Tax Client Information Sheet Template 2014-2026

What is the Tax Client Information Sheet Template

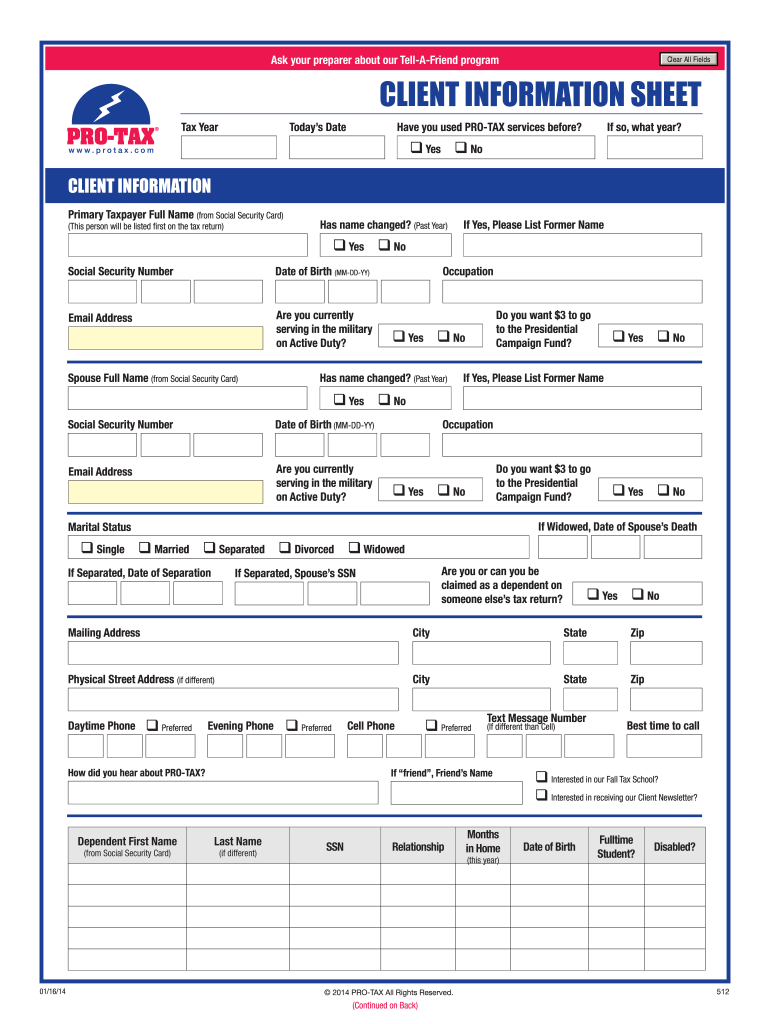

The Tax Client Information Sheet Template is a structured document designed to collect essential information from clients for tax preparation purposes. This template typically includes sections for personal details, income sources, deductions, and credits applicable to the client's tax situation. By utilizing this template, tax professionals can streamline the information-gathering process, ensuring that all relevant data is captured efficiently and accurately.

Key elements of the Tax Client Information Sheet Template

Several key elements are crucial for a comprehensive Tax Client Information Sheet Template. These include:

- Client Identification: Full name, address, Social Security number, and contact information.

- Income Details: Sources of income such as wages, self-employment earnings, rental income, and dividends.

- Deductions and Credits: Information on potential deductions such as mortgage interest, medical expenses, and education credits.

- Filing Status: Selection of the appropriate filing status, such as single, married filing jointly, or head of household.

- Taxpayer Signature: A section for the client to sign, confirming the accuracy of the information provided.

Steps to complete the Tax Client Information Sheet Template

Completing the Tax Client Information Sheet Template involves several straightforward steps:

- Gather Personal Information: Collect all necessary personal details, including identification and contact information.

- Document Income Sources: List all income sources and gather relevant documents, such as W-2s and 1099s.

- Identify Deductions: Review potential deductions and credits that may apply to the client’s situation.

- Fill Out the Template: Enter all gathered information into the template accurately.

- Review and Sign: Ensure all information is correct, then have the client sign the document to validate it.

Legal use of the Tax Client Information Sheet Template

The legal use of the Tax Client Information Sheet Template is supported by compliance with various tax regulations and guidelines. This template serves as a formal record of the information provided by the client, which can be critical in case of audits or disputes. It is essential to ensure that the template adheres to IRS guidelines and maintains the confidentiality of the client's data, as required by laws such as the Gramm-Leach-Bliley Act and the IRS Publication 4557.

How to obtain the Tax Client Information Sheet Template

The Tax Client Information Sheet Template can be obtained through various means. Tax professionals often create customized versions tailored to their practice. Alternatively, templates can be found online through reputable tax preparation resources or software platforms. It is advisable to choose a template that aligns with current IRS requirements and includes all necessary sections for comprehensive data collection.

IRS Guidelines

IRS guidelines provide essential information regarding the requirements for tax documentation and client data collection. Tax professionals must ensure that the Tax Client Information Sheet Template complies with IRS regulations, including proper record-keeping practices and confidentiality standards. Adhering to these guidelines helps prevent potential penalties and ensures accurate tax filings.

Quick guide on how to complete client information sheet pro tax

Discover how to effortlessly navigate the Tax Client Information Sheet Template execution with this straightforward guide

Filing electronically and completing forms online is growing in popularity and has become the preferred method for a diverse range of clients. It provides numerous advantages over traditional printed documents, including convenience, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can find, modify, signNow, enhance, and dispatch your Tax Client Information Sheet Template without being bogged down in endless printing and scanning. Follow this brief guide to initiate and finalize your form.

Utilize these steps to obtain and complete Tax Client Information Sheet Template

- Begin by clicking the Get Form button to access your document in our editor.

- Refer to the green indicator on the left that points out required fields so you don’t miss them.

- Take advantage of our advanced features to annotate, modify, sign, secure, and enhance your document.

- Secure your document or transform it into a fillable form using the appropriate tab functions.

- Review the document and check for mistakes or inconsistencies.

- Click DONE to complete your edits.

- Rename your form or keep it unchanged.

- Choose the storage service where you want to save your document, send it using USPS, or click the Download Now button to retrieve your form.

If Tax Client Information Sheet Template isn't what you were looking for, you can explore our extensive library of pre-uploaded templates that you can fill out with minimal effort. Check out our solution today!

Create this form in 5 minutes or less

FAQs

-

Do large consulting firms like McKinsey, Accenture, or BCG still have their staff members fill out time sheets? If not, how do they specifically track profitability by client projects?

As the others have said- yes, all consulting firms have staff fill out timesheets.One interesting thing- many staff work more than 40 or 50 hours- and work more hours than the project budget allows for. So each firm must determine how it wants to track the ‘extra’ hours. The simplistic approach is to tell staff ‘just bill 44 {or whatever the weekly total is} hours to the project’- as this simplifies accounting. The more accurate approach is harder: staff record every hour worked and code it to the relevant activity (internal / client). This requires some discipline about using ‘shadow’ client codes so that you bill them the time agreed in the contract {e.g., 44 hours/week} but then the consulting firm gets a sense of how many hours staff are truly working {probably 50–70 hours}.You mentioned project profitability- while timesheets do provide the data to compute basic project profitability, there is a lot more to this topic. There are a couple of really key profit levers that would not be addressed via timesheet data: follow-on sales and staff retentionFollow-on rate: To the extent that a project leads to a string of future projects, that project was VERY profitable, as it decreased the overall cost of sales on future work. This has a major impact on overall profitability, so one must account for projects’ differential follow-on rates in some way.Staff retention: good staff are very expensive to recruit and retain. Some projects can be real attrition machines (poor scope, poor leadership, unrealistic demands, etc) and firms need to understand if a given project can be logically tied to disproportionate staff attrition. If so, that project wasn’t nearly as profitable as it seemed via timesheet analysis. One analysis could be comparing billed hours versus total hours worked, and then for the outliers, note if there was higher attrition 6–12 months later.Of course, there are other considerations as well but I wanted to highlight a couple that showed how timesheet data is necessary but not sufficient to understand project profitability.

