns: Copies of recent tax returns may be necessary to confirm compliance.

- Payment Records: Documentation of any tax payments made during the specified tax year.

Quick guide on how to complete income tax clearance form

Accomplish Income Tax Clearance Form seamlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the essentials you need to generate, modify, and eSign your documents promptly without delays. Manage Income Tax Clearance Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Income Tax Clearance Form effortlessly

- Find Income Tax Clearance Form and click Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Income Tax Clearance Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

Which income tax form should be filled out by a beautician?

As a beautician, since you are self-employed, your income would come under the source- income from business or profession. So you could either file your ITR using ITR3 (if you wish to file normally) or you can use ITR4 (if you wish to file on presumptive basis).Hope you find my answer helpfulFeel free to contact me at abhinandansethia90@gmail.com for any assistanceRegardsAbhinandan

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the income tax clearance form

How to make an eSignature for your Income Tax Clearance Form in the online mode

How to make an electronic signature for the Income Tax Clearance Form in Google Chrome

How to create an eSignature for putting it on the Income Tax Clearance Form in Gmail

How to make an electronic signature for the Income Tax Clearance Form from your smartphone

How to make an electronic signature for the Income Tax Clearance Form on iOS devices

How to make an eSignature for the Income Tax Clearance Form on Android

People also ask

-

What is an Income Tax Clearance Form and why do I need it?

The Income Tax Clearance Form is an official document that certifies an individual's or business's tax compliance status. It's essential for proving that all taxes have been paid or are in good standing before engaging in various financial transactions or legal agreements.

-

How can airSlate SignNow help me with my Income Tax Clearance Form?

With airSlate SignNow, you can easily create, send, and eSign your Income Tax Clearance Form online. Our platform streamlines the process, ensuring you complete your documentation efficiently and securely, which is crucial for timely tax compliance.

-

Is there a cost associated with using airSlate SignNow for Income Tax Clearance Forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features that facilitate the smooth processing of documents like the Income Tax Clearance Form, ensuring you find an option that fits your budget.

-

What features does airSlate SignNow offer for managing Income Tax Clearance Forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking for your Income Tax Clearance Form. These tools enhance productivity and ensure your documents are handled with utmost efficiency.

-

Can I integrate airSlate SignNow with other software for my Income Tax Clearance Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM and accounting software. This integration allows you to manage your Income Tax Clearance Form and other documents in one centralized location, improving workflow efficiency.

-

How secure is my Income Tax Clearance Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Income Tax Clearance Form and all other documents, ensuring that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for my Income Tax Clearance Form?

Using airSlate SignNow for your Income Tax Clearance Form offers numerous benefits, including faster processing times, reduced paper waste, and enhanced collaboration. Our user-friendly platform empowers you to manage your documentation efficiently, saving you time and resources.

Get more for Income Tax Clearance Form

- Claimants first set of request for production mississippi form

- Request for production of documents to carrier mississippi form

- Zoning form

- Office lease agreement mississippi form

- Financial statement mississippi form

- Certificate of compliance mississippi form

- Mississippi notice form

- Commercial sublease mississippi form

Find out other Income Tax Clearance Form

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement