Mississippi Installments Fixed Rate Promissory Note Secured by Personal Property Mississippi Form

What is the Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

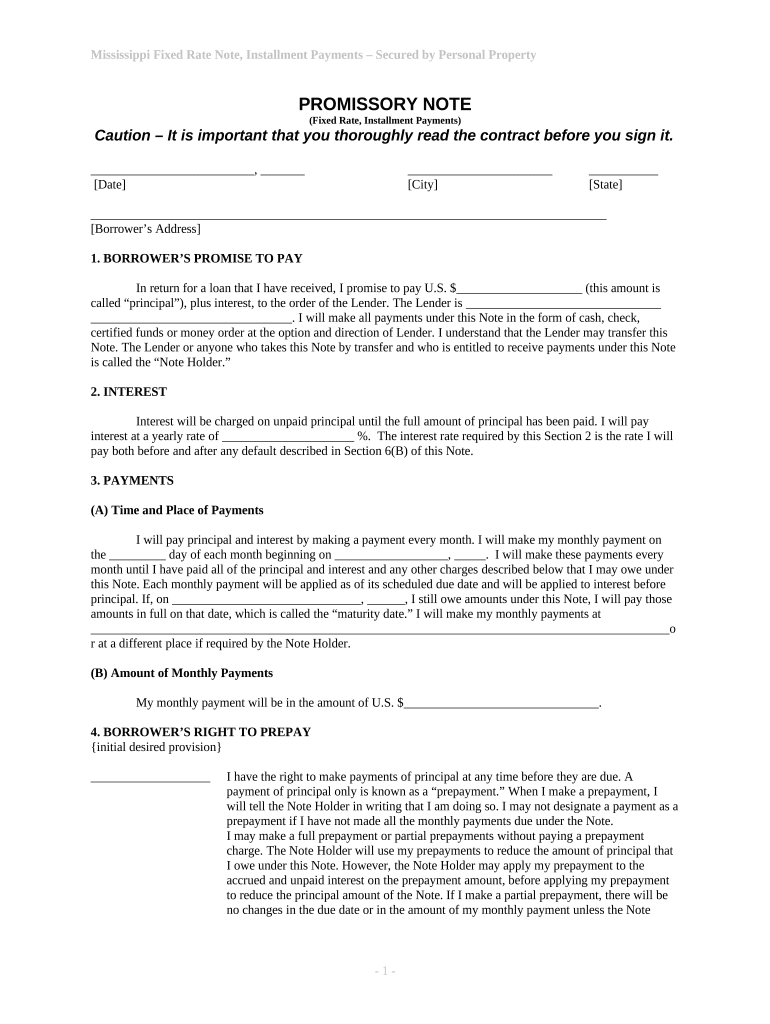

The Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document used to outline a loan agreement between a borrower and a lender. This note specifies the terms of repayment, including the fixed interest rate, payment schedule, and the collateral involved, which is personal property. The document serves as a binding contract, ensuring that both parties understand their obligations and rights under the agreement. It is essential for securing loans where the lender wants assurance that the borrower will repay the loan as agreed, using the specified personal property as collateral.

How to Use the Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

To effectively use the Mississippi Installments Fixed Rate Promissory Note, both the borrower and lender should carefully review the document to ensure all terms are clear and agreeable. The borrower should fill in their personal information, the loan amount, interest rate, and repayment schedule. The lender must ensure that the collateral is adequately described and legally owned by the borrower. Once both parties agree to the terms, they should sign the document in the presence of a witness or notary, if required, to enhance its legal standing.

Steps to Complete the Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

Completing the Mississippi Installments Fixed Rate Promissory Note involves several key steps:

- Gather necessary information, including the borrower's and lender's details, loan amount, and collateral description.

- Clearly outline the repayment terms, including the fixed interest rate and payment schedule.

- Fill in the document accurately, ensuring all sections are completed without omissions.

- Review the document for clarity and correctness, making any necessary adjustments.

- Sign the document in the presence of a witness or notary to validate the agreement.

Legal Use of the Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

The legal use of this promissory note is crucial for both parties involved in the loan agreement. The document must comply with Mississippi state laws governing loans and secured transactions. This includes ensuring that the terms are fair and that the collateral is legally owned by the borrower. In the event of a default, the lender has the right to claim the collateral as stipulated in the agreement. Therefore, it is advisable for both parties to understand their rights and obligations under the law before signing the document.

Key Elements of the Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

Several key elements must be included in the Mississippi Installments Fixed Rate Promissory Note to ensure its validity:

- The names and addresses of both the borrower and lender.

- The loan amount and the fixed interest rate.

- A detailed repayment schedule outlining the frequency and amount of payments.

- A clear description of the personal property being used as collateral.

- Signatures of both parties, along with the date of signing.

State-Specific Rules for the Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

In Mississippi, specific rules govern the use of promissory notes and secured transactions. It is essential to comply with the Mississippi Uniform Commercial Code (UCC), which outlines the requirements for secured transactions. This includes properly describing the collateral and ensuring that the lender's security interest is perfected, typically through filing with the appropriate state office. Additionally, both parties should be aware of any state-specific requirements for notarization or witness signatures to ensure the document's enforceability.

Quick guide on how to complete mississippi installments fixed rate promissory note secured by personal property mississippi

Complete Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely retain it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi with ease

- Locate Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property?

A Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that formalizes a loan agreement where the borrower agrees to repay the lender in fixed installments. This note is secured by personal property, which can provide additional security for lenders. Understanding this document is crucial for both borrowers and lenders to ensure compliance with Mississippi laws.

-

What are the benefits of using a Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property?

The key benefits include clarity in repayment terms, potential tax advantages, and enhanced security for lenders. By utilizing a Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property, both parties can ensure a smooth transaction process while protecting their interests legally. This structured approach minimizes uncertainties in loan agreements.

-

How can I create a Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property?

Creating a Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property is simple with airSlate SignNow. You can easily draft your document using customizable templates that comply with Mississippi regulations. Our user-friendly platform allows you to create, send, and eSign documents efficiently, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property?

AirSlate SignNow offers flexible pricing plans tailored to your needs, ranging from basic to comprehensive packages. Our pricing model ensures that you can access essential features for creating Mississippi Installments Fixed Rate Promissory Notes without breaking the bank. Explore our plans to find the best option for your business requirements.

-

Is airSlate SignNow compliant with Mississippi laws regarding promissory notes?

Yes, airSlate SignNow is designed to adhere to all relevant state laws, including those specific to Mississippi regarding promissory notes. We ensure that our templates for Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property are legally sound and easily customizable to meet your specific needs. Staying compliant helps protect both lenders and borrowers.

-

Can I integrate airSlate SignNow with other business tools for managing Mississippi Installments Fixed Rate Promissory Notes?

Absolutely! AirSlate SignNow offers seamless integrations with many popular business applications, allowing you to manage your Mississippi Installments Fixed Rate Promissory Notes efficiently. Whether you need to connect with CRMs, accounting software, or other tools, our platform supports integrations that streamline your workflow and enhance productivity.

-

How does eSigning work for Mississippi Installments Fixed Rate Promissory Notes on airSlate SignNow?

ESigning with airSlate SignNow is straightforward and secure. Once your Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property is drafted, you can send it to all parties for electronic signatures. Our platform uses advanced security features to ensure that all signatures are valid and legally binding under Mississippi law.

Get more for Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

- Notice of appearance form

- Razred eksterno interna provjera znanja na kraju iccg co form

- Alimony worksheet form

- Mysterysuspense book report form 1 chutrav com

- Design review application 7 22 09 pinehillsnet pinehills form

- Homeless declaration form

- Form 3581 tax deposit refund and transfer request form 3581 tax deposit refund and transfer request

- New hire information form hrnovations

Find out other Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property Mississippi

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online