-

What is the procedure for filling out the candidate information sheet of Cognizant online?

S Kiran's answer to What should every engineering student know before joining TCS, CTS, Wipro, Infosys, Accenture, HCL, or IBM?

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

When I fill out my tax information for a new employer, what do I put for max withholding, to get the biggest possible tax return?

It sounds like you wish to get a large tax return. In that case when filling out your W-4 form you should claim S-0 (that’s single with zero exemptions). This means that your employer will take out the maximum amount. For those people who insist upon the government having use of their money all year there is also an option to have additional funds taken out and held and then returned when your annual return is filed. For that matter you could allow the government to keep it all during the year and then when you file your return instead of taking a refund just tell them to keep it toward next years return. Seriously, I know the large tax return seems nice and for some people that is how they save for vacations and other things, but a tax return is not a gift from the USA. It is your money and receiving a large tax return means that you allowed someone else to have your money for a year without paying you interest for the privilege of keeping your money.

Create this form in 5 minutes!

How to create an eSignature for the client information sheet pro tax

How to make an electronic signature for the Client Information Sheet Pro Tax in the online mode

How to generate an eSignature for the Client Information Sheet Pro Tax in Chrome

How to make an eSignature for putting it on the Client Information Sheet Pro Tax in Gmail

How to create an eSignature for the Client Information Sheet Pro Tax right from your smart phone

How to create an electronic signature for the Client Information Sheet Pro Tax on iOS devices

How to generate an electronic signature for the Client Information Sheet Pro Tax on Android devices

People also ask

-

What is a Tax Client Information Sheet Template?

A Tax Client Information Sheet Template is a structured document designed to gather essential information from clients for tax preparation. This template streamlines the process of collecting data, ensuring all necessary details are captured efficiently. By using a Tax Client Information Sheet Template, accountants can save time and reduce errors during tax season.

-

How can I access the Tax Client Information Sheet Template through airSlate SignNow?

To access the Tax Client Information Sheet Template, simply sign up for an account on airSlate SignNow. Once logged in, you can browse our library of templates and select the Tax Client Information Sheet Template for your needs. This user-friendly platform makes it easy to customize and send the template to your clients.

-

What features does the Tax Client Information Sheet Template offer?

The Tax Client Information Sheet Template includes customizable fields, electronic signature capabilities, and secure cloud storage. These features enhance the user experience by allowing you to modify the template according to your specific requirements while ensuring the information is safely stored and easily accessible.

-

Is the Tax Client Information Sheet Template suitable for all types of businesses?

Yes, the Tax Client Information Sheet Template is designed to meet the needs of various businesses, including freelancers, small businesses, and large enterprises. Its adaptability allows it to cater to different industries and client requirements, making it an essential tool for anyone involved in tax preparation.

-

Can I integrate the Tax Client Information Sheet Template with other software?

Absolutely! airSlate SignNow allows seamless integration of the Tax Client Information Sheet Template with various software applications like accounting tools and customer relationship management systems. This integration helps streamline your workflow and ensures that all client data is synchronized across platforms.

-

What are the pricing options for using the Tax Client Information Sheet Template?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including a free trial to explore the features of the Tax Client Information Sheet Template. After the trial, you can choose a plan that fits your budget, allowing you to access premium features and templates at an affordable price.

-

How does the Tax Client Information Sheet Template improve client communication?

Using the Tax Client Information Sheet Template enhances client communication by providing a clear and organized format for gathering information. Clients can easily fill out the template, and accountants can request signatures electronically, minimizing back-and-forth emails and ensuring a smoother process. This clarity fosters better relationships and trust between clients and tax professionals.

Get more for Tax Client Information Sheet Template

- Petition to change name mississippi form

- Mississippi name change form

- Mississippi name change 497315648 form

- Mississippi unsecured installment payment promissory note for fixed rate mississippi form

- Mississippi promissory 497315650 form

- Mississippi installments fixed rate promissory note secured by personal property mississippi form

- Mississippi note 497315652 form

- Notice of option for recording mississippi form

Find out other Tax Client Information Sheet Template

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe